Forever Cryptos: The 3 Coins to Buy and Hold Forever (Plus a Can’t-Miss Recommendation)

In the crypto world, they say you “buy and HODL.”

And no, that’s not a typo.

HODL is an acronym for “hold on for dear life.”

It’s no secret that wild price fluctuations – sometimes driven by what seems like nothing at all – can make investing in crypto feel like strapping into a roller-coaster ride.

It’s also an industry that attracts inexperienced investors looking to get rich quick…

But getting rich and staying rich are not the same thing.

And when you’re just shooting in the dark and hoping your coin will return you big profits, you’re almost guaranteed to get burned.

There are plenty of ways to lock in profits from short-term crypto investing.

If you want to build your wealth, however – and not just get rich but stay rich – investing in long-term value is the way to go.

We will be the first to admit that crypto, at first glance, doesn’t seem to go hand in hand with stable growth.

But a buy-and-hold strategy works for this market… and it can work for you too.

Let us explain…

Holding Through the Swings

Crypto is still relatively young, and the Street doesn’t fully believe in it yet.

So sell-offs can hit particularly hard, and news that broader markets might see a shakeout has a tendency to send crypto prices reeling.

Because of these swings, when it comes to growing steady profits, you might prefer stocks to cryptos.

But individual stocks are subject to volatility too.

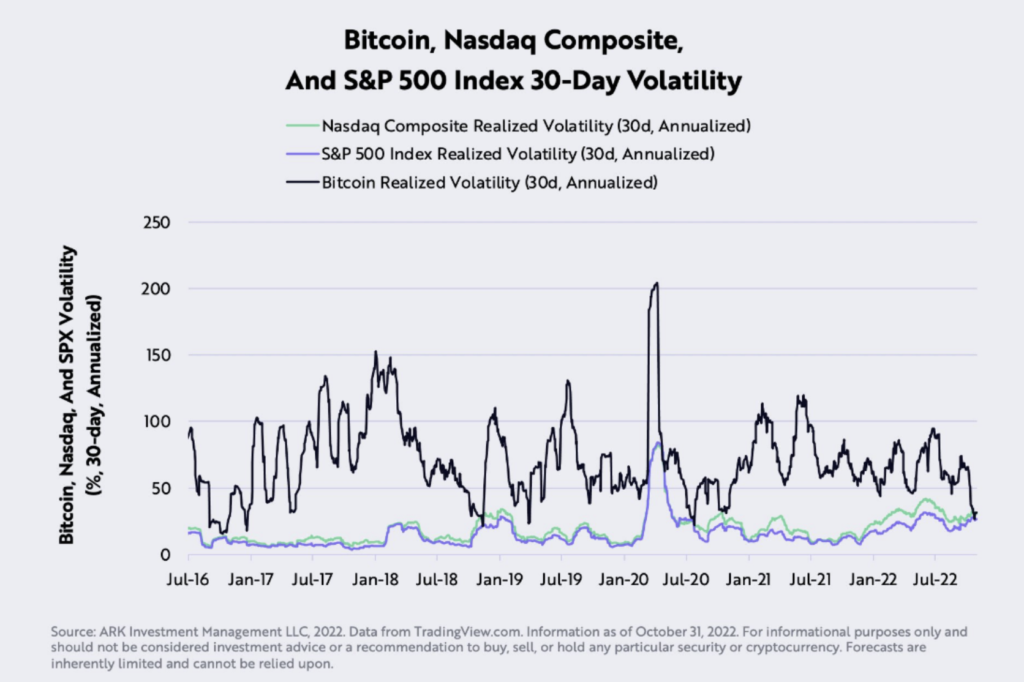

In fact, in 2022, Bitcoin was actually less volatile than the S&P 500… and it still maintained its incredible growth rate.

Since its inception, Bitcoin’s yearly growth has outpaced that of the S&P 500 77% of the time.

Yes, there have been some lean years sprinkled in… but the upswings have more than made up for the downswings.

Bottom line: Holding through the weak points has been a winning tactic.

The buy-and-HODL strategy may sound risky, but it recognizes that crypto is subject to volatility. And if you do hold on, you will be rewarded.

While your knee-jerk reaction may be to sell when things go south, the right coins bounce back… and fly even higher than before.

With thousands of coins to choose from, weeding out the losers is an overwhelming task.

The tricks are to find the coins that have staying power and to keep your emotions in check.

Bitcoin’s impressive run hasn’t happened simply because it’s gotten more attention from the market.

The price of Bitcoin is projected to continue rising because Bitcoin has real-world applications that legitimize its status as an asset.

And when you can buy your groceries with a digital coin, the value of that coin is rooted in something real, instead of being reliant on market hype.

Bitcoin is the most popular cryptocurrency, but it’s certainly not the only one. And some of its successors have improved its technology and have found their own footing in the real world.

Three coins in particular have promising futures in both the real world and the crypto market – making them perfect candidates to buy and hold… forever.

First up is Bitcoin’s biggest rival…

Ethereum: The World Computer

The goal of Bitcoin has always been to decentralize banks. But its competitor Ethereum, the world’s second-largest digital currency, has its sights set on decentralizing the internet.

