A Troubled Earnings Season Opens New Trading Possibilities

Shah Gilani|February 10, 2022

Most traders and investors want to buy stocks when they’re cheap. But just as many miss those buy-the-dip opportunities because they’re scared. Any dipping stock could drop lower, especially if investors think it will “miss” consensuses estimates on upcoming earnings.

That’s understandable, but not how I think.

Because I want to buy good stocks when they’re on sale, I like positioning myself in front of earnings using a special method that I’ll reveal to you today – with a new recommendation as a bonus.

Using this method, anyone could profit handsomely no matter which way the stock swings.

Going Up?

Earnings reports are scary, especially in volatile markets like we’re experiencing now.

Companies that have missed earnings expectations in their fourth-quarter have seen their stocks hammered. Meta Platforms Inc (Nasdaq: FB), for example, saw its stock get walloped 25% in a day – knocking its equity valuation down by more than $250 billion. And the selling continued.

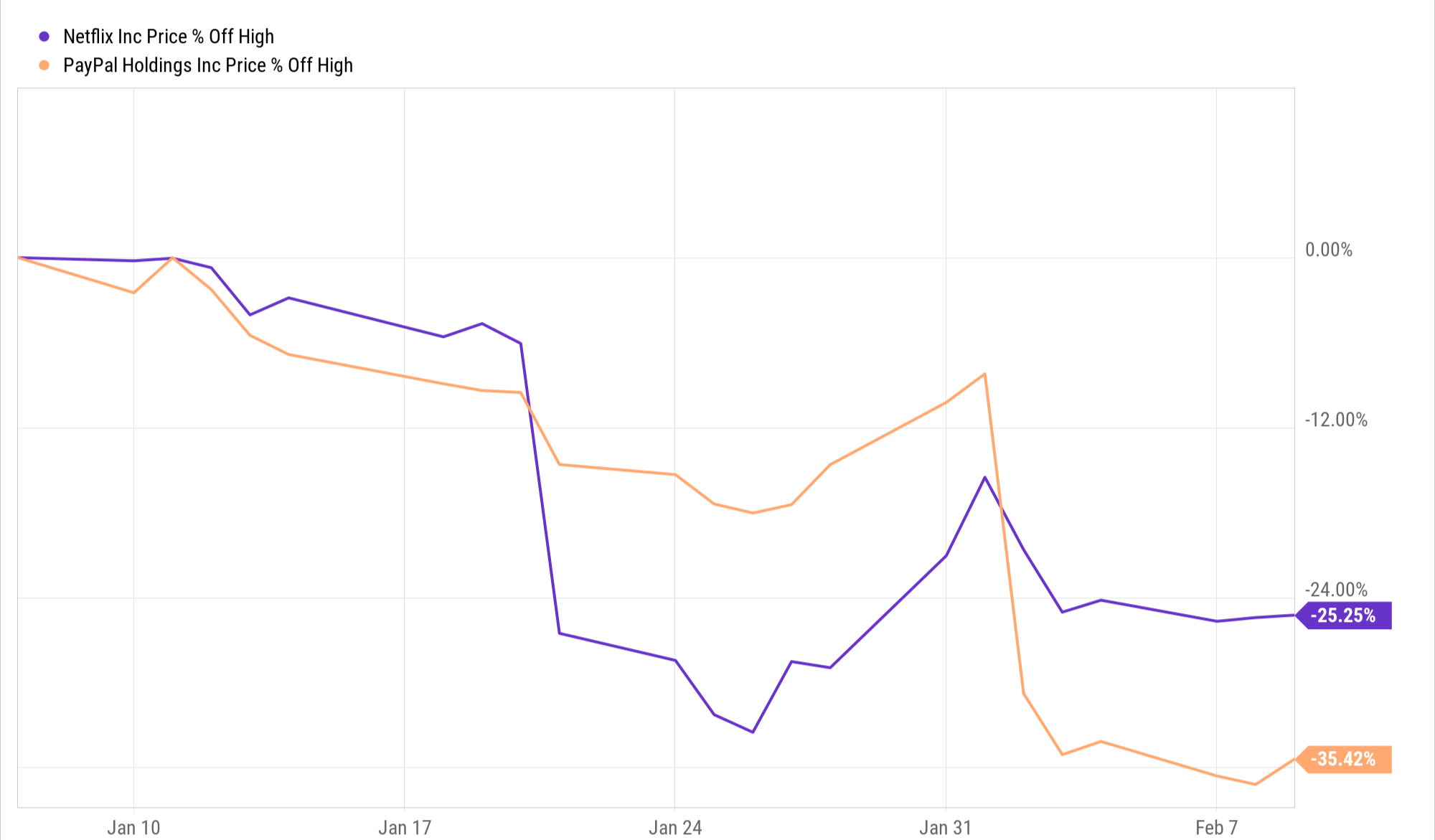

Netflix Inc (Nasdaq: NFLX) and PayPal Holdings Inc (Nasdaq: PYPL) were knocked down hard when they missed on earnings projections, too, and have paid a heavy price. NFLX is down 25% from its previous high in January. PYPL is down 35%.

