Your Financial Future in Two Parts

Shah Gilani|January 8, 2022

We’re only a week into January, and it’s already been one hell of a year.

These days, you could easily spend $60-$70 just to fill up your car. Inflation continues to threaten the global market as rates rise, and the quantitative easing imposed by the Fed has put no one at ease. The rivalry between China and Taiwan is heating up, with some fearing armed conflict. And then there’s Omicron, which is running rampant around the world.

Happy New Year, indeed.

A dose of hope would do us all some good, so I’m here to provide it with some good news: 2022 is going to be a golden year of opportunity for us, and I’m going to tell you how.

Starting today, you’ll receive my special two-part New Year’s Edition of Total Wealth. I’m taking a look at what 2022 holds for us and our wallets, and let me be the first to tell you that rising inflation, rising debt in China, and rising confidence in the Retail trader will all play directly into our hands.

A New Year of Inflation

Last year’s inflation set the stage for 2022.

The rapid run-up in every measure of producer and consumer inflation in 2021 was only a prelude to what we’re going to see this year. One reason – and it’s a huge one – is the supply chain snarls and outright breakage the Fed said was causing the “transitory” shadow of inflation (that they expected to fade to nothing) is getting worse.

Omicron may not be as deadly as the Delta variant, but it’s a hell of a lot more virulent – causing cities in China to shut down, factories to close, and supply chains to whip inflation up from a dust storm to a tornado; and of course, there are the rising wages, the ascent of labor and unions, the Great Resignation getting greater; on top of that, there are fewer workers demographically and an administration that’s hell-bent on slathering voters with stimulus and spending galore.

I think 2022 is going to make 2021 look like the calm before the storm. That’s going to be like rocket fuel for some companies that can increase prices, fatten their profit margins, and command the high ground in shelves and online. It’s going to kill a lot of companies that will succumb to higher input costs they can’t pass along, and they’ll have to borrow more in a rising interest rate environment to stay afloat.

It isn’t just about how much consumer prices or producer prices are rising, though they’re both rising fast. It’s not at all about numbers, though that’s how we look at it through the analytics and critic’s window. Underneath the numbers – down on the ground – people are going to hurt, go hungry, not be able to fill their gas tanks or heat their houses, not buy what their families need, and have to make choices Sophie would dread.

The numbers are ugly enough.

