Monday Takeaways: December’s First Week Could Decide Your Year-End Returns

Shah Gilani|December 1, 2025

We’re turning the page to December with a clean slate…

But the ink is barely dry and the markets are already down.

So much for last week’s momentum.

Here’s what’s going on…

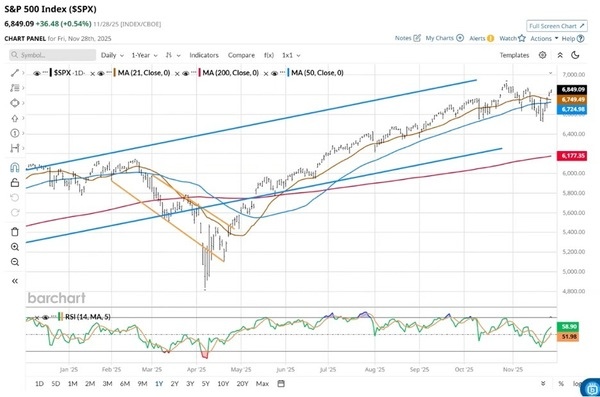

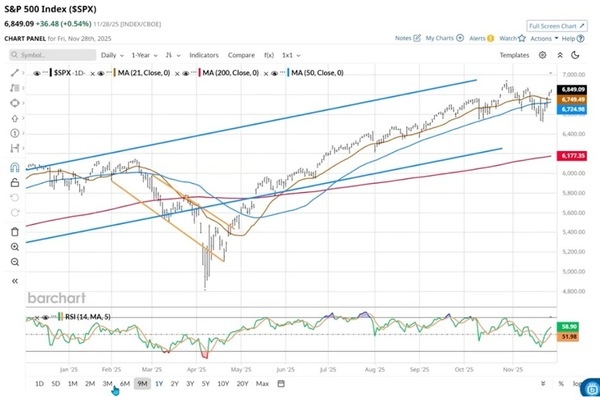

- The S&P 500 is within 1.5% of all-time highs after a spectacular rally

- November ended flat – zero gains for the month

- AI leadership has fractured between Nvidia (down) and Google (up)

- Money managers are desperate for year-end performance

This week’s packed with data that will determine everything. Wednesday: ISM services, ADP employment, industrial production, import prices. Friday: PCE, personal spending, personal income, Michigan sentiment, consumer credit.

Can stocks create enough momentum for the Santa Claus rally? Will money managers pile into names to show year-end performance? Or will this week’s data kill the rally before it starts?

I’ll explain why the AI story’s bifurcation creates serious problems for investors, what reaction to this week’s data releases will tell us about market direction, and why December’s first week might be the most important trading week of the entire year.

Click on the image below to see if December delivers the year-end rally or crushes it.

Transcript

Hey, everybody. Shah Gilani here with your Monday Takeaways. It’s going to be an interesting week, given the takeaways from last week, quite the rally.

Yes, I think it was somewhat short covering, and then buy the dip, and then – are we going to turn a corner? Is this going to be the beginning of what’s going to be a year-end rally, which a lot of analysts, myself included, have been calling for? But we’re not there yet. Yes, it was a great week in terms of turning stuff around.

How great was it? Well, how about I just give you a look at how it turned out on the chart? Because that tells the story. A picture always tells the better story.

Here it is. Wow. From the depths here, just a skyrocket higher. Looking up close on the three-month chart, this is a very nice movement up here.

It was getting scary. We’re looking at a double bottom here. We could have broken down.

But now, heading up, we’re only about a percent and a half away from all-time highs. So yeah, still within this nice rising channel as far as the S&P goes, and pretty good.

That being said, the Qs – or the NASDAQ Composite and the Qs representing the NASDAQ 100 – didn’t do as well last week, nor did they do as well for the month. Yes, they had a nice week, but didn’t do quite as well.

Still a bit of ways from their all-time highs as far as the NASDAQ 100 and the Qs go. But the interesting thing is you had some stocks that were beaten up do incredibly well.

Is that short covering? Because there wasn’t a lot of really positive news. And you look at something like Intel and how it moved 10% on Friday.

