Dealmaker’s Diary: This 191-Year-Old Company Is Beating 90% of the Market

Alpesh Patel|July 17, 2025

A 191-year-old company is quietly crushing 90% of the market.

No flashy marketing. No breathless hype. Just phenomenal numbers that most investors completely ignore.

This healthcare infrastructure giant has been around since 1833. It survived the Civil War, two World Wars, the Great Depression, and every market crash since.

Now it’s using cutting-edge AI to revolutionize healthcare delivery – and the results are staggering.

The metrics that caught my eye…

- Top cash returns on invested capital

- Sortino ratio near 1.0 (a rare one)

- Volatility of less than 10%.

While everyone argues about which startup will “disrupt healthcare,” this proven giant is already doing it with…

- AI-powered disease forecasting

- Robotics automation in distribution

- Microsoft Azure integration for oncology insights.

Click on the image below to see why age isn’t slowing this giant down.

TRANSCRIPT

Hi, friends. Welcome to the Dealmaker’s Diary and Stock of the Week. It’s one which I could have brought up well in advance of today because it’s been a good solid player for a very long time: McKesson (MCK).

Many of you may well have come across this multibillion-dollar company. It’s a quarter of a trillion dollars large. And you might ask, if it’s that big, where’s the growth likely to be? Well, we’ll come to that in a second. It’s also a very old company. Again, you might think, surely new technology is where it’s all at. Well, when you look at the numbers, and this is why we look at the numbers, we might put our biases away from going for smaller new companies.

So let’s look at what it’s been doing now. As you know, I like to look at AI in these companies, partly for my own education just to see what’s going on in the world, but partly to ensure that any company we look at is at the cutting edge of using artificial intelligence. So they’ve got conversational AI for customer support, NLP-powered virtual assistants. Now I don’t know if you know what NLP is: natural language processing.

It’s a clever way of saying intelligent virtual assistance.

And that’s going to save them time, help with customer relations, brand building. They’ve got predictive analytics for disease forecasting. I would expect them to do that. They are doing it.

That’s important. Robotics automation and distribution, good. Good to know. I wouldn’t have worked that out had I not seen that they’re doing it.

Then I would have thought, oh, yeah. It’s obvious. They should be doing it. Oncology insights via Azure OpenAI, good.

Azure being Microsoft’s big cloud-based engine. AI-powered prior authorizations. Yes. Good. Reducing costs, increasing profitability, increasing productivity, improving capital efficiency, all of those boxes that you would want to see ticked.

And obviously, back office automation claims optimization as well.

So, again, efficiency, efficiency, efficiency, all going well.

I should say, actually, in all of that, I’ve not mentioned what they do. You can see it on screen.

Healthcare, health tech, we would say today, delivering pharmaceuticals, medical supplies, digital health solutions. Now you might ask, because you’ve come up with quite a few health companies. It’s not because I’m looking at the sector. It’s because those are the numbers which are coming up.

And you ask, well, wait a minute. UnitedHealth and some of the healthcare companies have been taking quite a battering because budget deficit cuts and the like. Yeah. But if the companies are solid, then…

God. I might need one of those companies soon.

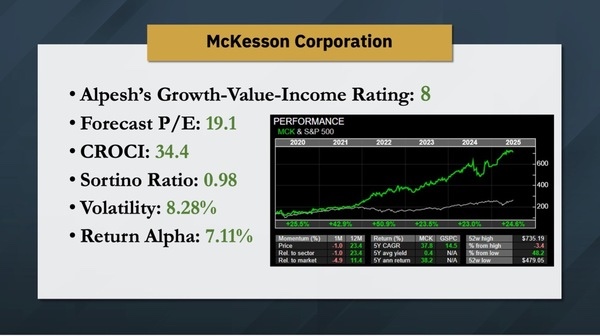

If the numbers are solid and the company is solid, then short-term noise usually provides a good opportunity to buy into any dips. On my proprietary growth value income, GVI rating, which weighs growth value and income, it’s got an 8. Anything above a 7, I love. OK?

Meets our minimum criteria. Forecast P/E, you’re only paying $19 for every future dollar of expected earnings. That’s cheap for a tech company. This is, make no mistake, a tech company.

Cash return on capital invested, phenomenal.

I’m trying to think of when I’ve seen numbers close to that. Maybe one or two recently I’ve brought up. That is rare. That’s the Goldman Sachs wealth management metric for picking stocks. They want companies in the top quartile. This is easily in the top 10%, the top 10% of all companies in terms of cash that they generate on the capital they invest, which generally means better stock market returns, and you can see that historically.

Sortino near 1, very rare for a company. I would say less than 10% of all companies have a Sortino that high. It’s a measure of average returns versus low risk of missing those. Volatility, ridiculously low. Again, I’d probably say under 10% of companies have volatility below 10%.

Even Microsoft doesn’t have that lower volatility, which is nice because I want my returns not to be too volatile.

What line am I going to draw other than the one I’ve drawn? It’s the obvious one.

OK. You can see the direction of travel, see strong growth, all looking solid and good based on a discounted cash flow basis undervalued on that as well by a phenomenal amount.

I’m lost for words.

Thank you. I hope you enjoyed that. Thanks very much. Back to Wimbledon and the tennis, I think.

Alpesh Patel

Alpesh Patel is an award-winning hedge fund and private equity fund manager, international best-selling author, entrepreneur and Dealmaker. He is the Founder and CEO of Praefinium Partners and is a Financial Times Top FTSE 100 forecaster. As a senior-most Dealmaker in the U.K.’s Department for International Trade, he is part of a team that has helped deliver $1 billion of investment to the U.K. since 2005 . He’s also a former Council Member of the 100-year-old Chatham House, the foreign affairs think-tank, whose patron is Queen Elizabeth. For his services to the U.K. economy, Alpesh received the Order of the British Empire (OBE) from the Queen in 2020. As a recognized authority on fintech, online trading and venture capital, his past and current client list includes American Express, Merrill Lynch HSBC, Charles Schwab, Goldman Sachs, Barclays, TD Bank, NYSE Life… and more.