How to Buy a $2,000 Stock for Just $50

Andy Snyder

I’ve been leading folks to intriguing moneymaking opportunities for a long time.

And if I had to pick just one thing that frustrates new investors the most… it would be price.

I get it. When you’ve got just a few hundred or a few thousand dollars to invest, nobody wants to put it all into a single share of a hot company.

It’s risky and, frankly, no fun.

But too many folks take this idea too far. That’s why penny stocks – which can be quite dangerous if you don’t know what you’re doing – got so popular.

With stocks that trade for just a few cents, investors can get hundreds of shares in dozens of companies.

But there’s a reason good stocks are “expensive” and lousy stocks are cheap.

You get what you pay for.

But that’s no longer entirely true.

Wall Street Is (Finally) Open to All

Thanks to some fresh innovation on Wall Street that I am quite fond of, price no longer matters. Whether you’re starting out with $5 or $5 million… you can now buy the same stocks.

Shares of Berkshire Hathaway (NYSE: BRK-B) are famously expensive. On Friday, November 22, 2019, for example, a single share of the billionaire-making stock would have cost you more than $325,000.

Only the rich could get in.

But that’s all changed.

On Monday, November 25… just hours after many folks happily plunked down hundreds of thousands of dollars for a share of Berkshire… you could’ve gotten a stake in the company for just a buck.

Fractional shares had become a reality on Wall Street.

Interactive Brokers was one of the first firms to kick off the trend, in late November 2019, and it’s been exploding in popularity ever since. Some small brokers tell us that up to 50% of their trades each day are now for fractional shares.

The way it works is quite simple.

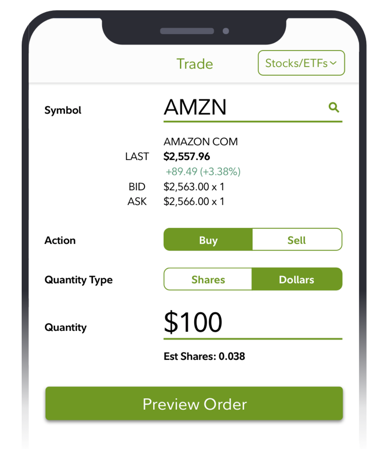

As an investor, all you need to do is make a trade using your brokerage’s platform. It’s easy. You can even do it on your phone.

Here’s what it looks like using Fidelity’s smartphone app…

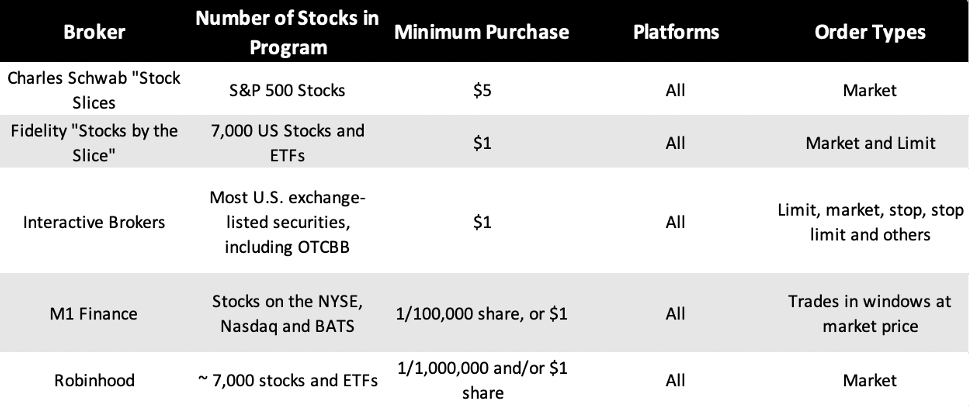

Each brokerage platform boasts slightly different options.

Interactive Brokers, for instance, requires a minimum investment of $1 and offers a wide array of limit orders.

Charles Schwab requires a $5 minimum purchase and offers only market orders.

(See the end of this report for an up-to-date list of popular brokerages that offer the service, including their minimum prices and any limitations.)

For most investors, these nuances aren’t major, but they are worth studying before you pick a brokerage.

A Whole New World

Once you place your trade, your investment is treated just as if you owned a full share. If the stock goes up by 10%… your stake goes up by 10%. If the stock goes down… your stake goes down.

It’s even true with dividends. If a stock pays a dividend of $1 per share, and you own, say, a tenth of a share… you get a $0.10 payout.

It’s very simple.

What’s not simple are the doors this new investing option opens.

This is huge.

Fractional shares make smart, modern diversification possible for even the smallest of investors.

Think about the popular FAANG trade, for example.

It requires a stake in…

- Facebook (Nasdaq: FB), which trades for around $270

- Apple (Nasdaq: AAPL), which trades for around $130

- Amazon (Nasdaq: AMZN), which trades for more than $3,000

- Netflix (Nasdaq: NFLX), which trades for just over $500

- Google’s parent company Alphabet (Nasdaq: GOOG), which trades for more than $1,700.

Just to buy a single share of all five would cost more than $5,600. That’s a lot for five much-hyped stocks… And it’s flat-out impossible for a novice investor, who may have just $1,000 to put toward their retirement.

With fractional investing, though, that same investor can now put just $100 into a FAANG trade… and spread the rest across an array of diversified stocks.

Like I said, it’s changed the world of investing. It’s democratized Wall Street and taken share price out of the equation.

That’s great… because now we can focus on buying stocks with the most value… not just the ones with the lowest price tag.

If you’re new to investing… don’t have much to invest… or just want to pick up a slice of some super-expensive stocks… find a brokerage that offers fractional investing.

The list is growing fast.

It’s a welcome innovation. Price no longer matters.