Even companies that have beaten earnings estimates handily, like Apple Inc, Alphabet Inc, and Microsoft Corp, saw their stocks initially pop but subsequently either stalled out or have slipped a little.

This earnings season has been tough. But that doesn’t mean investors shouldn’t position themselves ahead of earnings of favored companies they want to own.

My strategy is to get in before earnings are announced.

That way, I either get into a discounted stock as price drop, or profit handsomely if the company beats earnings estimates and takes off on account of being oversold, under-valued, or overly shorted.

Or, better yet, all three.

And we’ve got the perfect chance to use it coming round the bend.

Beyond Meat Inc (Nasdaq: BYND) is a meat-alternative company that uses modified mushroom proteins to create plant-based hamburgers and sausage. This is a hot trend, and BYND is the cleanest way to play the upside in this arena, especially with customers like McDonald’s, Taco Bell, KFC, and Pizza Hut.

The company’s earnings have been dismal for some time. Earnings per share (EPS) missed analysts’ expectations by wide margins over the past four quarters. Estimates for this quarter’s EPS are for a loss of 72 cents. The company’s EPS have been negative since they IPO’d in May 2019, and they haven’t made a profit yet.

That’s been the case for lots of companies – some, like Tesla, for years and years. But some of those companies’ stocks have soared.

BYND, too, has seen a cycle of soaring gains, only to give them back. Within the last twelve months, this cycle has repeated itself at least four times. And it could happen again.

The all-time lows for BYND are around $48, which in my book wouldn’t be a bad place to buy some shares. With the stock trading around $62 and change, it’s unlikely you’d be able to get in around $48.

Or maybe it isn’t. There’s uncertainty at play here, but we can get in and reap a profit regardless of the direction BYND swings – here’s why.

Beyond Meat reports earnings on February 24. If they’re a bust, the stock could come down, and if you make the right moves, you could potentially pick up stock around $49 -$50 a share, right around BYND’s all-time lows. On the other hand, if the company beats on earnings and the stock rockets higher, and you’re in the right position, you could haul in a very big gain.

Here’s how I recommend playing Beyond Meat’s upcoming earnings to make money one way or another.

First, if you want to own BYND lower (as close to $48 as you can get would be a great entry point), you can sell-to-open BYND put options. Then, hope to be assigned shares of BYND. For that to happen, shares of BYND would have to drop to somewhere below the strike price of the puts you sell.

Here’s an example. If you sell the $60 strike price puts a couple of months out, for say $10, and the stock is below $60 by expiration, you’d have to buy shares at $60 apiece. But, because you sold those puts at $10, your net cost on the stock would actually be $50 – the $60 strike price of the puts, minus the $10 you got paid for selling them.

That’s close enough to the stock’s $48 lows to be a great entry point.

On the other hand, BYND’s earnings might be better than expected. Knowing that the collective short positioning in BYND amounts to almost 40% of the company’s floating shares, and a significant upside surprise could jettison the stock higher as shorts run for cover, you’d be well served buying a bull call spread.

Since earnings are on the 24th, you could buy a call spread one month out. Maybe the $65-$70 bull call spread if you think the stock will go above $70. Or the $75-$80 bull call spread if you think a short squeeze could take the stock north of $80.

As long as you can buy one of those $5 spreads for around a dollar, you could make 400% on your trade if the stock closes above the higher strike price call you sell as part of your spread.

That’s how I like to play some earnings reports. That’s how we’re playing Beyond Meat’s upcoming earnings in my subscription trading service. We’re making both bets. And could win on both counts, especially if the stock soars and we win big on our call spread and get to keep the money we collected selling puts.

Either way, that’s what I do, that’s what we’ve done with BYND, and something for you to consider now and in the future.

Cheers,

![]()

Shah Gilani

Shah Gilani

Shah Gilani is the Chief Investment Strategist of Manward Press. Shah is a sought-after market commentator… a former hedge fund manager… and a veteran of the Chicago Board of Options Exchange. He ran the futures and options division at the largest retail bank in Britain… and called the implosion of U.S. financial markets (AND the mega bull run that followed). Now at the helm of Manward, Shah is focused tightly on one goal: To do his part to make subscribers wealthier, happier and more free.