Fed Cuts Without Recession: This Rare “Goldilocks” Scenario Could Trigger a 300%+ Crypto Rally

Robert Ross|September 2, 2025

Months ago, I told readers to prepare for what I called the coming “stimulus wave.”

The logic was simple. A combination of tax cuts, interest rate cuts, deregulation, and a weaker dollar would juice stocks and crypto to new highs.

That’s exactly what happened. Stocks and crypto delivered one of their fiercest rallies ever off the Liberation Day Crash lows in early April.

We got the weak USD after the crash…

We got the tax cuts in the Big Beautiful Bill…

And now we’re getting the rate cut, thanks to Jerome Powell.

But here’s the key. Interest rate cuts are coming without a recession. In other words, the Fed is cutting rates to juice the economy, not rescue it.

That’s the rare “Goldilocks” setup investors dream about… easy money without economic pain.

Last week at Jackson Hole, Jerome Powell confirmed it. The Fed is now openly signaling rate cuts at their next meeting. Stocks cheered, with the S&P 500 and Nasdaq ripping to new highs. My portfolio had one of its best days of the year, surging nearly 4% in a single session.

The same forces pushing stocks higher are now about to unleash something even bigger: a new surge in crypto.

Why Crypto Loves Liquidity

To understand why, remember what drives crypto cycles…

Liquidity.

Bitcoin was born after the Global Financial Crisis as a hedge against reckless money-printing. Every major bull run since then has coincided with waves of liquidity flooding into markets.

Take 2017, when Bitcoin surged from $1,000 to nearly $20,000. That run after years of near-zero rates and quantitative easing.

Or 2020, when Bitcoin soared from $5,000 to over $60,000. The catalyst? Stimulus checks, trillions in fiscal support, and the Fed slashing rates back to zero.

Crypto represents the purest expression of liquidity appetite. When money is loose, it pours into the highest beta corners of the market. And nothing has higher beta than crypto.

Stocks Lead, Crypto Follows

Stocks are the first stop for liquidity. History proves it.

When the Fed cuts rates without a recession, the S&P 500 has averaged 21% returns over the next 12 months – more than double the market’s long-term average of 10%.

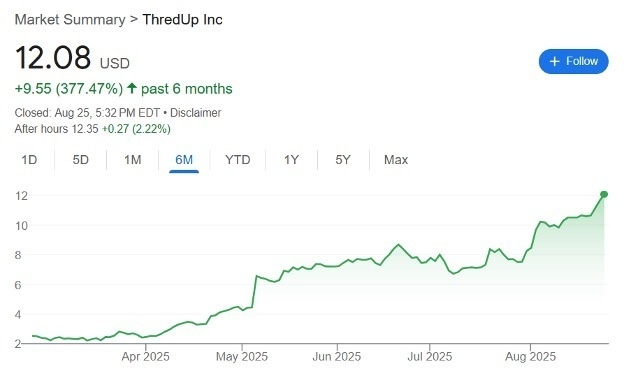

That’s why I’ve told readers for months that we want to stay long high-quality small cap stocks. This plan has worked well. One of our positions – ThredUp (TDUP) – is up over 250% since April…

But once that tide of money lifts equities, it inevitably spills into crypto.

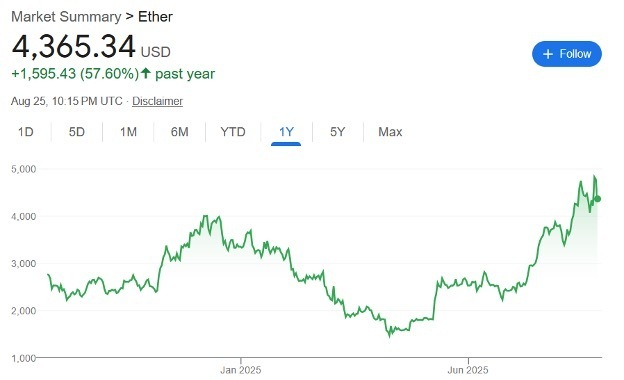

For instance, when the S&P 500 rallies 10%, you might see Bitcoin (BTC) rally 20% to 30%. Ethereum (ETH) might surge 40%. And smaller altcoins can move 50% or more.

Of course, leverage cuts both ways – crypto also falls harder during downturns. But in a Goldilocks environment where liquidity rises and recession odds fall, the skew favors upside.

How to Play This “Goldilocks” Moment

What makes this cycle particularly compelling is that crypto is no longer just speculative. It has real infrastructure and adoption behind it.

- Institutional demand is here. BlackRock and Fidelity have launched spot Bitcoin ETFs, pulling billions in inflows. Ethereum ETFs are next.

- Use cases are real. Stablecoins move hundreds of billions across blockchains every month, functioning as digital cash. Ethereum powers decentralized finance, NFTs, and even prediction markets like Polymarket.

- Global adoption is accelerating. From Latin America to Asia, people use crypto daily as a hedge against inflation and as an alternative financial system.

In short: this isn’t 2017 anymore. It’s not vaporware. The infrastructure rails are being built, the users are showing up, and institutions are piling in.

For conservative investors, Bitcoin remains the core position. It’s digital gold, with a fixed supply and growing institutional demand.

Ethereum is my second core holding. It recently surged to new highs on stablecoin adoption – a trend that won’t stop any time soon.

Beyond that, I use small, speculative allocations for higher-upside altcoins. These are the equivalent of small-cap growth stocks – volatile, risky, but potentially life-changing in the right cycle.

The key is sizing. Keep core crypto holdings at levels that won’t keep you up at night, then layer in smaller bets on the fringes.

Whether you think it’s a bubble, a mania, or the future of finance, the fact remains: when the Fed cuts rates without a recession, the riskiest assets fly the highest.

And in today’s market, nothing flies higher than crypto.