Get Ready for the Fed’s Prime-Time Shock

Andy Snyder|January 17, 2022

What’s that old saying… we’d rather battle an army of lions led by a sheep than an army of sheep led by a lion?

It’s very true in the world of money these days.

So far, Jay Powell is a sheep.

He follows the herd. He never strays far from what he knows. And he seems to be easily spooked.

But, believe us, sheep do dumb things. Put enough pressure on them, or scare them just a bit, and they act wildly and unpredictably.

That’s what has us so scared.

He may soon try to impersonate a lion.

Hear the Roar

Paul Volcker was a lion… but the kind we’d want on our side.

You may recall that, on the evening of October 6, 1979, he unholstered his “Saturday Night Special.”

It was a series of big, swift moves. It changed the way the Federal Reserve fought inflation. Gone were the timid, step-by-step moves his predecessors had failingly used in an attempt to tame market volatility and runaway prices.

Volcker announced a drastic change in the Fed’s mindset. Instead of targeting interest rates, it would target the country’s rapidly expanding money supply.

Pay Attention Here…

Volcker kicked off his new plan with an immediate 1% hike in interest rates and then said he’d take a more hands-off approach to rates as he worked to tighten bank reserves.

We all know what happened next. Markets went into turmoil and rates soared.

Volcker took heat from the sheep on both sides of the aisle. They said he was taking a “tremendous gamble with the economy.”

But we say the big, tall lion could teach our current flock of sheep a thing or two.

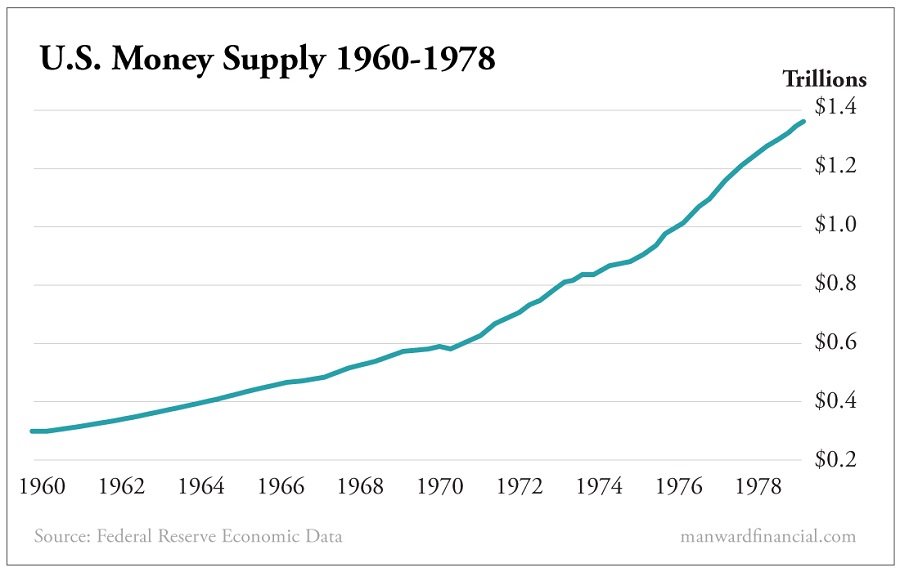

Prior to Volcker’s shock, the nation’s money supply was rising at an annual rate of 10%… far higher than the Fed’s maximum target of 6%.

Over the two decades leading up to his reign, the amount of money in the nation’s economy surged by close to 150%.

Volcker knew he was creating a recession – and a nasty one at that – but he was convinced his recession would be less lethal than what would come if his Fed did nothing.

Another One?

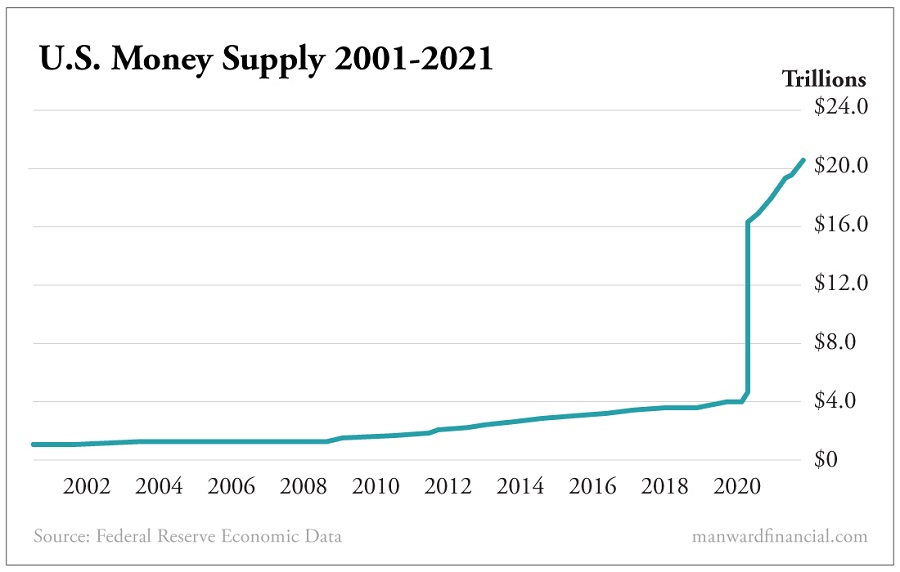

Things are even worse these days.

Over the last two decades, the amount of dollars floating through the world has surged from $1.1 trillion to, baaaahhh, $20.3 trillion.

The only shock in the modern-day chart is going in the wrong direction…

Volcker stood by his independent take. He didn’t buckle to the pressure. He merely continued to pound home the idea that the slowdown he created would be much less impactful than the slowdown the market’s natural forces would unleash on the economy if nothing were done to prevent it.

We don’t hear anybody making the same arguments today.

We hear only the jingle of a rusty, sharp-edged can getting punted down the road.

Our enemies like it that way.

They’d rather battle an army led by a sheep… than one led by another lion like Volcker.

But Powell is feeling the heat. He’s acting spooked, and we’re worried about what comes next.

Will he take to the stage for a prime-time “shock”? With each passing day, we think the odds are getting better.

If he does, it won’t be good.

Try as it might… a sheep can never roar like a lion.

Be well,

Andy

Andy Snyder

Andy Snyder is an American author, investor and serial entrepreneur. He cut his teeth at an esteemed financial firm with nearly $100 billion in assets under management. Andy and his ideas have been featured on Fox News, on countless radio stations, and in numerous print and online outlets. He’s been a keynote speaker and panelist at events all over the world, from four-star ballrooms to Capitol hearing rooms.