The BEST News About the 2024 Presidential Election

Robert Ross|October 15, 2024

You may have heard we have an election come up in the U.S.

When I visited my family in Michigan last week, I was bombarded by political ads. No surprise… since Michigan – along with Pennsylvania – is a key swing state in this election.

And candidates are spending like it’s going out of style on ads.

In fact, between the presidential and congressional races, both parties have raised $14.8 billion, according to the Federal Election Commission.

And I imagine this spending will speed up over the next few weeks. It’s an extremely tight race, with Polymarket – the world’s largest betting market – showing the two candidates at close odds:

But whether you have a preferred candidate or not, the winner will likely have a minimal impact on your portfolio.

Spend, Spend, Spend

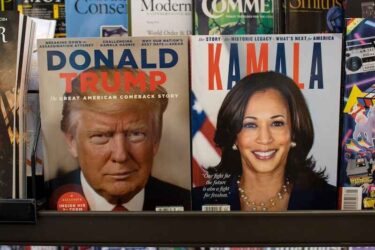

No matter who wins the White House, both Donald Trump and Kamala Harris will spend aggressively.

During Trump’s presidency, his policies, including tax cuts and defense expansion, added $7.8 trillion to the national debt, largely due to the 2017 Tax Cuts and Jobs Act. His plans for another term include more tax cuts and infrastructure spending, driving the deficit even higher.

On the other hand, Harris would continue the Democratic push for massive social programs and climate initiatives, similar to Biden’s $6 trillion budget proposal. Medicare for All and climate-focused spending, which Harris supports, would lead to further ballooning of the deficit.

Ultimately, whether it’s Trump’s tax cuts or Harris’s social programs, the deficit will continue to rise.

Markets, however, often shrug off political leadership changes.

And this time won’t be different.

Doesn’t Matter Who’s in Charge

Stocks have historically performed well under both parties.

Over the last 90 years, the S&P 500 has delivered positive returns in 75% of the years – even with both Democrats and Republicans holding power. Between 1930 and 2022, the average annual return of the S&P 500 under Democratic presidents was 10.6%, while under Republicans, it was 4.8%.

While some elections bring uncertainty, the stock market tends to focus more on long-term economic fundamentals than short-term political changes. For example, during Barack Obama’s two terms, the S&P 500 surged over 180%. And during Donald Trump’s term, it gained about 67%.

Even in a contentious political environment, stocks typically continue their upward trend.

The stock market’s resilience is due to broader economic forces, such as corporate earnings, interest rates, and technological innovation. Investors who stay the course benefit from this long-term growth, regardless of who holds the presidency.

But it’s not only the president that stocks don’t care about…

Knock, Knock. Who’s There? No One Cares

While the Senate and House are powerful institutions with purse strings and legislative control, their influence on the stock market is nil.

From 1926 to 2023, the S&P 500 averaged an annual return of 10.2% during periods of divided government… and 14.1% during unified government. And it doesn’t matter which party has unified control. Republican unified governments are at 14.5% and Democratic unified governments at 14%.

This shows that even with different political parties, the stock market trends upward in both scenarios. Again, that’s because the market’s long-term momentum is driven by deeper forces: innovation, consumer behavior, and global economics.

Just Keep Buying

Whether that was the Global Financial Crisis, 9/11, or COVID-19, it’s always uncertainty – not who wins an election – that creates financial calamity.

And don’t get me wrong… Politics can create uncertainty. We saw this when government shutdowns were threatened, or trade wars during the Trump administration spooked investors.

However, even then, markets recovered quickly. In the long run, economic fundamentals, not political figures or party control, drive stock market growth.

The reality is that uncertainty, rather than specific policy outcomes, tends to create short-term volatility. But history has shown us that the market recovers from crises. Whether it was after the Global Financial Crisis, 9/11, or the COVID-19 pandemic, the long-term trajectory for stocks remains upward.

Staying invested during these periods, while others panic, has always been a sound strategy.

So, as election season heats up and political ads bombard your screen, remember that the stock market has weathered every administration for the past century. Focus on long-term trends and fundamental investments, both of which are themes I invest around every week in Breakout Fortunes.

The best strategy is to tune out the political noise, avoid market timing, and stay the course -because the market doesn’t care who’s in charge.

Editor’s Note: Get ready… Manward’s Chief Investment Strategist Shah Gilani predicts there will be a massive STOCKWAVE after the election. And he says these nine stocks should be in every investor’s portfolio when it happens. Details here.