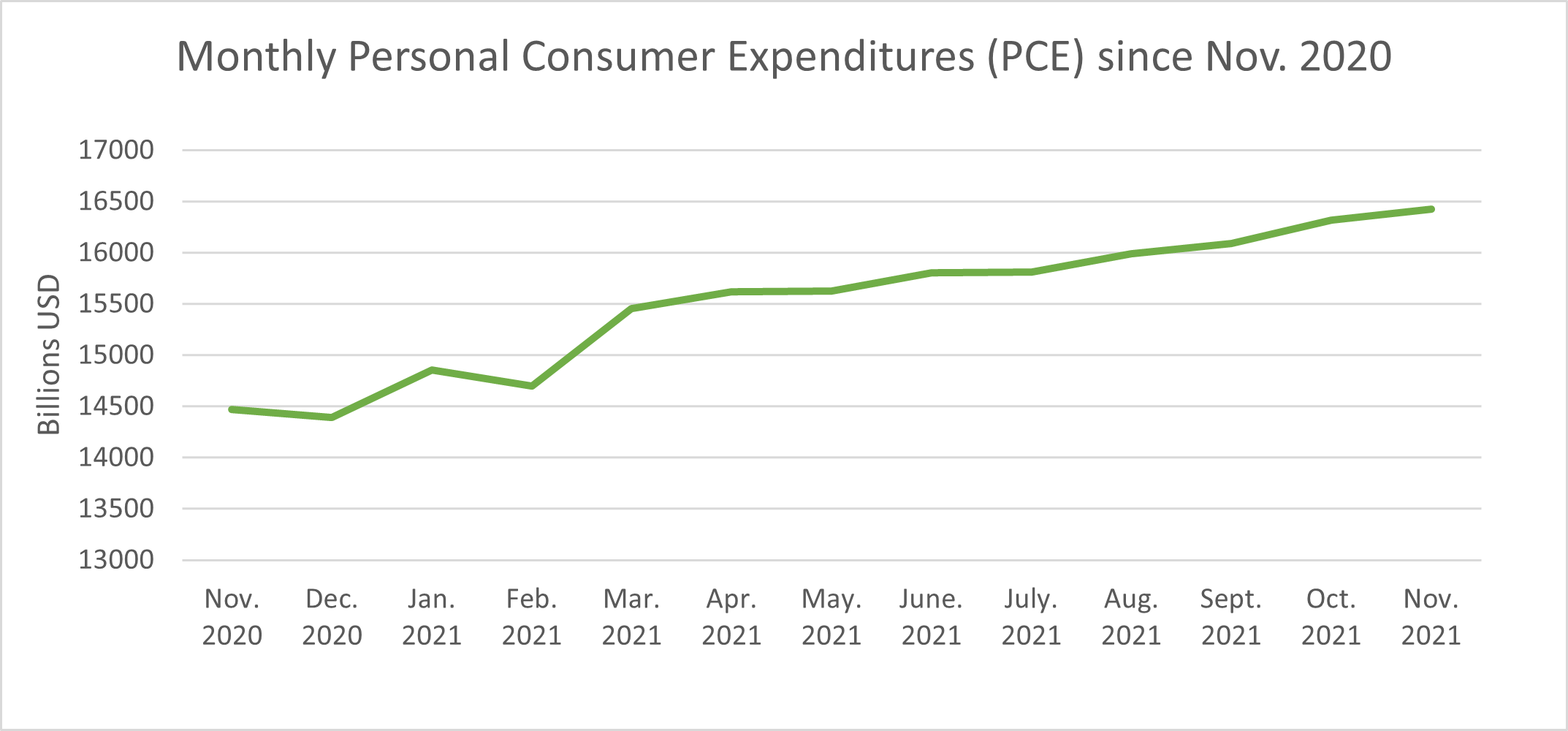

Annual CPI inflation at the November reading came in at 6.8% year over year (YOY), the highest reading since June 1982. That was the ninth consecutive month that inflation was above the Fed’s 2% target. Excluding food and energy, it was up 4.9% in November, the highest since June 1991. And on top of that, personal consumer spending is rising.

The producer price index for final demand was up 9.6% for the year ending November 2021, the largest advance since 12-month data was first calculated in November 2010. Final goods for energy were up 43.8% YOY. Energy goods at the producer level accounted for 5% of total final demand spending. Producer prices for food, which is 5.6% of final demand spending, increased 11.7% YOY. Energy costs were the biggest gainers – up an annualized 33.3% vs. a 30% jump YOY at the October reading; gasoline came in at 58.1% vs. 49.6% at the October reading.

We’re already paying more for basic necessities, and as 2022 progresses, there’ll be less and less to buy due to supply chain issues and COVID shutdowns – and prices will soar for almost everything.

It’s going to be a long, cold winter of our discontent. And the only thing springing up after winter will be prices – again.

Inflation is the sum of critical components, including:

- Supply and demand for everything in an economy…

- Supply chains that move all those goods and services…

- Jobs, wages, and unions…

- Government spending programs…

- Government social safety programs…

- Consumer expectations…

- Bond market bets…

- And more.

All of which are manifesting in changing interest rates.

Rates have been kept in check only as the Omicron spread threatens growth in the U.S. and around the world. They have fallen on market downdrafts as the usual flight-to-quality trade sets in. But once any dips look like they’ll reverse, rates pop higher.

With inflation running hot, the Fed will have no choice but to end its bond buying and eventually raise rates – if for no other reason than shepherding their credibility.

And rising rates, in turn, will spur rising prices and costs on inputs and inventorying goods to rise. That translation to consumer inflation will prompt consumers and workers to demand raises.

Each component of that broad-based scenario is in play for the first time since the ’70s.

We will see many of the component pieces of inflation explode – and some implode – this year and in the process, move and shake markets, as well as hundreds of specific stocks.

And that’s where our opportunities lie.

