A New – and Exciting – Way to Play Gold’s Next Surge

Andy Snyder|May 19, 2021

Let us show you how to make some money in this market.

It has to do with gold and one of those gauges we discussed yesterday.

It’s the strongest of them all.

If you know how real interest rates move the markets, you know what most folks don’t. We’re convinced this simple little trick is the difference between reliably making money and praying things work out.

What’s happening in the gold market is proof.

As inflation ticks higher and drives real interest rates lower, gold is surging higher. (Remember, real rates are the nominal rate that’s reported in the press… minus the rate of inflation.)

In fact, since we last reported on gold’s bullish setup on April 28, the metal is up by $100 an ounce.

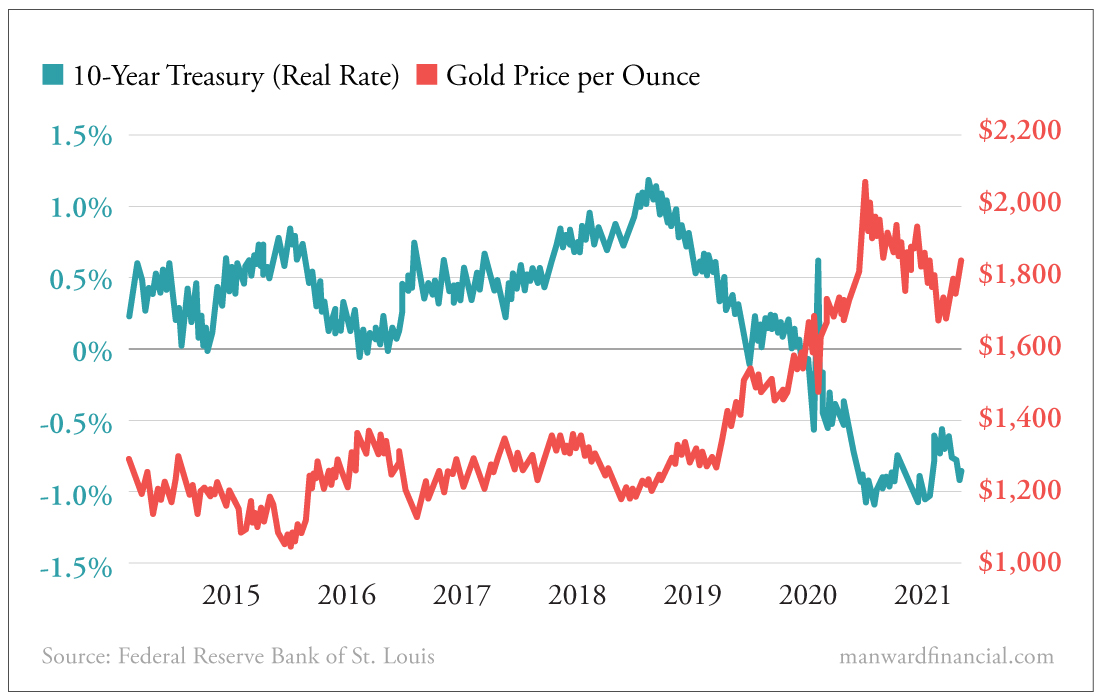

This chart shows why…

The red line is the price of gold.

The teal line represents the real rate of the 10-year Treasury. It’s the nominal rate of the 10-year (about 1.65%) minus the official rate of inflation (2.54%)… or a real rate of -0.90%.

But the math doesn’t matter. It’s the relationship that counts.

When real rates dip, gold rises.

Forget tracking mining output, central bank demand or the size of this year’s “Indian wedding season.” That’s silly. All that matters is that when one of these lines dips, the other rises.

It gives us a clear and obvious chance to make money.

Here’s How…

Just this week, Fed officials once again said to expect rates to stay lower for longer.

That means the inflation that even the blind see coming will pull real rates even lower. Without rising rates, we could see real rates fall to record lows.

That means, of course, as with the record low rates we saw a year ago, gold should soon be hitting record highs.

The price of gold is likely to head 10% to 15% higher in the next few months.

The investment opportunities are clear.

On the simplest side of things… buy gold. An ETF will get the job done, but physical gold ticks all the boxes.

We don’t get paid to recommend our friends at Asset Strategies International… We just like them and agree with their core values.

For a bit more leverage and therefore a bit more risk, buy shares of a gold miner.

That’s what we did in our Venture Fortunes subscription service. Just a couple of days after penning my thoughts on gold for this column, we told our subscribers to jump into a rather conservative gold miner.

It paid off.

In two weeks, the stock is up 15% and our option stake is up more than 80%.

Until recently, that’d be our choices… buy a miner, buy an ETF or buy the real stuff.

But thanks to one of the hottest trends on Wall Street right now, there’s another option. It will cost you less than $10 per share… and if things don’t go right, there’s a good chance to get your money back.

As we mentioned on Monday, SPACs – or special purpose acquisition companies – offer a speculative way to get into pre-IPO opportunities like never before. Although they’ve been around for many years, not until very recently have they evolved into something everyday investors would want to be part of.

In this case, a new SPAC – African Gold Acquisition (AGAC) – just listed on the NYSE in March. Its aim is to soon bring a private gold mine to the public markets.

That’s an exciting idea – especially right now.

How many folks have ever had the chance to buy a gold mine… before it went public?

There’s more you need to know about SPACs and how to play them before you buy. With as many as 700 expected to hit the market this year… opportunity abounds. But details matter.

More on that – including a HUGE announcement – tomorrow.

For now, know that Manward Letter‘s exclusive Modern Asset Portfolio currently calls for a 10% allocation to gold.

If you haven’t already, it’s time to stock up.

Note: A big announcement could be coming from the Fed on June 16. It could mean big things for the price of gold… and how you own it. We’ve compiled all the historical research and details on what to do next at this link.

Andy Snyder

Andy Snyder is an American author, investor and serial entrepreneur. He cut his teeth at an esteemed financial firm with nearly $100 billion in assets under management. Andy and his ideas have been featured on Fox News, on countless radio stations, and in numerous print and online outlets. He’s been a keynote speaker and panelist at events all over the world, from four-star ballrooms to Capitol hearing rooms.