Don’t Let the Devil Take More Than His Fair Share

Andy Snyder|July 26, 2021

We lost two lambs this week. It was a mess.

The first one tried her hardest. The little darling escaped a ravaging predator, but not before he got his mitts on her. He put a tear in the two-month-old lamb’s side that went straight through the skin.

We held her and did our very best to help. But it was clear the fox had won.

We could peer into the wound and see things we weren’t supposed to see.

We found only pieces of her sister.

The devil got his cut.

It’s our fault. We’ve seen two brave foxes for several weeks now. Daylight or darkness, they’re bold and eager – a product of their young age.

We should have corralled the sheep. We should have kept them closer to the house… in a pasture where they’d be treated better. But no, we kept them in the big, green pasture where the lush grass keeps them happiest.

We paid for it with two souls.

Like we said, the devil got his cut… but he sure didn’t have to.

Keeping What’s Ours

It’s no different with our money.

We all do dumb, lazy things with it. We leave piles of cash in accounts that don’t bear interest. We let a position grow so large that it dominates our portfolio. And, to our point today, we too often let the devil take more than his fair share.

That idea is on our mind this morning.

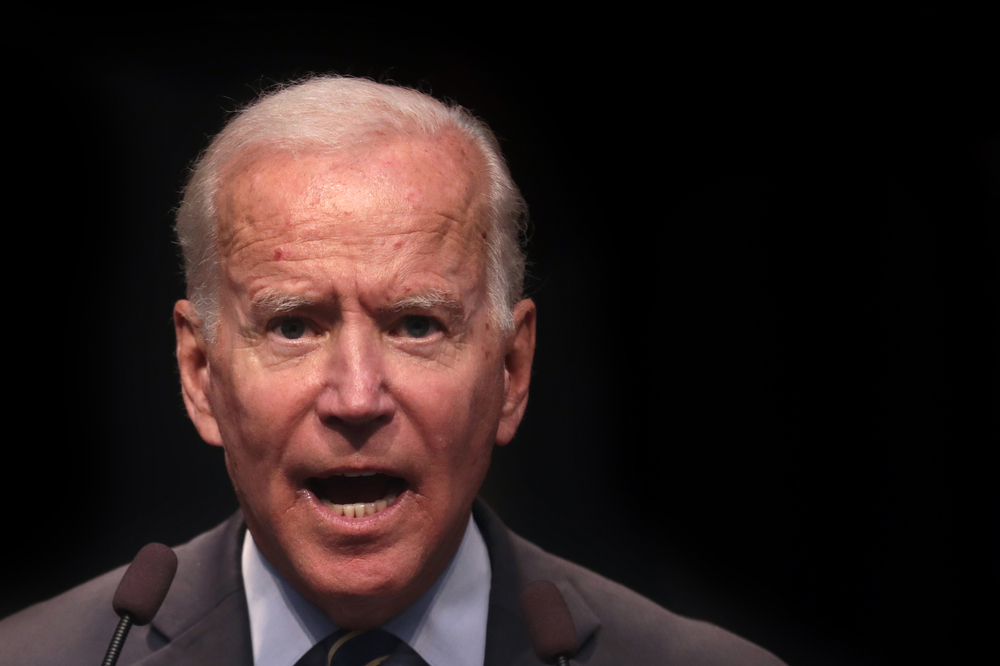

President Biden said something last week that savvy investors should know about.

“I’m tired of trickle down,” he said.

“I think you should be able to go out and make a billion dollars or a hundred million dollars if you have the capacity to do it. I just ask one thing…” he said, coming to the sort of whisper a bank robber murmurs into a teller’s ear. “Pay your fair share.”

It’s like the fox in our pasture. “I don’t mind if you graze your sheep right outside my den. Just let me steal…” he says quietly and so close to our ear that we can smell his mouse-tinged breath, “my fair share.”

The problem, of course, is that our fox is a greedy little bastard. And so are the folks in Washington.

If it were just the one fox, how much could he eat? But he’s fathered pups. And they’ve had pups. And now the whole lot of them strut around the place while we eat our lunch.

It’s no different from what we see in Washington.