As I noted above, rising rates spur rising prices, making global commodities the place to be in 2022. Stocks of mining companies have been hit by Omicron woes and the fear that global growth will come to a standstill amidst lockdowns and production halts. Analysts are already talking about a possible recession in 2022, which – combined with inflation – spells stagflation.

All those fears across all industries – minerals, farming, energy, you name it – have set up incredible buy-the-dip opportunities in those commodity sectors and downstream subsectors.

On account of inflation already knocking hard on consumers and households, we can also count on some companies winning as inflation increases their profit margins. I’m talking about companies with indispensable products or services that can easily pass along higher prices – so much so that they’ll expand their profit margins. I’m talking about companies that are the source or fountainhead of other products we can’t do without.

Think about companies in the energy field, natural resources, banking, semiconductors, tech, cybersecurity, cloud, and pharma – these are the core sectors able to ride the inflation nation to victory.

And I’ll be tracking all of them this year. Here are a few examples that you may want to buy into today.

In energy…

- The Williams Companies Inc. (NYSE:WMB)…

- Cheniere Energy Inc. (NYSE:LNG)…

- And Chevron Corp. (NYSE:CVX).

In natural resources…

Banks can pass along higher costs of money easily and always do. Everyone understands the cost of money is mirrored in rising interest rates, which are themselves inflated to combat inflation. Plus, as rates rise – as the yield curve steepens – banks’ net interest margins fatten.

So among banks, I like…

In tech, we can’t do without…

We also need chipmakers like…

- Advanced Mirco Devices Inc. (Nasdaq:AMD)…

- NVIDIA Corp. (Nasdaq:NVDA)…

- And Applied Materials Inc. (Nasdaq:AMAT).

These will all be winners…

As will cloud behemoths and data storage companies like…

- Microsoft Corp. (Nasdaq:MSFT)…

- Palo Alto Networks Inc. (Nasdaq:PANW)…

- Crowdstrike Holdings Inc. (Nasdaq:CRWD)…

- And Snap Inc. (NYSE:SNAP).

Then – of course – there’s Big Pharma, with indispensable companies like…

All of which will be able to reflect rising inflation in their bottom lines.

When China Sneezes… the World Catches Cold

2022 will be the year China implodes from its mountain of debt.

The Red Dragon hasn’t had a depression or Great Recession or even a meaningful slowdown in four decades, going on five, and has grown to unfathomable heights on debt – and worse by far, leveraged debt.

China’s corporate debt exceeds $27 trillion. Foreign debt exceeds $2.4 trillion.

Now, debt is fine as long as you have GDP growth to back it up. The problem with China is that its debt is growing faster than its GDP.

At $14.72 trillion in 2020, China’s GDP has been growing at an average rate of just under 11% a year over the past 11 years vs. the national debt at $9.76 trillion in 2020, growing over 11% a year over the last 11 years. That’s just national debt, as in outstanding treasury obligations.

Total public debt exceeds 300% of GDP – over $44.16 trillion.

Now, add that to the national debt, and you see how high that mountain is…

It’s $58.8 TRILLION and counting.

And now, China’s growth is slowing… maybe to a stop. The country could see a recession and negative GDP growth possibly by late 2022…

Which will cause problems for all of us. Besides being a massive debtor, it’s been a creditor to the world.

It finances U.S. debt – buying and holding government treasuries valued at $1.065 trillion, which is 3.68% of the $28.9 trillion in U.S. national debt as of October 2021…

And China bankrolls Belt and Road Initiatives (BRI) – worldwide infrastructure projects in 138 countries to be exact.

China supports all this by borrowing from domestic sources – primarily, its big, state-owned banks and its sovereign wealth fund.

It also borrows from what’s called the Silk Road Fund to lend to BRI countries at low-interest rates to finance projects built with Chinese know-how, managers, and – in many cases – Chinese workers. BRI, sometimes referred to as the New Silk Road, launched in 2013 by President XI Jinping, lent $47 billion in 2020 alone. Estimates are they’ve already lent $200 billion. Morgan Stanley says that number will be $1.2-$1.3 trillion by 2027. That global credit has been a function of domestic debt issuance, leveraged against wealth management products. The credit is issued by brokerages and backed by banks and local governments who are – in turn – backed by the government and banks’ balance sheets and off-balance sheet accounting.

