Thanks to This New Drug, Moderna and its Peers are “Yesterday’s News”

Shah Gilani|November 18, 2021

Moderna Inc. (Nasdaq: MRNA) and BioNTech SE (Nasdaq: BNTX) were two of the big stars of the COVID-19 Pandemic.

But those two biotechs – and other players like Merck & Co. (NYSE: MRK) – are scrambling to find that “Next Big Thing” to stay relevant, or get hot again, in the post-peak-pandemic world.

But I’m here to deliver some very bad news: None of these three are going to pull this off.

And that makes them “stocks to avoid.”

There’s a fourth company – one not on this mini list – that’s leapfrogging the pack. It’s a stock you want to buy now and tuck away as a core holding – because I see it as a long-term winner.

Let me spend today sharing the tale of this mystery winner stock – while at the same time protecting you by getting you to steer clear of the “high-risk trio.”

Two Losers and the Runner-Up

Let me begin with a blunt statement a lot of investors may not be happy to hear – though it’s something I believe to my core.

The fact is that Moderna is a one trick pony . Until it comes up with another homerun drug, its stock is going to continue its journey back to earth after a run up of 355%.

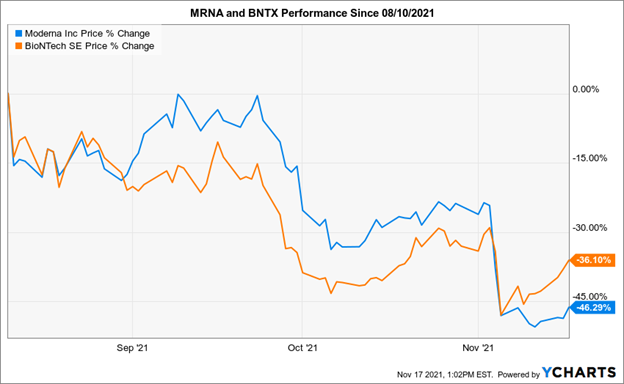

We’re talking about a stock that skyrocketed from $109 at the end of 2020 to a high of $497 on Aug. 10. Since then, however, it’s absolutely collapsed, and trading way below its 200-day moving average of $254. Moderna is not a great company – it lacks real prospects, meaning its stock is a lousy long-term play.

For BioNTech, it’s pretty much the same story. The company may be more diversified with a better pipeline of drugs, but its shares rode the same rocket as Moderna, and like that company it lacks a “COVID encore.”

At the end of 2020, you could have picked up BioNTech for around $80. By Aug. 10, it also skyrocketed to $464. Since then, BNXT’s experienced the same freefall as Moderna. It’s now just above its 200-day moving average of $224. But it’s well below all the other important moving averages, and the shares are just lingering around $265. And like Moderna, it lacks the prospects needed to jump-start its shares.

And who knows if either will ever bounce back in light of their biggest competition rolling out the drug of the century: a pill that kills COVID-19.

Even here there are “haves” and “have nots.”

Merck has a pill it says is a COVID killer. But, as we’ll see in a second, it’s shaping up to be an “also-ran” drug.

Merck is playing second-fiddle to another company – the stock we’re recommending here today.

And the Winner Is …

That company is Pfizer Inc. (NYSE: PFE), which revealed early this month that it’s seeking U.S. Food and Drug Administration approval for its antiviral pill Paxlovid.

Merck’s has a rival offering, Molnupiravir. But studies so far show the Merck pill reduces hospitalizations by only 50%.

Jeffries & Co. the investment bank that follows all the Big Pharma firms, says Pfizer’s pill could tack another $10 billion a year onto Pfizer’s current yearly revenue of $69 billion.

Pfizer hitched a ride on the same rocket ship that launched Moderna and BTNX to orbit, going from $37 at the end of 2020 to a high of $52 on Aug. 18. But unlike Moderna and BioNTech, which each stalled out after flying a little too close to the sun, PFE drifted back down to $41 – then rebounded and shot back up toward its high once again.

Pfizer is now trading well above all its important moving averages and, at $49.92, is only a hair’s breadth away from making new highs.

And there’s a kicker: Pfizer sports a tidy dividend yield of 3.14%. Which, as I always say, is a beautiful thing when a company pays you to own its shares.

Pfizer is a “Buy” right now and a long-term hold for as long as there are viruses and diseases out there to battle.

Cheers,

Shah

Shah Gilani

Shah Gilani is the Chief Investment Strategist of Manward Press. Shah is a sought-after market commentator… a former hedge fund manager… and a veteran of the Chicago Board of Options Exchange. He ran the futures and options division at the largest retail bank in Britain… and called the implosion of U.S. financial markets (AND the mega bull run that followed). Now at the helm of Manward, Shah is focused tightly on one goal: To do his part to make subscribers wealthier, happier and more free.