You might think the internet is already decentralized. Anyone can create their own website, right?

In reality, there’s almost no activity that happens on the web without some sort of third-party involvement.

Companies like Google, Meta Platforms and Amazon currently act as middlemen, collecting and storing our data on their servers. Trusting these centralized institutions has major flaws… the biggest being that – even with their vast resources – single points of failure make them vulnerable to cyberthreats.

Using blockchain technology, Ethereum has created a system that circumvents those central authorities. A truly decentralized internet would connect users directly to each other… completely cutting out the middlemen.

The Ethereum platform is run by thousands of independent computers. And even the network’s programmers don’t have control over it.

Eventually, the end result could look like a worldwide supercomputer and provide internet-like infrastructure to people around the world.

Ethereum’s platform hosts a number of decentralized applications (or dApps) that run using “smart contracts” – coded agreements that take the form, “If x, then y.”

In the real world, we encounter some form of contract every day. For example, if I give my landlord $1,000 in rent, then I can live in my apartment.

A smart contract could hypothetically make it so that my landlord would not need to collect my money. If I didn’t pay, then the code would trigger an automatic lockout, preventing me from accessing my apartment.

But creating and using dApps isn’t free.

In order to use the network, developers and users have to get their hands on Ether (ETH) – Ethereum’s native token.

You can think of Bitcoin as digital gold, whereas Ether is more like digital oil used to fuel the Ethereum platform and all the processing it requires.

There are two main things that give Ether value…

Ether – like many other crypto assets – gains value from pure speculation.

Ether is traded much like a stock… It goes up not only because of its practical use but also because of speculative interest.

And there’s certainly been plenty of interest in this coin… The price of Ether absolutely skyrocketed last year from $1,195 to $2,281 an outstanding 91% increase.And more growth is likely on the horizon. Just like Bitcoin, Ethereum crashes and rebounds with some frequency but in the long term it’s going up.

It’s clear there have been price swings, but there’s no denying that HODLing has given investors big gains in just the past few months.

While the price has fluctuated greatly over the years, it has moved up over the long term. The coin is up more than 1,200% from where it was five years ago…

And since falling off in 2022, Ether has rebounded.

Speculation is to blame for any seesawing. The crypto market has both investors who go all-in and investors who quickly get cold feet.

What makes Ether different from many other coins that see wild price fluctuations is that it has a second reason for its value…

Ether has utility.

Within the Ethereum platform, Ether is used to pay transaction fees. Since some smart contracts are more complex than others, the amount of Ether charged per transaction can fluctuate.

The more people who participate in the Ethereum network, the more the price of Ether goes up.

As of the end of June 2024, there were 4,000 dApps deployed on the Ethereum platform – more than on all other blockchain platforms in the world combined.

And these dApps have real-world uses… Many smart contracts facilitate the types of financial services you would normally get through a bank, like lending and borrowing.

Ether is also used to participate in spaces like the NFT (nonfungible token) market. NFTs are almost exclusively purchased and stored on the Ethereum blockchain… and, as you know, everything on the platform is funded by Ether.

Anyone who wants a part of the applications run on Ethereum – with uses spanning finance, web browsing, gaming, advertisements, etc. – has to buy Ether and exchange it for the digital product, giving Ether more value in the process.

Decentralizing the internet may seem like a lofty goal, but Ethereum has already proven itself to be the one crypto project that can do it…

Still, the price of a coin is subject to plenty of volatility, which makes jumping in a little nerve-wracking.

Ethereum is looking to address that volatility, however.

Thanks to a recent upgrade, Ethereum has modified how transaction fees are charged and recorded on the blockchain. This tightens supply and stabilizes the value of Ether.

Ethereum is still adapting, but Ether is on track to have a role as one of the largest and most supported cryptocurrencies in the world… one to buy and hold for years to come.

Next up is the native token of one of the leading dApps on Ethereum’s blockchain…

Uniswap: A Voting Coin

Uniswap (UNI) is the most unconventional of our forever crypto picks.

Crypto began as a decentralization tool… Bitcoin wanted to decentralize banks, and Ethereum wanted to decentralize the internet.

But many popular cryptocurrency exchanges, like Coinbase and Gemini, are still centralized.

Remember how we wanted to cut out the middlemen? Well, an exchange like Coinbase is a middleman – anyone who wants to trade on the platform has to submit a buy or sell order that is then facilitated and recorded by the exchange.

And for every centralized exchange, there is one company that has complete control over it… and, in turn, your funds.

In contrast, a truly decentralized exchange (or DEX) doesn’t have to use a middleman because it operates via smart contracts. Tokens are swapped directly between users.

Since they don’t derive liquidity from the number of buyers and sellers using them, DEXs use liquidity pools, which are shared pots of funds given by “liquidity providers.”

To compensate them for providing these funds, the exchange gives them a fraction of every trading fee paid on the platform.

Now that we’ve covered all that… let’s get into Uniswap.

Uniswap is a decentralized exchange based on the Ethereum infrastructure. To start taking advantage of the platform, all you need to do is link your Ethereum wallet to Uniswap’s website.