Things have sure grown.

Thomas Paine got it right so many years ago when he said, “What at first was plunder assumed the softer name of revenue.”

Calvin Coolidge took it even further, saying, “Collecting more taxes than is absolutely necessary is legalized robbery.”

And, of course, Ronald Reagan nicely summarized this evolution of government gone mad.

“The government’s view of the economy,” he said, “could be summed up in a few short phrases: If it moves, tax it. If it keeps moving, regulate it. And if it stops moving, subsidize it.”

That’s how we got to where we are today… when annual tax receipts of $3.7 trillion are not enough to keep the lights on. We’ve got to borrow some money and print the rest.

Like we said, the fox is a greedy little devil… and he’s getting hungry.

The Truth Comes Out

Biden’s statement demands a retort. Fortunately, the president gave it himself.

“We have more corporations registered in Delaware than all the rest of America… combined.”

Golly, Mr. President, he seems to beg us to ask, can’t you just do for the nation what you did for Delaware?

Gee whiz, that’d be great.

Well, friend, Delaware’s corporate success has everything to do with our problem with the sheep and the foxes.

It has nothing to do with paying our “fair share” and everything to do with moving our money – and our flock – to where it’s treated best.

Like we said, we should have moved our little lambs. We should have taken them to a safe place where the predators don’t roam.

In the United States, when it comes to money, that place is Delaware. It doesn’t attract 75% of all new corporate filings because it offers a slick and easy way for companies to pay their – quiet and slowly now – “fair share.”

No… it treats them well – the best of any state in the nation.

Delaware offers fair and flexible corporate laws. Its unique Court of Chancery – established in 1792, just a bit before Biden took office – resolves corporate issues quickly and efficiently… with a judge, not a jury.

The system greatly limits personal liability.

In 1899, the Delaware General Corporation Law took things even further. As neighboring states fought over attracting more businesses, Delaware lowered the bar to the ground. The new law “reduced restrictions upon corporate action to a minimum.”

It lets businesses be businesses.

The state is also home to the “Delaware loophole,” which allows companies to declare revenue in Delaware instead of the state where the business transpired. Plus, it doesn’t levy taxes on intangibles like royalty payments, copyrights and leases.

And, finally, Delaware makes it easy to start a business. It doesn’t require reams of paperwork or information. Anybody can incorporate a business in less than an hour.

It’s said that it’s easier to set up a corporation in Delaware than it is to get a driver’s license.

Game the System

We doubt Biden would like the answer given by George Washington University professor David Brunori when he was asked why Delaware has been a business attracter since the early 1900s.

“Delaware is an outlier in the way it does business… What it offers is an opportunity to game the system and do it legally.”

In other words, if Biden wants to do for America what the men who came long before him did for Delaware, he must do three things.

He must lower taxes. He must make business creation and investment more efficient. And he must back a court system that is fair, equitable and not prejudiced against business.

We look around and don’t see much of that… not at all.

But here’s the thing… This is where this idea can start to transform your wealth.

As always, personal accountability is key.

The dopes in Washington – on the left, on the right and on “your side” – aren’t going to do what’s right anytime soon.

They’re in it for the power, not the people.

Just like it was up to us to move those lambs… it’s up to you to move your money to where it’s treated best.

There are more “Delaware loopholes” out there – plenty of them.

Put your income-spewing assets into an IRA. Take advantage of 529 plans. Start a small business and dump your expenses into it.

The options are robust and lucrative.

We’ll leave you with a quote from Thomas Jefferson…

The tax which will be paid for the purpose of education is not more than the thousandth part of what will be paid to kings, priests and nobles who will rise up among us if we leave the people in ignorance.

The devil will get his cut.

Don’t sit idly by with your sheep, or he’ll make counting them easier every day.

Andy Snyder

Andy Snyder is an American author, investor and serial entrepreneur. He cut his teeth at an esteemed financial firm with nearly $100 billion in assets under management. Andy and his ideas have been featured on Fox News, on countless radio stations, and in numerous print and online outlets. He’s been a keynote speaker and panelist at events all over the world, from four-star ballrooms to Capitol hearing rooms.