The Bad News Behind Soaring Bank Stocks

Andy Snyder|October 18, 2021

This may go down as the biggest and costliest mistake in monetary history.

Few folks are talking about it yet… but the effects are roaring to life.

Governments around the globe have printed massive amounts of money. It’s still happening. The Federal Reserve has printed more than $5 trillion… with more coming off its virtual printing press each day.

The rationale for the move was simple… as in simple-minded.

The crushing weight of the pandemic and the economic lockdowns associated with it would destroy jobs, businesses and income streams, the folks at the Fed reasoned. Massive levels of debt would go unpaid.

The money behind those unpaid obligations would simply disappear.

Jay Powell and his colleagues in Washington figured that they’d print an equal amount and stuff it into the economy and all would be well – or, at least, well enough.

But they messed up.

Big-time.

We saw it in the news last week…

A Dearth of Defaults

Shares of Citigroup (C) jumped late last week as the behemoth bank released a whopping $1.16 billion from its loan loss reserves.

JPMorgan Chase (JPM) released even more… $2.1 billion.

Bank of America (BAC) released $1.1 billion in cash it figured it would have to write off due to bad loans.

And rounding out the big banks, Wells Fargo (WFC) transferred some $1.7 billion back onto the books because folks are actually paying their bills.

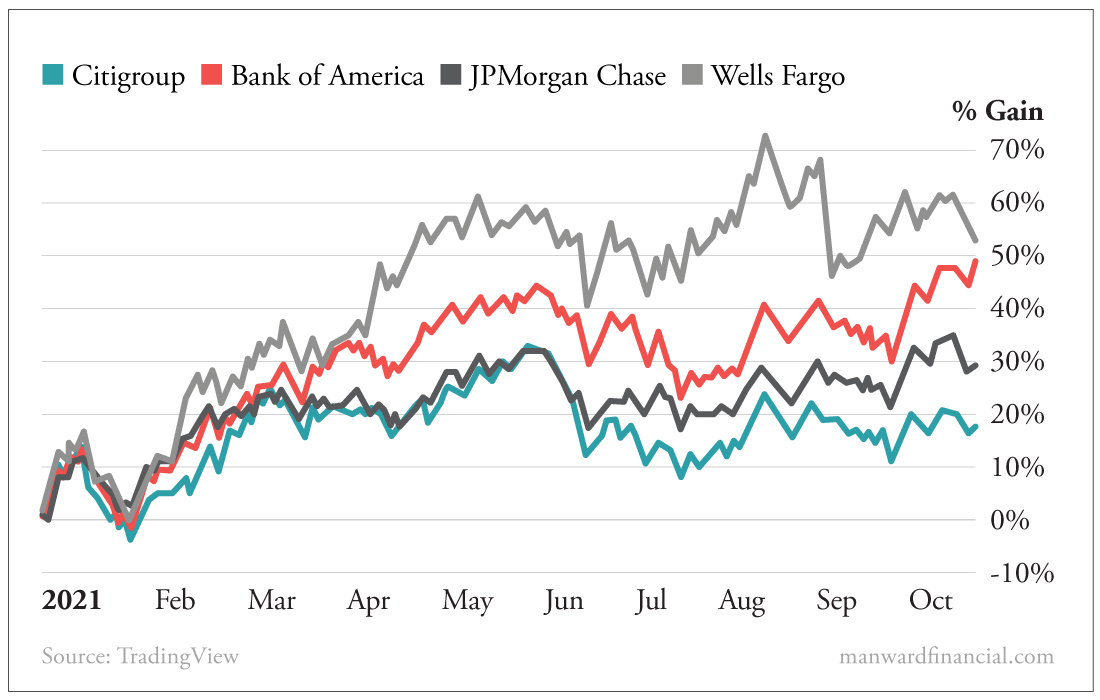

We could say it’s thanks to Washington’s printing efforts – that its free-money bonanza really did save the economy and is leading to big gains for bank shareholders. After all, all four companies named above have flat-out crushed the market over the last year (just as, ahem, we said they would).

But that would be too simplistic of a view.

There’s plenty of other data that suggests most of those loans would not have defaulted even without all the government’s help.

After all, some 11% of the stimulus money sent to citizens went directly into the stock market in the form of new investments. A full third of it went not to paying monthly bills but to actually paying down debt faster than required.

That’s four out of every 10 dollars that did the opposite of their intent. They didn’t ensure people could pay their monthly bills. They helped to eliminate them.

More evidence of the damage done by the Fed’s overzealous ways comes from the nation’s employment crisis. A record 4.3 million folks quit their jobs last month. The unemployment figure came in at 4.8%… solidly below the long-term average.

Across the country, companies are scurrying to raise wages and offer other incentives just to keep workers from jumping ship.

It wouldn’t happen if there weren’t too much money in the economy.

More Money… More Problems

It shows the Fed’s guesses for where things would head after last year’s mess were not just wrong… but criminally wrong.

Now the economy must find a way to digest all that extra money. It’s doing it by raising the cost of each transaction.

It’s the classic definition of inflation. There is too much money chasing too few goods.

The Federal Reserve, at the direction of the folks on Capitol Hill, printed far too much money. It made a huge misjudgment that is turning into one of the greatest monetary follies in American history.

We’re all going to pay for it. And Powell is likely to pay for it with his job.

We reckon the banks will throw him one hell of a retirement party.

He’s treated them well.

Andy Snyder

Andy Snyder is an American author, investor and serial entrepreneur. He cut his teeth at an esteemed financial firm with nearly $100 billion in assets under management. Andy and his ideas have been featured on Fox News, on countless radio stations, and in numerous print and online outlets. He’s been a keynote speaker and panelist at events all over the world, from four-star ballrooms to Capitol hearing rooms.