Buy This, Not That: The Safer Way to Lock in an 11% Yield

Shah Gilani|November 26, 2025

Two income stocks. Both paying over 11%. Both down about 20% from their peaks.

So which one should you buy?

The answer comes down to one critical number most investors ignore.

When borrowers can’t pay back their loans, who gets paid first matters. A lot.

One of these funds has 97% of its money in first-position loans. The other has just 76%.

That means if things go south, one fund has far better protection for your principal and your dividends.

In today’s Buy This, Not That, I show you exactly why this difference could save your income stream.

Click on the thumbnail to dive in.

Transcript

Hey, everybody. Shah Gilani here with your weekly BTNT, as in Buy This, Not That.

First of all, it’s a short week for traders and investors because of Thanksgiving on Thursday.

So I want to wish you all a very happy Thanksgiving.

And speaking of perhaps hoping for more to be thankful for, I want to discuss a couple of business development companies – publicly traded business development companies that I’m going to put side by side.

Business development companies essentially are publicly traded companies that invest in private loans. They don’t invest in publicly traded bonds.

The great majority of their portfolios are loans, usually leveraged loans – in other words, to companies with a lot of leverage on their balance sheets – that they then package together and put into a portfolio from which they sell shares.

That’s what a BDC is. The reason I’m covering BDCs and comparing two this week is because they’ve been in the news lately. The one that’s been in the news is Blue Owl.

Blue Owl Capital Corp. (OBDC) has been in the news because it has a sister-type fund, which is much bigger and is private. That fund is known as Blue Owl Capital Corp. II.

Blue Owl Capital Corp. is the publicly traded entity, and Blue Owl Capital Corp. II is the privately traded fund. The privately traded fund was much smaller in terms of its portfolio, and it was struggling and certainly wasn’t attracting enough attention. So the sponsors – Blue Owl – wanted to merge the private fund into a publicly traded BDC – in other words, OBDC.

But investors balked, and that brought all of these business development companies to the forefront. Why wouldn’t these folks who would have more liquidity – because they could sell shares if they got out of the private fund and it merged into a publicly traded company – want to do the deal? They could get out because they can sell their shares. The deal blew up and ended up getting knocked down. In other words, it didn’t happen.

Blue Owl says it might happen later. Nobody knows when because the investors in the private fund didn’t like the conversion into the public fund. Why? Because the public fund, OBDC, was trading at about a 20% discount to its NAV – to its net asset value, to the value of the loans underlying the portfolio.

The problem with trading at a big discount to NAV is that those who were going to convert from the private fund would have been marked down at the discounted price. So a dollar moving from the private fund into the publicly traded fund would have been brought over not as a dollar but at that discount. In other words, you wouldn’t be moving over a dollar. You’d be moving over 80 cents. They, of course, didn’t like that.

They pushed back hard, even though the idea was, “Hey, you’ll have liquidity if you want to get out.” At the same time, Blue Owl said, “We’re also going to restrict your redemption ability while we’re doing the conversion.” So those private investors threw up their hands and said absolutely not. That brought the whole BDC space to the forefront for the time being.

The problem – besides that and what’s been drawing attention – is that a lot of these BDCs have gotten beaten up lately. So I’m going to pull up some charts for you and show you as I go through a side-by-side explanation of how OBDC, the Blue Owl Capital Corp. publicly traded BDC with its portfolio of loans, compares to – and this is a real apples-to-apples comparison because the sizes are pretty similar – the Blackstone Secured Lending BDC. The Blackstone Secured Lending Fund (BXSL). So we’re going to compare OBDC to BXSL. Let me pull up some charts while I’m going through some numbers with you. I’m going to pull up OBDC first, and you can take a look at the chart. Here’s OBDC.

As you can see, it’s kind of an ugly picture here. It’s gone down quite a bit. Back on the high here, we’re going back to February of this year – the intraday high was $15.73. At its low, Blue Owl Capital Corp. traded down 26%. It has since bounced, but it is still about 18% off of its highs. That’s not so good, but not so bad because it looks like it’s trying to make a bounce. I’m going to have a look at Blackstone, BXSL, and take a look at that chart and show you that it has had a bit of a tumble too.

