Markets Are Telling Us They Want To Go Higher: Here’s What to Do

Shah Gilani|May 27, 2020

The stock market’s bounce off its March 23, 2020 lows is over. We’re not bouncing now, we’re rallying.

There’s a difference.

A rally won’t let you down. In fact, a rally will give you an opportunity to make money, hand over fist, four days a week… and it only takes one hour per day.

My friend and colleague, Andrew Keene, has devised a system that can make you four-figure windfalls, day after day, four days a week.

And it only takes an hour, every day.

You don’t have to take my word for it. Just ask Steve Milton, who made $250,000 with Andrew’s system.

Or Carrie Saunders, who made $3,000… three days in a row.

Or Mark Befano, who made $706,000 in only one year.

Andrew’s system made it possible for these folks to grab mind-boggling windfalls, and he can do the same for you.

He’s willing to share his secrets, all you have to do is click here.

Now, here’s what the market’s trying to tell us.. and what to do about it right now.

First, if you read my articles, ever followed me in any way, you know one of my favorite sayings is, “It’s all good, until it isn’t.” That’s exactly how investors should be looking at the market now.

It’s all good, just go with it, until it isn’t. Why? Because the “it isn’t” part may not come.

The rally on top of the bounce doesn’t mean the worst of anything is over. Not by a longshot.

COVID-19 infection rates can spike again. The coronavirus can mutate and a whole new set of serious problems could materialize. The economy, which is just starting to open up, could be shut down again, though that’s unlikely, knowing what we do now about how much damage and devastation shutting down the country inflicted on businesses and lives, but it could still happen.

And there are other issues markets face, like rising unemployment, mounting bankruptcies, and saber-rattling between the U.S. and China.

But, the market’s like a honey badger, “and honey badger don’t care.” It’s telling us it wants to go higher. All you have to do is listen, or watch, and you’ll understand.

FOMO’s New Friend: TINA

Markets aren’t inanimate objects, they’re alive in a very human sense. They’re a reflection of investors’ and traders’ psychology, which manifests itself in their buying and selling of stocks.

Investors and traders have both been buying. A lot of traders have been buying a lot more than they hoped to have to buy, because they’re being forced to buy to cover their short bets on stocks.

A lot of negativism about the economy, entirely justified in my opinion, has motivated traders and some big investors to short U.S. equities, both individual equities and indexed ETFs, in the very sensible belief that the sinking economy will eventually sink the rallying market.

A lot of investors have been buying stocks and indexed ETFs based on FOMO, or fear of missing out. They’re looking at how quickly and steeply markets bounced off their lows, and as suddenly cheap stocks got bid up, they chased them up, afraid they’d miss out on a generational buying opportunity.

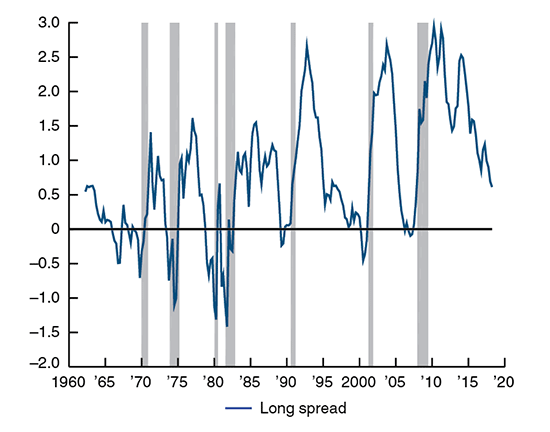

Besides FOMO, TINA is singing loud and clear. TINA, or “there is no alternative,” refers to equities being the best place to garner returns when central banks are manipulating interest rates lower and longer.

Sometimes FOMO and TINA buying and short covering becomes self-fulfilling as it sets up a positive feedback loop.

Whether all the buying is blind to what appears to be an historic economic slowdown, or investors are seeing past all the bad news headed our way, doesn’t really matter because we don’t know. What we don’t know.

What we do know is what the market’s doing. It’s going higher.

What we should be doing is following it.

It’s Time to Get Back into The Game

All the so-called “easy money” has presumably already been made, though buying the market or stocks when they looked their worst is hardly easy. The narrative now is as the economy opens up investors will jump into still beaten down stocks, cyclicals, industrials, consumer discretionary stocks, and sectors and stocks that do well when there’s economic growth.

It doesn’t mean there’s going to be economic growth in the near future. But, markets are saying, there will be eventually, and by the time everyone realizes the recession is behind us, stocks will already have been bid up enough to make them fully priced.

If you’re trying to make sense of the market, trying to apply basic logic to how the market reacts, or should react, to news, to economic metrics, to company-specific earnings, or politics, good luck.

For every reason you have, someone else has an opposing reason, and you can both be right. But one of you will probably be wrong in terms of your timing.

That’s why letting the market tell you what it wants to do makes sense. It’s got the timing right, whether that’s for a week, month, quarter, year, or decade, it’s always right, because it is what it is.

Is this rally on top of the V-shaped bounce for real? I don’t know, and you probably don’t either.

But the market’s telling us it wants to go up. And that’s what it’s been doing.

So, if you are willing to follow what the market’s doing, you should be buying.

Don’t worry if the bad news out there turns the market around. You know that can happen.

If it doesn’t happen, if markets keep going higher and you miss out, you won’t be ringing the cash register.

Here’s What to Buy

Right now I like the Russell 2000 Index (RUT) because it has lagged the other major benchmarks and because there are more “domestic” companies in the Russell that could bounce as the economy opens up and investors chase lagging stocks and indexes higher.

The iShares Russell 2000 ETF (IWM) tracks the actual Russell 2000 index and is a good exchange traded fund to buy if you want to ride the market higher.

Because I’m still worried about all the bad news out there, I’d use a stop-loss order to sell my IWM shares at $130, about 5% lower than where its trading now, to exit with a small loss if the market backtracks.

If it does, it doesn’t mean the rally is over. When the market sells off it’s important to know what’s causing the profit taking and selling.

For all kinds of heads-up on what the market’s doing and why, keep tuning in here.

Until then,

![]()

Shah

Shah Gilani

Shah Gilani is the Chief Investment Strategist of Manward Press. Shah is a sought-after market commentator… a former hedge fund manager… and a veteran of the Chicago Board of Options Exchange. He ran the futures and options division at the largest retail bank in Britain… and called the implosion of U.S. financial markets (AND the mega bull run that followed). Now at the helm of Manward, Shah is focused tightly on one goal: To do his part to make subscribers wealthier, happier and more free.