Some of the countries in China’s BRI have borrowed as much as 20% of their GDP from China to build up their infrastructure. If we see another global recession, many of these countries are going to have to extend and pretend they’ll be able to pay China back or default and tell the Chinese where they can stick it.

China’s state-owned banks are already sitting on hundreds of billions – probably trillions – of dollars worth of bad debts and nonperforming loans, especially in the $60 trillion property sector. And they keep extending terms on those debts so they don’t have to take the write-offs and hits to capital.

This is exactly what the biggest U.S. banks did in subprime to not declare insolvency in 2008.

If you don’t remember, all the big U.S. banks that ended up having to get bailed out back then were financing subprime speculation by holding trillions of dollars worth of subprime “assets” in off-balance-sheet vehicles. To evade capital reporting requirements, they set up structured investment vehicles (SIVs), and special purpose vehicles (SPV). Chinese banks are doing the same to hide bad loans and look to all the world as if they’re not only solvent but well capitalized and growing their loan books.

Lehman Brothers was king of this in the investment bank world. They also created an accounting gimmick by creating “Repo 105.” Lehman would classify a short-term loan (a repo) as a sale and use the cash proceeds from the “sale” to reduce its liabilities.

All these tricks the Chinese learned from American banks and Wall Street are employed with gusto in China.

Underneath the banking surface, there’s a staggering quantity of leveraged debt, off-balance-sheet lending, wealth management products, and hundreds of billions – probably trillions – of dollars of local government funding vehicles.

The property problem is where we see the direct impact of overextended leveraged debt unable to be repaid. Evergrande, Fantasia, China Properties Group, Modern Land China, Sinic Holdings, and Kaisa Group have all technically “defaulted” on debt contracts. But they’ve been short lifelines like Bear Stearns was.

The big U.S. banks were given breaks, including how they calculated reserves. Chinese banks are getting the same “regulatory help” because they were all too big to fail, just like what’s happening here.

Still, that doesn’t stop a “Lehman moment” or a crash and a Great Recession. Because “if it keeps on raining, the levee’s gonna break.”

Most commercial banks are state-owned and lend freely to state-owned, controlled, or favored local projects, companies, other local governments, and industries. This happens even though default risk is high on lots of loans. It’s the government’s “extend-and-pretend” help plan, which happens in the junk-bond world when corporations only survive on account of being able to keep issuing high-yield junk bonds that high-yield investors want. Because everyone knows it’s all a house of dominoes, and if they let the wrong house fall, it will cascade on every other leveraged house, and they’ll all fall in on each other.

Those banks hold more than an admitted $540.70 billion in bad loans as of 2020. The numbers for all of 2021 aren’t in yet. They’re also holding just over $1 trillion of so-called “special mention loans,” otherwise known as “distressed.” The true amount of distressed debt as bad loans could be considerably higher.

A popular way in China to get bad loans off books is to package them and sell them to investors. Probably 70% of these “investments” were sold at inflated prices based on the way bundles were structured, and that’s just the way they learned to structure them from Wall Street. On many bad bank loans packaged and sold, the bank is still a guarantor. This means banks are more leveraged to bad loans than is even calculable.

And that’s just banks. Beyond banks is the shadow banking industry that occurs through nontraditional institutions like brokerages, trusts, and local government lenders through wealth management products.

In 2020, the shadow banking industry was estimated to have a “value” of $13 trillion.

But it could be much higher than that. China’s opaque account disallows us from seeing into their system in full.

More COVID-19 closedowns and debt relief programs will delay the day of reckoning, but all the delays and short-term relief can’t last forever. Pandemic relief consists of extending loan maturities, recalculating payment amounts, and pretending when things get past lockdowns, everyone will pick up where they left off and make enough money to get back on track and pay down their debts. Already, more closures have impacted supply chains, impeding production, which requires more “extend-and-pretend” gaming.

