This Corner of the Real Estate Market Is on the Move

Amanda Heckman|June 10, 2023

The free market always finds a way…

As the Fed debates its next move ahead of next week’s big meeting, the real estate sector has been making moves of its own.

Fed Chair Jay Powell has been desperately raising rates to cool inflation… which has raged in the housing market due to a combination of ultra-low rates and free money sparking a frenzy of transactions, insane bidding wars and ridiculous sale prices. (You’ve no doubt seen this play out in your own neighborhood.)

The Fed’s interest rate hikes over the past year have led to higher mortgage rates… which have led to some cooling in the market.

It’s getting harder and more expensive to take out a mortgage. Current homeowners are reluctant to sell and lose their dirt-cheap mortgage rates.

So after seeing some negative prints last year when it comes to home sales and builder sentiment, can we consider Mission: Cooldown accomplished?

Hardly.

Despite the headwinds, the homebuilder sector is having a very good year.

Movin’ on Up

After nearly a year in negative territory, homebuilder sentiment in May came in at 50. That reading means homebuilders are feeling better about their current prospects as well as their prospects six months from now.

One reason? All those would-be buyers who can’t find existing homes to buy have started buying newly built homes.

And homebuilders are being creative and making it worth their while. Over half of builders are offering some sort of incentive, from buying down mortgage rates (in a nod to the current rate environment) to reducing prices.

New home sales clocked in at 683,000 for May, up 4.1% over April’s 656,000. That trounced expectations of 665,000.

New home sales have also taken up a larger percentage of home sales. In March, they made up 33% of sales… nearly triple the average from 2009 to 2019.

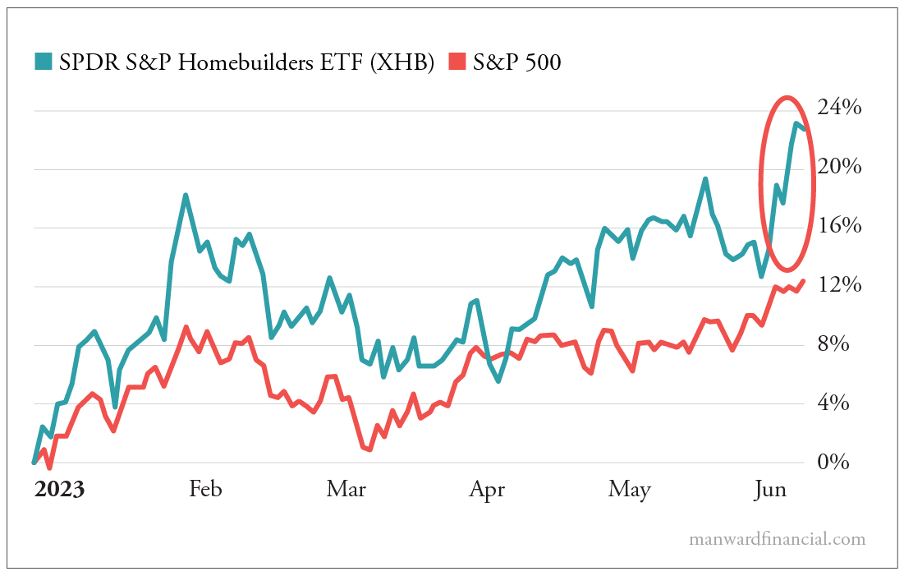

And the bullishness is showing up in the charts…

Year to date, the SPDR S&P Homebuilders ETF (XHB) is up 23%, while the S&P 500 is up 12%. And thanks to good news about new home sales, the ETF has soared in June, rising nearly 10% for the month.

But individual homebuilders are doing even better.

Well-known names are outperforming this year – like Lennar (LEN), up 25%… Toll Brothers (TOL), up 48%… and PulteGroup (PHM), up 56%.

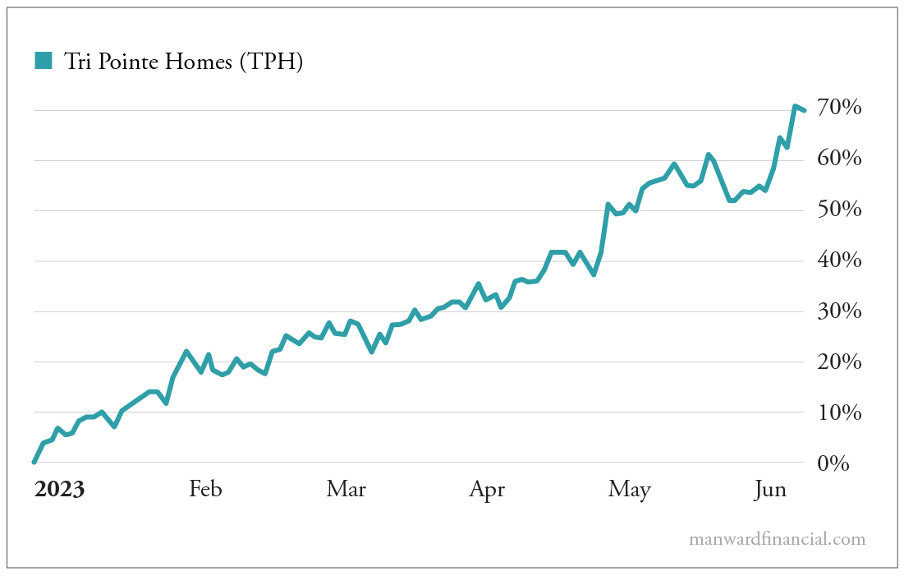

But as Alpesh told us yesterday, he likes the prospects for leading homebuilder Tri Pointe Homes (TPH), which has been on an absolute tear this year… It’s up a scorching 70%!

He’s convinced the stock has much more room to run thanks to misguided pessimism bringing down estimates.

You can see Alpesh run through the stock’s numbers right here.

So while the real estate sector has plenty of headwinds thanks to higher rates… tighter supply… and inflationary pressure on supplies…

Parts of the sector are doing just fine on their own… thankyouverymuch.

Looking at homebuilders is the right move for your portfolio today.

Amanda Heckman

Amanda Heckman is the publisher of Manward Press. With unrivaled meticulousness, she has spent the past 15 or so years in the financial publishing industry. A classically trained musician and a skilled writer in her own right, Amanda takes an artistic approach to the complex world of investing. Her skill has led her to work with numerous bestselling authors, award-winning financial gurus, and – lucky for us – the fine folks at Manward Press.