Beat the Crowd: This Sector Will Be Huge in 2022

Amanda Heckman|January 8, 2022

Another year… another set of nasty economic headwinds…

Including inflation, rising interest rates and a stock market acting like it's still recovering from its New Year's Eve hangover.

But there’s a bright spot amid the uncertainty.

It will help lead us through some tough economic headwinds in 2022 – and could even reshape our economy… period.

And that means there’s huge opportunity for investors in the know.

It’s the rise of the little guy… the American self-starter and self-supporter.

Small business applications have soared since the beginning of the pandemic.

As many folks faced reduced hours, layoffs and burnout… they began embracing their entrepreneurial spirit.

Buoyed by extra time on their hands and generous stimulus checks in their mailboxes… they discovered just how fulfilling it can be to start a business.

Thanks to the pandemic accelerating our nation’s shift to a digital economy (indeed, speeding up our digital transformation by several years, according to McKinsey), a growing number of intrepid entrepreneurs found they could run a business from anywhere, with all the resources they needed at their fingertips… and their customers within reach online.

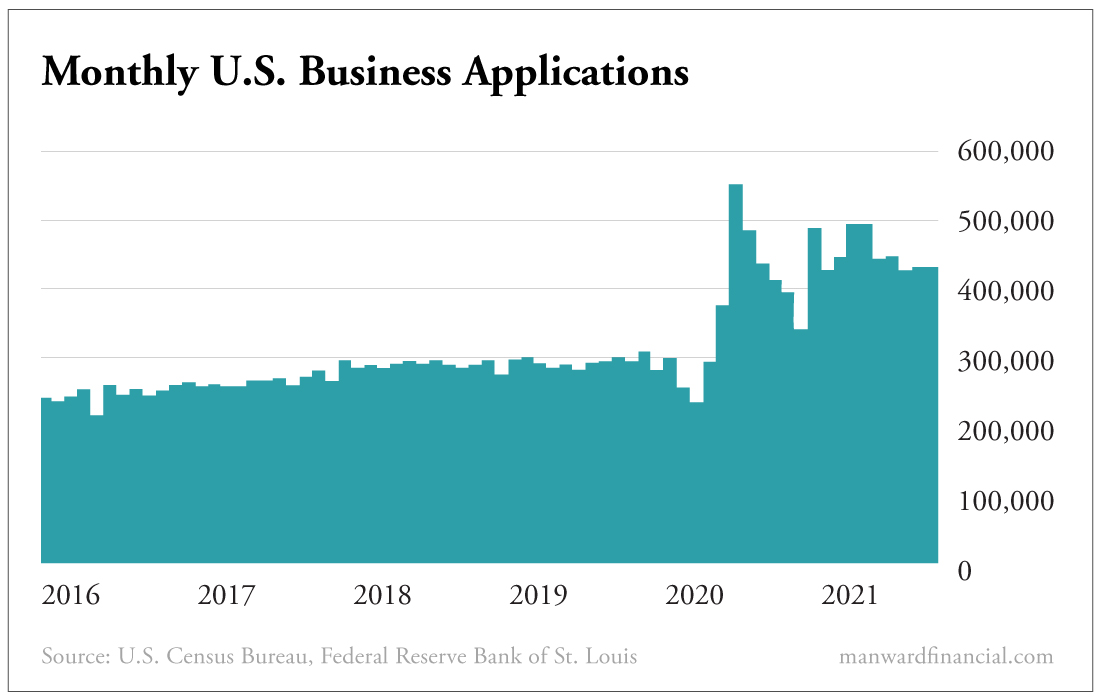

This chart from the U.S. Census Bureau shows the trend…

As of November (the latest numbers available), nearly 500,000 applications for new businesses were filed each month on average in 2021. That’s a significant jump compared with 2019, when an average of roughly 293,000 new business applications were filed each month.

And the trend shows no signs of stopping…

A December 2021 Intuit QuickBooks survey predicted that up to 17 million new small businesses may be formed in 2022.

And looking further out… as we said at the top, the pandemic has caused lasting shifts in our economy. No doubt many of these new businesses are responding to those shifts and are shaping them as we move forward.

Now, here’s where it gets interesting – and profitable – for investors…

The Start of Something Big

We've often railed against the expensive and time-consuming process required for a company to go public. It’s why companies are staying private longer, using other means of funding to build and grow their businesses.

As a result of this, the private equity and crowdfunding sectors have soared in recent years. It’s now easier than ever for individual investors to get in on potentially big opportunities with young, innovative startups nearly from the get-go… instead of waiting years for an IPO that may never come.

And this deluge of new small businesses means this sector will be rife with opportunity…

Plus, there is a rich history of companies started in economic downturns going on to become some of the richest, most innovative companies on the planet. Microsoft, Uber, Disney, Revlon, Warby Parker, GE – those were all started during economic downturns.

That means many of these pandemic-born companies could be at the start of something huge.

The pandemic has created a new environment where entrepreneurship and startups can thrive.

And we’ll be telling you more about the investing opportunities that are coming out of this space in the weeks ahead.

Amanda Heckman

Amanda Heckman is the publisher of Manward Press. With unrivaled meticulousness, she has spent the past 15 or so years in the financial publishing industry. A classically trained musician and a skilled writer in her own right, Amanda takes an artistic approach to the complex world of investing. Her skill has led her to work with numerous bestselling authors, award-winning financial gurus, and – lucky for us – the fine folks at Manward Press.