The world’s seen this before. The last time was the subprime implosion of all the leveraged debt accumulated in that build-up. The scale here may dwarf that. We don’t know. No one knows what we can’t see, but everyone knows it’s out there and that the levee’s going to break.

The implosion of debt markets in China will be met with relief efforts by the government. Some efforts are already in place and have been piled on. This is only adding to leverage, of course, but they will be insufficient for foreign creditors who will have to write down loans because of foreign/domestic regulations. The size of write-offs will spook markets, especially equity markets starting in China which will start to falter and then spread around the world.

Get Ready to Play

While it’s going to be bad for many markets, it’s going to be great for investors who are ready to play the implosion – first in China, then globally, then the rebound.

Chinese tech stocks, which have already been pounded by new regulations and the government’s prying eyes and paranoia, will be the first place to load up.

Then there’s betting on Chinese banks tanking, as well as companies with easy-to-trade ADRs, which will create a sea of opportunity for us.

While the obvious way to play the downfall of U.S.-listed Chinese stocks is to buy puts on them, puts are already expensive as investors are eyeballing prospects for a potential meltdown. Of course, puts make sense when you want a one-way bet where if you’re right, you can win big, and if you’re wrong, you know your risk. Puts will be worth paying up for.

But there’s another, cheaper way to play the downfall of Chinese stocks. And that’s by shorting them and at the same time, buying calls on those short positions. That’s called a synthetic put.

If puts are going to get more expensive, it stands to reason that calls will get cheap for the same reason. By shorting the stocks and buying calls, you get the downside profitability exposure 100%, and buying calls limits your risk against the stocks going higher and against you. That’s how a lot of pros play opportunities like this.

The contagion effect on this will be ugly and swift. The way to play that is by buying calls on inverse ETFs that go up in value when markets go down. Since global markets have been rallying, inverse ETFs have been getting beaten up, and call options on them are cheap. Now’s the time to start looking at some cheap plays and setting up your positions.

When everything hits the wall, there will be more ways to make money on U.S. stocks with exposure to China falling. You can make the same kinds of plays on them – buy puts and create synthetic puts.

Finally, the drop will be quick and possibly broad, which means there’ll be a rounding bottom – not a COVID-like rebound to the moon. That rounding bottom will be the time to buy back into great companies that have taken it on the chin.

I think 2022 will be the year China pukes all over the world, something like what the U.S. did in 2008.

A New Market Paradigm

I’ve said it before, and I’ll say it again: Retail is now the tail wagging the dog.

In 2022, trading will be dominated by retail – more so than 2021 – because of the number of accounts and the amount of money wielded by this retail army.

The onset of the pandemic saw retail traders and investors flood into the market to compensate for lost jobs, plunging retirement plans, or outright work-from-home boredom. More than 10 million new brokerage accounts were ultimately opened up in 2020, says data analytics firm JD Power in a study of the rush into the market.

The stage had been set for their mass entry back in 2019 when commission-free trading took root thanks to disruptor Robinhood. After Robinhood saw a flood of new accounts opened, the rest of the industry followed suit, and it became a race to the bottom. Brokerages vied for new accounts by offering commission-free trading and low-cost options. They would eventually also offer some free options trading, fractional shares, and other free perks to converting customers.

On peak trading days in 2020, individual traders’ share of total trading volume doubled to an average of 20% of trading, up from 10% of trading volume in 2019, according to market-making behemoth Citadel, the order buying firm that trades the retail orders brokerages front.

The impetus after the COVID-19 crash to buy was primarily based on a “buy-the-dip” narrative that had proven itself with a perfect record since 2009.

But it wasn’t until January 2021 when the realization of retail’s power was headline news.

Back in 2006, GameStop was the largest game retailer in the U.S. and the world. Its stock was trading at $60, but by August 2020, it was down to $3 as institutional shorting of a perceived brick-and-mortar loser looked like the company’s end. With some early trader influence because of a monumentally large short of float ratio, shares got to $17.25.

That’s when Redditors executed the first concerted retail short squeeze in history, driving GME to $483.

The GameStop attack on shorts cost institutions – mostly, hedge funds – $6 billion and caused institutional traders to question the future of shorting.

