Buy This, Not That: The Zero-Commission Pioneer vs. the Established Giant

Shah Gilani|September 10, 2025

It’s not every day that a “meme stock darling” earns its way into the S&P 500…

But that’s exactly what just happened to Robinhood. On September 22, the company officially joins the ranks of America’s 500 most important companies.

Meanwhile, Charles Schwab has been a fixture in the index since 1997.

So which brokerage should you bank on? The established giant with a $170 billion market cap… or the disruptor that’s up 218% year to date?

The answer might surprise you. Especially when you see what Robinhood’s profit margins are doing compared to Schwab’s…

Click on the thumbnail below to see which one Shah picks – and why.

Transcript

Hey, everybody. Shah Gilani here with your weekly BTNT, as in Buy This, Not That. Today, I’m going to put Robinhood up against Charles Schwab. Why?

Because Robinhood is about to enter the S&P 500. Yes, it’s about to become part of that illustrious group of 500 stocks that make up the institutional benchmark that we all watch. Now that happens on September 22nd.

Schwab, in the meantime, has been in the S&P since 1997. So it’s been in the S&P benchmark for some time. So people want to know, should they buy Schwab or should they buy Robinhood? And I’m going to tell you.

Start off with Schwab. Big company. Got a $170 billion-plus market cap. Tremendous revenues for Charles Schwab.

$21.63 billion trailing 12 months.

Looking pretty good as far as profit margin too. 33.68%. I call that really good. So makes really good money.

Plus, it has other good metrics. Balance sheet is fine. It’s all good. It’s good, in fact.

But what’s more impressive – yes, 33.68% profit margin is impressive. What’s more impressive is on a year-over-year basis in the quarterly revenue growth, trailing 12 months, but year over year, quarterly revenue growth looks to be about 24.8%. That’s pretty good revenue growth. Their quarterly earnings growth year over year, 59%.

Pretty darn good. So Schwab is in great shape. Have a quick look at the chart on Schwab, and it looks pretty darn good too. So Schwab, again, pretty solid chart here.

Here’s the one-year chart on Schwab symbol, of course, SCHW.

Now what I’m going to point out about Schwab in terms of year to date, Schwab is up 26.6%. And from the ugly April sell-off here, Schwab is up 42%. So yes, got hit a little bit, like pretty much most stocks got hit and made a very nice recovery.

Again, it’s up 26.6% on a year-to-date basis based on yesterday’s close and up 42% from the April lows. Pretty darn good. However, that gets dwarfed by Robinhood.

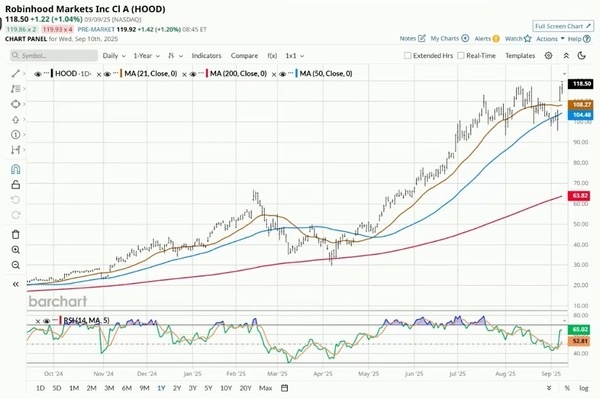

Robinhood, people, is up year to date 218%.

Robinhood is up 306% from the April lows here, people.

So Robinhood has trounced Charles Schwab, and now it’s going into the S&P 500. So as far as size, pretty darn big at a $105 billion market cap. As far as revenue, nothing like Schwab’s $21.63 billion. It’s got revenue of $3.57 billion, but their profit margin, 50% versus Schwab’s very handsome 33-plus percent. 50%, staggeringly good for Robinhood.

Quarterly revenue growth, I told you, Schwab’s quarterly revenue growth year over year was 24.8%.

Robinhood’s 45.5%.

Quarterly earnings growth, Schwab came in at 59%, quarterly earnings growth year over year.

Robinhood’s quarterly earnings growth year over year, 105%. So, yes, it’s going into the S&P 500, but it’s the new all-around go-to platform for whether it’s crypto, whether it’s chasing meme stocks, it’s a retail darling. Schwab is an older demographic as far as the overall company. Robinhood, I think, is going to continue to make tracks with retail investors, especially the younger cohort.

So, yes, people. I say buy Robinhood, not Charles Schwab, especially because it’s going into the S&P 500. That’s it for today. Buy Robinhood, not Charles Schwab.

Catch you guys next week. Cheers.

Shah Gilani

Shah Gilani is the Chief Investment Strategist of Manward Press. Shah is a sought-after market commentator… a former hedge fund manager… and a veteran of the Chicago Board of Options Exchange. He ran the futures and options division at the largest retail bank in Britain… and called the implosion of U.S. financial markets (AND the mega bull run that followed). Now at the helm of Manward, Shah is focused tightly on one goal: To do his part to make subscribers wealthier, happier and more free.