How to Survive the Market’s May Massacre

Amanda Heckman|May 14, 2022

Lordy, lordy.

We’re not going to sugarcoat it.

The markets sank across the board this week… and crypto fared even worse.

The headlines would have you believe we’re facing a “May massacre.”

But are we?

That’s why we held a live “town hall” with several hundred of our paid subscribers on Thursday…

To talk about what’s going on… why it’s happening… and what investors should do about it.

It’s scary out there. But it’s not all doom and gloom… and the worst may be over.

Reap What You Sow

As Andy told attendees, what’s happening right now can be summed up with a simple phrase…

You get what you vote for.

This turmoil is the result of 40 to 50 years of bad decisions… folks voting for what’s easy… instead of what’s right.

And as we’ve often said…

The government is the greatest threat to your wealth.

Well, we’re seeing that now.

Mind-numbing amounts of money ($5 trillion!) were printed… overzealous regulations are blocking innovation and growth… and a proxy war is hurting everybody except the folks paying for it.

But here’s the thing…

We can’t change the mentality in Washington… but we can change our reactions.

Just because the market is dropping… doesn’t mean you should bail out.

No. Think back to the dot-com bust. Once the dust cleared, folks were shouting to stay away from internet companies. But guess what grew out of that bubble? Amazon and Google.

Look at today…

The crypto market’s falling? Good. Let’s thin the herd and let the coins that are truly innovative (and not reliant on memes or hype) rise again.

Coins like…

- Polkadot, which enables data to travel the blockchain faster and more efficiently

- Chainlink, which connects data to smart contracts on the blockchain

- Stellar, which works as an open-source blockchain payment system.

Companies and cryptos that solve problems will always be in demand… so don’t change your strategy based on short-term volatility.

It’s Time

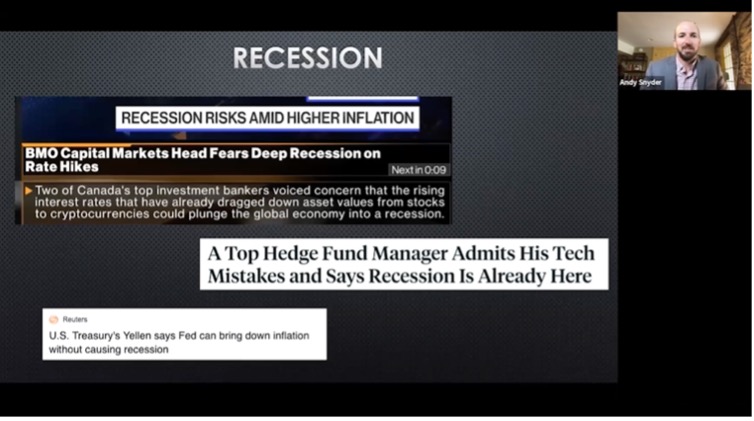

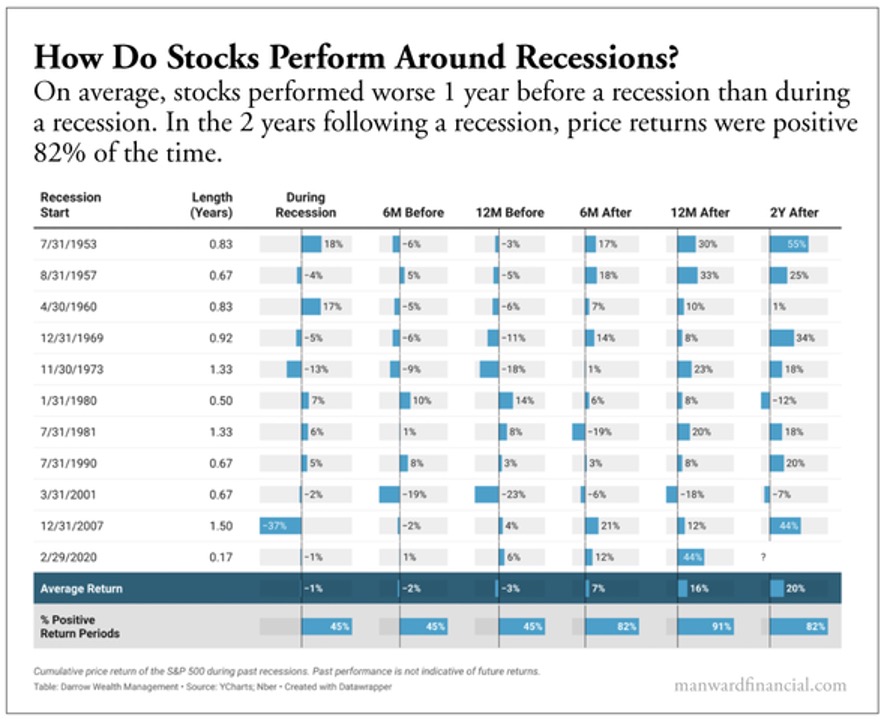

And all this pain could be a very short-term problem. As Andy proved to subscribers on the call, the data from past recessions shows that we’re in the worst of it now…

When (not if) his prediction of a recession in the second half of the year comes true (we’d be gobsmacked if consumers actually increased their spending this quarter), things will start to improve.

Because history shows that stocks hit their lowest points six to nine months before a recession… and then start gaining again.

You can see it in the chart below…

Despite all the bad news that surrounds a recession… there’s reason for optimism – especially now that we’ve likely endured the worst of it.

As Andy told attendees, tune out the day-to-day volatility and the scary headlines.

Keep buying… but protect yourself with stop losses. (If you don’t know how to set a stop loss, watch our video here.)

And – perhaps most important of all – don’t look to the folks in Washington to fix things. They’ve done enough damage already.

You get what you vote for.

Amanda Heckman

Amanda Heckman is the publisher of Manward Press. With unrivaled meticulousness, she has spent the past 15 or so years in the financial publishing industry. A classically trained musician and a skilled writer in her own right, Amanda takes an artistic approach to the complex world of investing. Her skill has led her to work with numerous bestselling authors, award-winning financial gurus, and – lucky for us – the fine folks at Manward Press.