But 2020 was just the beginning.

In January 2021, approximately six million people downloaded trading apps, and the rush of retail continued throughout 2021. In the first quarter of 2021, Schwab added 3.2 million new accounts, and Fidelity added 4.1 million new accounts. For the full year of 2021, Fidelity added 5.778 million new accounts, Robinhood added 10.8 million new accounts, and Schwab added an amazing 18.282 million new accounts.

The power of retail isn’t just in the number of accounts now – it’s in the assets under management (AUM) moving in and out of trades and investments. Schwab, the largest, now has $7.6 trillion in AUM, Fidelity has $4.288 trillion, Bank of America Merrill Lynch has $3.693 trillion, and Robinhood has $0.81 trillion.

The average account size at Robinhood is now $3,500. At E-Trade, it’s $100,000. At Charles Schwab, it’s $240,000. As markets rise, all that money appreciates in all those accounts, and there’s more capital to trade with and more investments to make.

Retail trading in 2021 lead to record-high trading volume in stocks and options. At multiple times in 2021, retail trading accounted for a third of all market trading according to Credit Suisse – that’s up from 25% on peak days in 2020. Bloomberg calculated that retail accounted for 23% of all 2021 trading – twice that of 2019.

Now that retail knows its power, it will increase its collective influence in 2022 on several fronts. Sometimes, they know what they’re doing. Sometimes, by their sheer weight they influence market function without knowing it.

But those who understand what that weight influenceswill be able to front some retail moves and quickly get on board as their momentum train runs. According to Bloomberg Intelligence, the massive collective capital of retail is now equivalent to “all hedge funds and mutual funds combined.”

In 2022, the rising success of apps like Robinhood will lead to more apps – more “sites” specifically geared toward retail. There will be new companies coming to market to cater to retail. Sites and apps will report the numbers retail traders will want to hear about. They will want to influence companies with buying and selling power to move shares – with metrics geared toward trading strategies centered on the whole market, sectors, or specific companies. There will be apps that tell retail traders what other retail traders are buying and selling so they can pile into whatever momentum is happening. There will be existing sites that will gear toward retail, brokerages that will benefit by what retail does and what they do for retail, and all the exchanges will benefit by increased volume.

The majority of retail traders are completely new and primarily buy and sell stocks but also aggressively speculate in options. They’re willing to take larger risks because they have more personal freedom to experiment. They invest based on personal affinity and are often value based when they aren’t purely chasing a trend, narrative, social media, chat room, or influencer-inspired play.

They are less likely to use traditional market data and lean more on social media and the technologies they grew up with and trust. That will impact data and analytics firms that traditionally cater to institutions. I think 2022 will see shifts here too.

The difference-making fundamental paradigm of retail is they trade their own money. They were once a small, shut-out lot – but not anymore.

With brokerages offering no minimums on accounts, commission-free trading, fractional shares, and retail-oriented apps, 2022 will see more Robinhoods come to market – with more trading and retail impact.

That influence will impact ESG allocation and the rise of those investments.

It will impact gamma’s effect on market makers’ positions in options, which – if understood – can lead to understanding what the market’s going to do. This is especially true at month’s end, more so at quarter’s end, and especially on options expiration dates.

Payment for order flow (PFOF) could be impacted – not in a big way, but enough to impact some brokerages. There will be opportunities there on several fronts.

There will be greater promotion of financial literacy this year and opportunities there for all of us. Something to look forward to in 2022…

And there will be more looking forward tomorrow morning.

The second part of your 2022 financial plan, including important information about Biden’s regulatory bid for a stronger Federal government and an impending crypto-wipe out, will be in your inbox early tomorrow morning.

See you then,

Shah

Shah Gilani

Shah Gilani is the Chief Investment Strategist of Manward Press. Shah is a sought-after market commentator… a former hedge fund manager… and a veteran of the Chicago Board of Options Exchange. He ran the futures and options division at the largest retail bank in Britain… and called the implosion of U.S. financial markets (AND the mega bull run that followed). Now at the helm of Manward, Shah is focused tightly on one goal: To do his part to make subscribers wealthier, happier and more free.