Bitcoin’s Secret Weapon No One Can Copy

Robert Ross|August 19, 2025

When I first bought Bitcoin in 2017, most people thought I was crazy.

Back then, the headlines were all about price volatility, exchange hacks, and strange internet coins promising to “replace the dollar” overnight.

But my bull thesis wasn’t about Bitcoin replacing the dollar.

It was about trust.

That’s why Bitcoin was the very first chapter in my book, A Beginner’s Guide to High-Risk, High-Reward Investing. Of all the speculative opportunities I’ve researched over the years, Bitcoin had – and still has – the strongest moat I’ve ever seen in the crypto world.

And unlike many assets that fall in and out of favor, my thesis hasn’t changed.

The Moat Is the Network

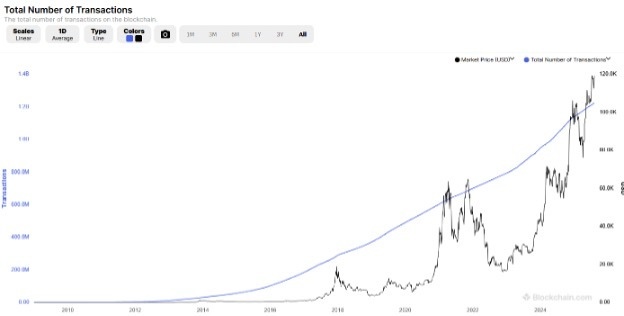

If you strip away the hype, Bitcoin’s advantage comes down to one thing: its network. Every single transaction, from the very first one in 2009 to the one that happened two seconds ago, is recorded permanently on a public blockchain that anyone in the world can verify.

This transparency – paired with a fixed supply of 21 million coins – creates a system that cannot be inflated away by politicians, bankers, or anyone else.

No other cryptocurrency has been able to match Bitcoin’s track record in this regard. Others might claim faster transactions or more features, but those advantages are fleeting. Features can be copied. Trust cannot.

Why Institutions Are Now Paying Attention

In 2017, Bitcoin was still a fringe asset. Today, it’s a mainstream conversation.

We have Bitcoin ETFs trading on U.S. exchanges. Public companies hold it on their balance sheets. Some countries have even adopted it as legal tender.

More importantly, large institutional investors – the kind that manage billions – are now entering the space. As of last week, you can even buy crypto in your retirement accounts.

They aren’t doing this because Bitcoin is trendy. They’re doing it because they trust the asset’s design and its rules.

In the world of finance, trust is a moat. And Bitcoin’s moat gets deeper the longer it survives.

Surviving the Test of Time

Over the last eight years, I’ve watched dozens of crypto projects explode higher… and then disappear completely.

Many promised to be “the next Bitcoin.” They had flashy marketing, celebrity endorsements, or better “technology.” For instance, does anyone remember the EthereumMAX pump-and-dump scheme promoted by Kim Kardashian in 2021?

While these scam coins had celebrity endorsements, they lacked the two things that make Bitcoin unique: decentralization and security.

When a cryptocurrency is run by a small group of founders or controlled by a foundation, you don’t have a moat; you have a single point of failure. And in crypto, single points of failure don’t last long.

Bitcoin, by contrast, is not run by any one person or company. Its rules are enforced by tens of thousands of independent nodes across the globe. It’s been attacked, criticized, and declared “dead” hundreds of times. Yet it’s still here… stronger than ever.

Why This Matters for Investors

You don’t have to be a crypto evangelist to see the value in this.

We live in a world where fiat currencies are constantly being devalued. Government debt is exploding. And trust in traditional financial institutions is near all-time lows.

In that environment, an asset that is transparent, scarce, and resistant to censorship has real-world utility.

That’s the moat.

And the beauty of Bitcoin’s moat is that it gets stronger as more people use it. Every additional holder, every transaction, every institutional buyer makes it harder to attack, regulate out of existence, or replace.

That’s why Bitcoin isn’t an all-in bet. But it is a high-conviction position within a diversified portfolio.

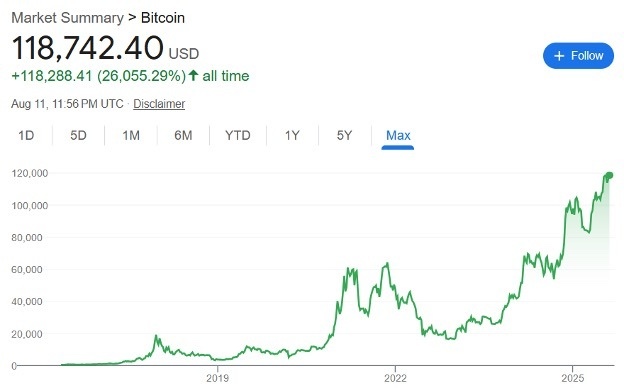

I’ve held it through multiple boom-and-bust cycles, from $7,000 to $120,000 and everywhere in between. The volatility can be brutal. But I’ve never confused volatility with fragility.

In fact, volatility is the price you pay for asymmetric upside.

And Bitcoin has proven – over and over – that it can survive volatility and come back stronger.

That’s the hallmark of a real moat. And while I can’t promise where Bitcoin’s price will be in six months, I can tell you this after holding since 2017: I’ve never seen another cryptocurrency that passes the trust test like Bitcoin does.

That’s why it was the first chapter in my book. That’s why it remains in my portfolio today. And that’s why – even after all these years – I believe its moat is still deep, wide, and growing.