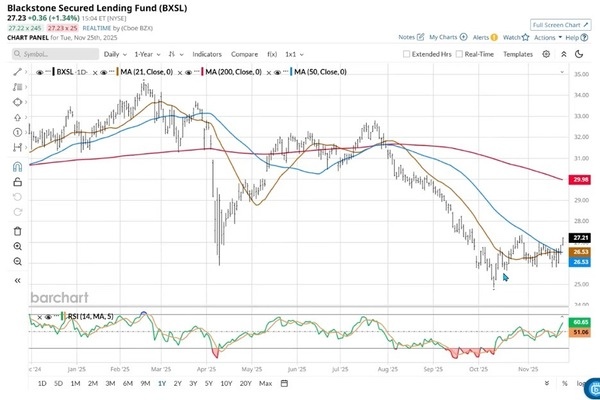

So BXSL has had a high around a similar timeframe. BXSL’s high was back in February also, back here in February of 2025. But then it fell precipitously. On its low, BXSL was down 28%. It has bounced a little bit. It’s down 19.6% off of its highs.

The first thing I want to point out here is that Blackstone has now moved up above its 50-day moving average. That’s a pretty steep sell-off, but at least now we’re up above the 50-day moving average.

As far as OBDC goes, it has had a nice move up, and it is just above the 50-day, but it has got a big gap and it has got a lot more room to fall back down to below its 50-day. Whereas BXSL, there was some accumulation around its 50-day and it pierced the 50-day.

So this gives you a little bit of pause here, but I’m going to give you a side-by-side comparison and tell you which one I like, which one to buy, which one not to buy.

First of all, as far as similarities, they’re very similar. As far as market cap, OBDC is $6.46 billion and Blackstone is $6.21 billion. Profit margin on Blue Owl is 36.89%. Better profit margin on Blackstone – it’s 42.42%.

The yield, the trailing yield on Blue Owl is 11.7%, but that dividend has been cut because perhaps some of the loans were rolled over. Since most of them are floating, they likely reloaded them at a lower rate, hence a lower yield. So the forward dividend now for Blue Owl is 8.93%. Blackstone’s yield is 11.46%, both forward and trailing based on its current price.

So they haven’t had any cut of the dividend yet, and I don’t know whether they will or not. But what I really want to compare are the portfolios and what’s likely to result from any other leverage action or maybe a downturn in the credit markets. Both of these are highly leveraged.

The fair value portfolio of Blue Owl – fair value portfolio – is about $17.1 billion at its current price.

It has been trading around a discount of 17% to 21% discount to NAV. As far as Blackstone Secured Lending, BXSL, it has been trading pretty much close to par – between zero discount and a 4% discount. So I think that tells me that investors are more secure with that portfolio. One of the reasons they may be more secure is that in the Blue Owl portfolio, 76% of the loans are first lien.

As far as Blackstone, 97% of the loans are first lien. So it’s a better, more secure portfolio as far as the assets underlying it and each fund’s access to those assets if there are issues with repayment of those loans. So all things being equal, to me, Blackstone is a better deal.

I would much rather buy Blackstone on account of the fact that I like the better portfolio. I like the fact that they have far more first-tier loans. I like the fact that they haven’t cut the dividend yet. I like the fact that they both have had similar knockdowns from their highs, but I think Blackstone has got a better portfolio.

It’s a more diversified portfolio. And for my 11.46% yield, I’m going to take Blackstone, BXSL, over Blue Owl Capital Corp., OBDC. That’s it for this week.

A little bit of understanding, explanation, and education on business development companies.

One last thing on BDCs – a lot of them are lending to AI-related companies, private companies, startups.

Obviously, there’s a lot of demand in that space. Blue Owl is slightly more – probably a good bit more – leveraged to AI startups and loans than Blackstone’s fund. So that’s another reason I like Blackstone over Blue Owl at this juncture.

Happy Thanksgiving, everybody. Catch you guys next week. Cheers.

Shah Gilani

Shah Gilani is the Chief Investment Strategist of Manward Press. Shah is a sought-after market commentator… a former hedge fund manager… and a veteran of the Chicago Board of Options Exchange. He ran the futures and options division at the largest retail bank in Britain… and called the implosion of U.S. financial markets (AND the mega bull run that followed). Now at the helm of Manward, Shah is focused tightly on one goal: To do his part to make subscribers wealthier, happier and more free.