Crypto and Taxes: Two Key Rules to Follow

Andy Snyder|February 12, 2021

Want to know the very best way to tell if an asset is red-hot?

Simple… When the top question from a group of investors isn’t about what to buy, but how to pay taxes on all their profits.

That’s when we say it’s time to celebrate.

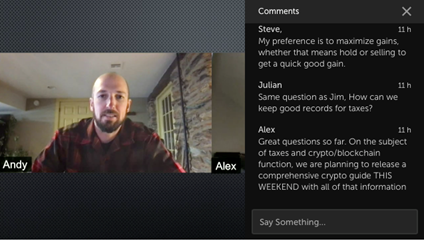

We hopped online Wednesday night for a live chat with our Alpha Money Flow subscribers.

Several hundred folks tuned in.

We pegged the night as a bit of a party. All of our recommendations are up by double digits… and several have doubled in just the last few weeks.

One was up 60% just yesterday.

It’s like we told our subscribers this week… As long as the free money keeps flowing from Washington, the gains will continue.

But our pals in D.C. giveth and taketh.

As you can see from the chat log… folks are wondering how to pay their taxes on all their gains.

It’s a good problem to have… as far as problems go.

It’s a good problem to have… as far as problems go.

While we’re no expert on taxes, we are an expert on paying them.

We could have bought a dozen senators for all we’ve paid.

The Rules

There are two key things to know with cryptocurrency and taxes.

The first is simple… Crypto isn’t currency. It’s property.

We pounded the table Wednesday night over this idea. It’s dangerous to think of crypto solely as a form of money. It’s not.

Out of the thousands of coins and tokens on the market, only a small handful want to be money.

The rest are designed to do something.

So when the IRS classifies crypto as property, we agree.

This ruling means we must treat our holdings just like a fancy painting or a vintage car.

The IRS requires folks to report all transactions on their annual tax forms. Just like with the exchange of an antique car, we report the buying price and selling price. Our tax liability ebbs and flows with the difference between the two numbers.

The trick – and the sloppy part of all this – is knowing what Yellen and her Treasury Department define as a taxable event.

Again, in the simplest of terms, it’s when we buy and sell a crypto. It’s easy if we’re trading coins like stocks.

But what if we buy, oh, say, a Tesla with our coins? That transaction is taxable.

Oy.

The law says we must report the exchange of our coins based on their fair market value at the time (a tall task given recent volatility).

Think of it this way… If you’re converting a coin to anything else – including other coins – it’s a transaction. Any ups and downs in the price from when you acquired the coin will affect the taxes you owe.

If you simply buy and hold coins or transfer them from one wallet to another, it is not a taxable event.

It may sound tricky, but really, it’s simple.

Unless you’re buying actual goods with your coins, their tax treatment isn’t all that different from how you treat stocks.

Keeping Track

But here’s where things get tougher…

At the end of the year, we get a handy 1099-B from our stockbroker. It contains the details of all of our trades.

That’s not the case with crypto.

If you’re lucky, you’ll get a 1099-K that details all of your transactions.

It’s the same form our family’s small business gets from our credit card processor each January. It details the transactions for the year and even breaks them down by month.

But with crypto, this form says nothing of your basis. It just tallies the amount you spent.

A 1099-K does you virtually no good. But it does kindly alert the IRS that you have cryptos and are buying things with them.

Gulp…

Once again, if you are treating your coins like stocks – and are not using them to buy electric cars or flowers for a sick friend – the reporting process is much simpler. While you won’t get a traditional 1099, most popular exchanges offer complete trading details that outline the buy and sell price.

With a bit of quick math, any tax obligation is clear.

To be sure, the bean counters (or in this case, the bean takers) have a lot of work to do when it comes to this new asset class.

For you, though, our advice is simple.

Treat crypto just as you would a stock. Buy it, hold it and sell it for a profit.

If you’re doing that, paying your obligations is no problem.

After the gains we’ve seen this year, the taxman has some big checks coming his way.

Perhaps he’ll use them to buy a new printing press to keep the good times rolling.

P.S. We didn’t see you on our call Wednesday night. That’s not good at all.

If you want to join us on the next call, the process is simple. Just join us at Alpha Money Flow. This latest presentation shows exactly why we’re having so much success… and details how you can get in on my three favorite cryptos today. Click here now.

Keep the crypto questions coming. Send them to mailbag@manwardpress.com.

Andy Snyder

Andy Snyder is an American author, investor and serial entrepreneur. He cut his teeth at an esteemed financial firm with nearly $100 billion in assets under management. Andy and his ideas have been featured on Fox News, on countless radio stations, and in numerous print and online outlets. He’s been a keynote speaker and panelist at events all over the world, from four-star ballrooms to Capitol hearing rooms.