Dealmaker’s Diary: Why Paying $36 for Every $1 of This Company’s Profits Makes $$

Alpesh Patel|September 18, 2025

The math doesn’t lie, but it sure looks crazy.

Paying $36 for every $1 of future profits? Most investors would run screaming.

I’m backing up the truck.

Here’s why this “expensive” auto parts giant might be the steal of the decade…

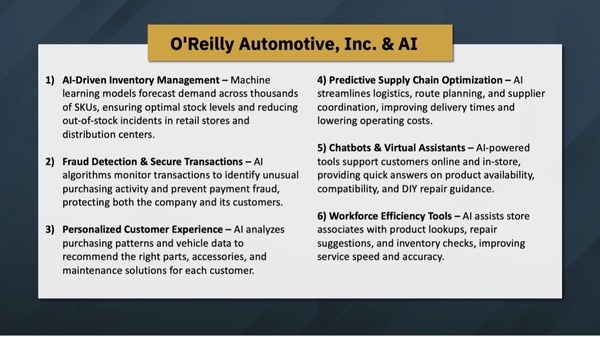

Let’s look at what this $90 billion company actually delivers. AI-powered inventory management that eliminates waste. Predictive supply chains that crush competitors. Workforce enhancement tools that turn regular employees into profit-generating machines.

The result? Numbers that put this company in the top 0.1% of all stocks for consistency.

I’m talking about a Sortino ratio of 1.3 – a metric achieved by maybe 10 companies out of 10,000.

Sometimes what looks expensive becomes cheap when you understand the competitive moat.

Click on the image below to see why this AI transformation justifies every penny of that premium valuation.

Transcript

Hello, friends, and welcome to another Stock of the Week. I have one that you will all have heard of, for a change.

Not quite the company you think it is. A lot of AI is involved in this company and some amazing numbers for what is a simple auto parts company. Let’s dive a little bit deeper into this and why I like it. It’s not just the net income of $2.5 billion or $2.4 billion or the market cap of over $90 billion. Would you believe it? I bet when you walk around those parking lots and you see an O’Reilly’s, you don’t think to yourself, “$90 billion market cap.”

It, of course, doesn’t just serve the United States, but also the Mexican markets as well.

What caught my eye is not what you’re seeing on screen now.

It’s the AI. Now you know I like to, each week with these, go through how they’re using AI, partly for educational reasons, partly because we want to make sure with the companies. AI-driven inventory management – you’d expect that. Fraud detection – that’s becoming increasingly important, because the level of fraud is just skyrocketing. There are criminals using AI, and that’s a problem. Personalized customer experience – maybe not so surprising.

Predictive supply chain optimization – now this is where it gets interesting. If you can streamline logistics, route planning, supply coordination, improving delivery time, you have the bottom line improving.

You’re basically removing inefficiencies, and that’s good for your company. Chatbots and virtual assistants – okay, fine. Workforce efficiency tools. Now, again, if you can improve and upscale your labor force, it’s not a question of AI replacing workers, but AI giving workers superpowers, and that’s what I like here.

I’ve used AI in my own asset management business with my team, and all of a sudden, the team has superpowers. They can do things well, they can do the work of people who would have cost five times more than my team does. And that makes my team more valuable, which means they’re worth paying more.

So it increases their salaries.

On my proprietary Growth-Value-Income metric, it’s a seven out of 10. Remember, this is an algorithm where we look at the valuation of a company, the growth, the dividend yields. Seven out of 10. Minimum is seven, so this hits that.

Forecast P/E – you’re paying 36 times future earnings when you buy this. So you’re paying $36 for every future dollar of profit. That’s expensive. There’s no two ways about it.

That is expensive. Valuation, yes, it is a problem. However, cash return on capital invested – that Goldman Sachs metric, which says companies in the top 25% by cash return on capital invested generate the best returns – well, this company is knocking the ball out of the park. That’s where the efficiency from AI comes in.

Makes the company more competitive, makes it more likely to deliver the kinds of results that it has been for an even longer period of time.

Volatility under 10%, and it’s just a consistent upward move.

Sortino 1.3 – that’s the measure of average return versus downside risk.

There are probably about 10 stocks that have a Sortino above 1.0 or 1.3 or above out of 10,000. I don’t think I can think of any off the top of my head. Incredible consistency of returns.

That’s my projection. Seems the obvious and simple one to do. Yes, it’s a bit overbought.

Yes, it’s a little bit expensive. You can see it here on the P/E ratio down there.

On a discounted cash flow basis, the valuation suggests it’s overvalued.

Valuation is the concern. Valuation is not the only thing that moves stock prices. Momentum does. Growth does.

So can’t have everything, but you’ve got a lot of things here going for you. Classic buy the dip. Don’t bother having a stop loss.

Simple.

Thank you.

Alpesh Patel

Alpesh Patel is an award-winning hedge fund and private equity fund manager, international best-selling author, entrepreneur and Dealmaker. He is the Founder and CEO of Praefinium Partners and is a Financial Times Top FTSE 100 forecaster. As a senior-most Dealmaker in the U.K.’s Department for International Trade, he is part of a team that has helped deliver $1 billion of investment to the U.K. since 2005 . He’s also a former Council Member of the 100-year-old Chatham House, the foreign affairs think-tank, whose patron is Queen Elizabeth. For his services to the U.K. economy, Alpesh received the Order of the British Empire (OBE) from the Queen in 2020. As a recognized authority on fintech, online trading and venture capital, his past and current client list includes American Express, Merrill Lynch HSBC, Charles Schwab, Goldman Sachs, Barclays, TD Bank, NYSE Life… and more.