Dealmaker’s Diary: This $82 Billion Comeback Creates Rare Value Opportunity

Alpesh Patel|September 4, 2025

Wall Street left this company for dead in 2013.

They took it private. Stripped it down. Rebuilt it from scratch.

Seven years later, it came roaring back as something completely different – and most investors still don’t realize what happened.

This isn’t the same company that disappeared from public markets. This is a $107 billion revenue machine that powers every major AI breakthrough you’ve heard about.

While investors chase shiny AI software stocks trading at 100x earnings, this infrastructure giant trades at just $13 for every dollar of future profits.

The market still sees the old company. Smart money sees the 27% discount to fair value.

The transformation numbers are staggering:

- Revenue exploded to $107 billion annually

- Now dominates AI infrastructure (the picks and shovels of the AI gold rush)

- Trading 27% below intrinsic value

- Conservative projections show 60% upside potential

This company died, got reborn, and emerged as the secret monopoly powering the AI revolution.

Click on the image below for the name and ticker.

Transcript

Hi, friends. Stock of the Week: Dell. Oh my God, it’s been around for ages. It went private, came back to public.

![]()

I used to own so much Dell gear. Well, it’s a different company from what it used to be, and it continues going from strength to strength. One hundred seven billion dollars in revenues over the last 12 months alone. We’re talking market cap of $82 billion.

Massive company, heavily investing in AI-optimized infrastructure. Well, let’s look into that. You’ve got these other numbers here, which we’re going to get to in a moment. Let’s look at how it’s using AI.

They’re using it in their service, their storage, their networking – every single part of the business as you would expect.

But then there’s this whole area of Internet of Things, which has gone a bit quiet generally in the markets, but it’s still there and it’s important.

Okay. So real-time analytics, predictive insights – all those things you’d expect. Not only what am I seeing right now across any business, but what am I likely to be seeing in the future? And that allows, as it says, faster decision making and gives a competitive advantage.

It’s like you’re running with somebody wearing Nike trainers and you’re barefoot – you’ve got a problem. You need to be also wearing a jetpack to get ahead, and that’s what AI is doing. It’s giving people a jetpack, and we’ve got to make sure before we invest in any company that we use our own predictive analytics. Let’s see how they’re using AI, okay?

Cybersecurity with AI – of course, you would expect that. Developer tools, solutions that they’re providing, data management, automation – all those things I would have expected. But like I always say, expected in hindsight. I mean, I’m not a specialist in Dell.

When I read it and how they’re using it, then I think to myself, “Right, that’s how the world’s working.” This is interesting. Probably the most important thing I’ll read all day because it tells me how the world around me is working. I could read all the newspapers and the headlines and everything else. They don’t necessarily tell me how the world’s working. This tells me how the world’s working.

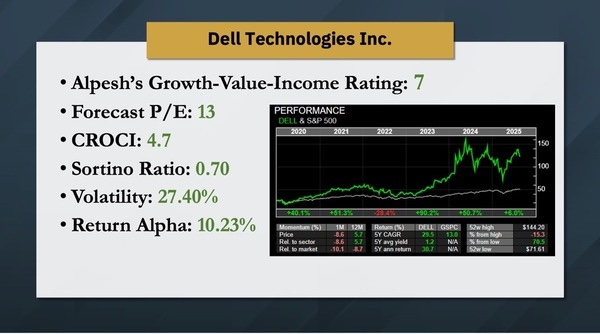

My proprietary Growth Value Income rating: seven out of 10. So you want seven, eight, nine, or 10. That gives me a lot of comfort. You’re only paying $13 for every future dollar of profits.

That’s cheap. Cash return on capital invested – would have preferred over 10. It’s the Goldman Sachs Wealth Management metric. Would have preferred it over 10, but I can handle 4.7.

It’s positive at least. Sortino – good for a stock. It’s the average return versus the downside volatility and risk. If you can get a few stocks with 0.7, you actually end up with a portfolio with a Sortino above one, which is what you want.

Okay? And this would be good for that mix.

The volatility is a bit high, but the returns have been good.

The returns have been good, as we will see in a second. Now if you were to project forward and were to call today, let’s say, the bottom of the market, which it may well not be, and that’s why we’re not trading, we’re looking at investing in this, and you project forward a typical upward move it’s had previously, and then make it a bit more conservative – you’re looking at 60% over the next 12 months on that basis.

The danger is, and often happens with the moving averages here that you can see, the MACD kisses its own moving average and then falls a bit low before rising up. So you could continue to get falls before you get the moves up. So don’t be surprised if in the near term this even went to $100. But you probably don’t want to risk it in case you missed the boat and don’t catch the train.

Discount cash flow: 27% undervalued.

Nice. Ticks that box as well. That’s your lot for Dealmaker’s Diary. Hope you enjoyed it. Thank you.

Alpesh Patel

Alpesh Patel is an award-winning hedge fund and private equity fund manager, international best-selling author, entrepreneur and Dealmaker. He is the Founder and CEO of Praefinium Partners and is a Financial Times Top FTSE 100 forecaster. As a senior-most Dealmaker in the U.K.’s Department for International Trade, he is part of a team that has helped deliver $1 billion of investment to the U.K. since 2005 . He’s also a former Council Member of the 100-year-old Chatham House, the foreign affairs think-tank, whose patron is Queen Elizabeth. For his services to the U.K. economy, Alpesh received the Order of the British Empire (OBE) from the Queen in 2020. As a recognized authority on fintech, online trading and venture capital, his past and current client list includes American Express, Merrill Lynch HSBC, Charles Schwab, Goldman Sachs, Barclays, TD Bank, NYSE Life… and more.