Our Trailblazing Investment Philosophy (MAP Theory)

If you’ve ever picked up a book on investing, you know much of the money management world follows a model known as “modern portfolio theory.”

It’s the idea that if we put a mix of stocks together, measure their correlations and adjust our position sizes based on those figures, we can optimize our portfolio’s returns and reduce our risk.

Its debut revolutionized the world of money. In fact, it won a Nobel Prize.

Then again, so did António Moniz… the man behind the frontal lobotomy.

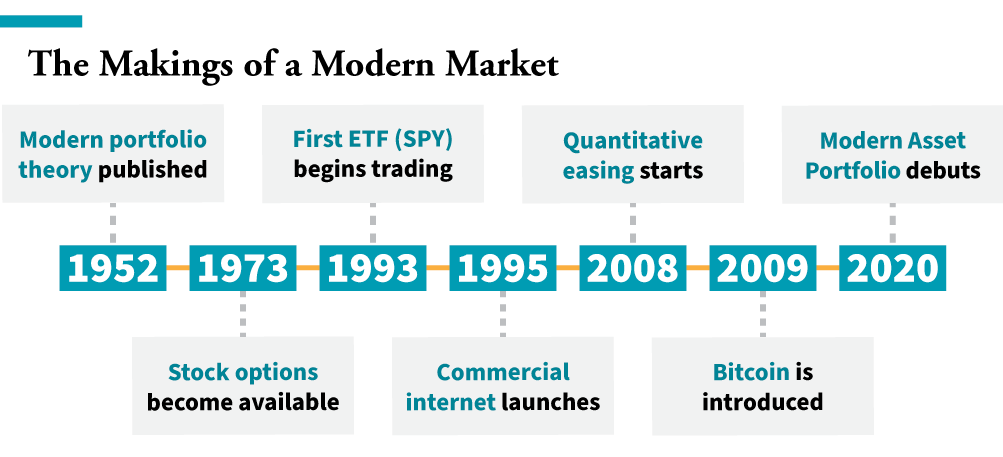

The problem with modern portfolio theory is that it’s about as modern these days as a black-and-white TV. After all, the first color TV debuted in 1953 – one year after modern portfolio theory was first published.

It doesn’t take into account modern inventions like stock options… ETFs… cryptocurrencies… quantitative easing… near-zero interest rates… runaway government debt… or, perhaps the biggest disrupter of all, the internet.

The bottom line is… things have changed over the last 70 years. Our modern markets look a whole lot different than they did in the 1950s. That means our investing models must look different.

And that’s precisely where our “modern asset portfolio” theory – or MAP theory – comes in.

It’s a smarter way to invest. Because with MAP theory, we aren’t focused on how the markets worked more than half a century ago. We’re focused instead on a truly modern market… with an investing model based on what’s happening right now.

Get all the key details about MAP theory and how it can radically improve your investing when you subscribe to Manward Financial Digest.

As soon as you enter your email below and hit “Submit,” we’ll rush you a free copy of Manward’s investment treatise: “It’s Not Too Late: Manward’s Guide to Making Dreams Come True.”

(And you can refer back to it as often as you’d like here in the Manward Trading Academy.)

We think you’ll agree… It’s time for something different.

Something better.