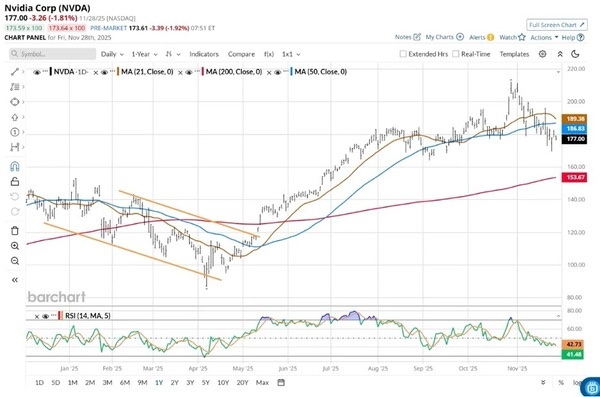

This is an awful chart here, pretty ugly. Then bang, out of the blue, a rocket ride higher, which gave a lot of investors a lot of hope. So what’s going on? Let’s have a look at some of the big names because really the takeaway from last week was the turnaround in a lot of tech names and that buy-the-dip cover, but not so much for the likes of the leadership stocks in terms of the AI story, which is Nvidia. That did not do well.

All of the Nvidia-related, OpenAI-related plays didn’t do well, but the Google Gemini and their associated plays did well last week because Google did exceptionally well.

So now we have this bifurcation in terms of the AI story. You’ve got OpenAI and Nvidia on one side, and then you’ve got Google Gemini and their cohorts on the other side.

That is creating a problem for investors because which way is this AI story going to unfold? Look at Google and you say Google is going to be the winner. Not only are they using their own chips, but a lot of other folks are going to start to use them too. So this is part of the problem we’re seeing in the AI narrative and the bifurcation that I just talked about. So Google through the roof certainly helped stocks last week.

Now this is going to be a very interesting week as far as the takeaways from last week.

The bottom line was at the end of November, the month was flat. The S&P was flat, and the NASDAQ was down 1.6% in November. So here we are turning the page. Now we’re in December, new month.

Will we get that year-end rally? Do stocks have – can they create enough momentum for investors and money managers and mutual funds and the like who don’t have the performance because it’s been a pretty good market? Will they pile into a lot of names to try and say at the end of the year, “Yes, we were in those stocks”? Will that create the year-end or Santa Claus rally that a lot of folks think we can get? And yes, we can get that.

Will we? I don’t know. Here it is Monday morning pre-open, and the futures are down. The S&P is down almost three-quarters of a percent. The NASDAQ is down 1% in early trading futures. And that’s all of a sudden like – what? Where’s the momentum from a tremendous week last week?

Well, it’s back to questioning the AI story. It’s going to be a very interesting week. It’s going to be a bumpy week. It could go one way or the other. Why? Because today, Monday, we’ve got both PMI manufacturing and we’ve got ISM manufacturing numbers. Wednesday, U.S. industrial production, ADP employment numbers. We have Institute for Supply Management numbers – ISM services numbers – on Wednesday. We have import prices on Wednesday.

It’s going to be a very interesting Monday, but Wednesday is going to be much more interesting. And then we have Friday. Anything can happen. We’ve got PCE on Friday. Wehave personal spending, and we have personal income. We also have the Michigan sentiment numbers. We’ve got consumer credit numbers.

So Wednesday is going to be interesting. Friday is going to be even more interesting. It really depends going into Wednesday or coming out of Wednesday, how the market looks, and then going into Friday and what the numbers are and coming out of Friday.

Because if markets don’t like the numbers and investors and traders sell and push indexes down, then we’re going to have a hard time starting the month with the kind of energy and momentum we need to get into a year-end rally situation. It’s going to be a really interesting week.

Takeaways from last week are we have a clean slate this week, but we have a lot of numbers, and a lot of investors are going to have to take away a lot and juggle those numbers. And it’s not so much about the numbers. The numbers are important. What’s always more important – the takeaway from the numbers – is always the reaction to those numbers.

Are traders and investors buying or selling on them? So what is it? Because sometimes good news is bad news, and sometimes bad news is good news. That’s part of the takeaway from data. Data is a mixed bag. It’s not always black and white. This week is going to be pretty gray. So enjoy it out there and stay warm.

Cheers, everybody.

Shah Gilani

Shah Gilani is the Chief Investment Strategist of Manward Press. Shah is a sought-after market commentator… a former hedge fund manager… and a veteran of the Chicago Board of Options Exchange. He ran the futures and options division at the largest retail bank in Britain… and called the implosion of U.S. financial markets (AND the mega bull run that followed). Now at the helm of Manward, Shah is focused tightly on one goal: To do his part to make subscribers wealthier, happier and more free.