Anyone can create a token on Uniswap for free, which led to the creation of scam coins that threatened to delegitimize the application. So in September 2020, Uniswap launched its own coin, which trades under the ticker UNI.

In contrast to other cryptos, UNI isn’t designed to be a currency… so don’t expect to be able to pay for real-world items with it anytime soon.

Instead, holders of the coin get to influence and vote on the development decisions of Uniswap. The end goal is that the founders of Uniswap will eventually phase themselves out, leaving control of the platform entirely in the hands of coin holders.

It’s this distinction that makes UNI unique – the coin gains value when more people believe in its future (and perhaps want to take part in it).

In addition to UNI being a governance token, investors can profit as its price goes up over the long term.

Not only that… but you can also earn interest on liquidity pools if you choose to park funds in them. How much interest you earn is based on the price of UNI and how many times users swap it for Ethereum coins.

UNI has a shorter history than the other coins we’ll go over today. However, similar to Ether, UNI fell in 2022 (along with the rest of the crypto market).

But also like Ether, this coin rebounded in 2024 – good news for the HODLers out there. Despite its crashes, it’s moving up in the long-term just like what Bitcoin did. As its popularity grows, so do the reasons for buying and holding it. And it has continued that growth, hitting 71.69% growth over the last 12 months.

And projections from crypto analysts have UNI’s price on course to hit more than $25 by the end of 2024 – and up to $114 by the end of the decade.

These are still just predictions, but with UNI, the foundation you can count on is that it has thousands of holders who aren’t just buying it to make a quick buck… Instead, they are buying and holding because they believe in the exchange and want to be involved in its decision-making process.

That could make UNI a special coin to hold onto even if you don’t care about voting in the next Uniswap meeting.

Speaking of buying and holding (or HODLing, I should say), let’s get into our final long-hauler…

Ripple: Replacing an Outdated System

As is the case with many cryptos, Ripple was created in order to solve inefficiencies in the way our world operates.

Ripple’s target? Banks.

More specifically, Ripple seeks to improve the global payments network.

Major banks still use 40-year-old systems to transfer money from one account to another. And not all banks are even connected… so sending money can be a long, expensive and limited process.

The process is even more painful for international money transfers, where banks are less likely to have solid connection lines and currency needs to be converted.

Ripple seeks to get around this back-and-forth by creating a way for money to move freely and efficiently.

Just as Ether is Ethereum’s native coin, XRP is Ripple’s native coin, and the ticker and the company’s name are often used interchangeably. Those who believe in Ripple’s platform buy the XRP token in order to invest in the idea behind it.

Let’s say a big bank wants to move money. With Ripple, instead of having to transfer the money from one smaller bank to another to get it to its final destination, the big bank would only have to convert the funds into XRP and send the XRP to the recipient.

That would also help cut costs, as banks wouldn’t need to hold various different currencies. All they would need is XRP.

Sending an XRP transaction takes about three to five seconds – blowing normal transfer speeds out of the water AND beating Bitcoin’s 10-minute processing time.

Plus, XRP can handle 1,500 transactions per second, whereas Bitcoin can handle about seven.

Speed, processing power and low costs are all huge factors in Ripple’s long-term success.

Ripple also coded a limited supply into the makeup of the coin, which will give XRP more value over time.

But none of this really matters unless banks actually begin to adopt XRP. Luckily, Ripple has already made a name for itself amongst the large financial institutions.

In fact, by early 2020, about a third of the world’s 100 largest banks had begun or were about to begin using Ripple’s cross-border payment tech. Nowadays, the crypto has partnerships with more than 300 financial institutions, including Bank of America, the Royal Bank of Canada, American Express, Bank of Australia and many others.

More recently, digital currency firms GlobaliD and Uphold have teamed up to make a Mastercard credit card that gives cash-back rewards in the form of XRP.

The more financial platforms that actively use XRP, the higher its value will fly.

In 2021 and early 2022, Ripple’s price rose. That growth peaked in July of 2023 before the coin plunged, creating another buying opportunity for HODLers.

As with Ether, though XRP’s price clearly went higher, it’s hard to ignore the volatile dips.

The crypto market saw weakness in 2022 because of concerns over government intervention, lack of liquidity and the broader market falling.

But now, after the surge of 2023, threats of regulation don’t hold the sway they once did, especially since respected financial institutions have begun to accept Ripple’s validity. As a result, the price has held its own over the last year.

The more XRP is used by these big banks, the more value it will gain outside the speculative crypto market.

And if you can hold on, you’re likely to see gains as Ripple continues to seep into the real world.

Strap Into the Ride

Too many people buy cryptocurrencies and don’t have the nerve to hold.

So they can blame the wild price fluctuations only on themselves.

Crypto is still getting its footing, and it’s got quite a road ahead… It will need to weather scrutiny from not only wary investors but also governing bodies.

Buying and HODLing isn’t for the faint of heart. We’ve seen firsthand that even coins with bright futures can be knocked down by panic-selling.

But the three coins I introduced you to today all have practical, real-world uses.

If you want to get in and are ready to ride the crypto roller coaster higher, any one of these tokens could be a great place to start.