Throw Out the Old Way of Investing for Retirement

Joe Hill|July 12, 2023

It’s time to grow up, retirees.

That’s right. Enough silliness. You need to start acting your age.

Or should we say… “investing your age”?

That’s what the stuffed shirts at The Wall Street Journal are suggesting, anyway. In a piece cheekily titled “America’s Retirees Are Investing More Like 30-Year-Olds,” they write…

Older Americans keep rolling the dice in the stock market, ignoring the conventional wisdom to protect their nest eggs by shifting more of their investments to bonds.

They point to a few key stats:

- At Vanguard, close to half of 401(k) holders aged 55 and older have more than 70% of their portfolios in stocks.

- At Fidelity, nearly 40% of investors between 65 and 69 have two-thirds (or more) of their portfolios in stocks.

Clearly people don’t have the same love for bonds that they used to.

Gee, we wonder why…

Could more than a decade of quantitative easing and rock-bottom interest rates be to blame?

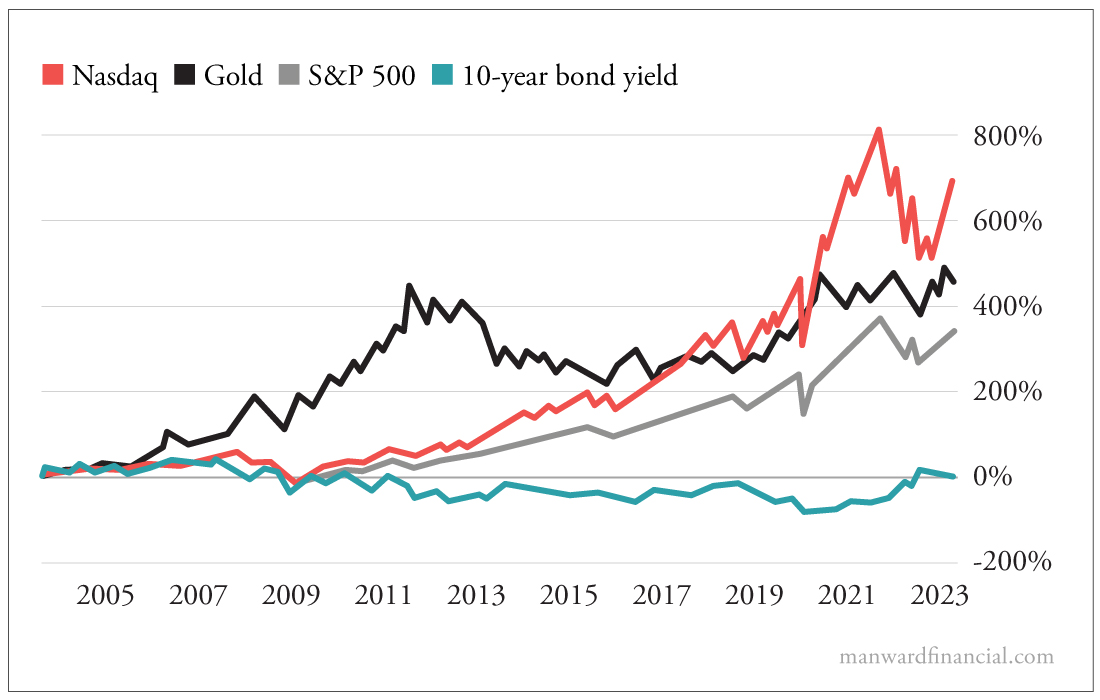

Or what about the fact that bond yields dropped precipitously for almost 20 straight years as “risky” instruments like blue chips and tech stocks – and even gold! – offered far superior returns?

The evidence is clear. If you want to do more than just survive in retirement, the “conventional” way of investing doesn’t cut it anymore.

That’s the problem when you do what everyone else does…

You get what everyone else gets.

Manward Letter readers should be nodding along. We hit some of these same notes when kicking off our just-released July issue.

It started with a look back at Apple‘s (AAPL) iconic “Think Different” ad campaign.

Steve Jobs knew he had a hit on his hands when he heard those two words uttered in a pitch meeting. He knew they would resonate with potential customers.

They still resonate with us today.

Our humble publishing outfit has remained “different” since day one.

It’s why we’re able to (proudly) publish the works of trading champion and hedge fund CEO Alpesh Patel right alongside those of everyone’s favorite lunatic farmer, Joel Salatin.

And it’s why, unlike some of our stodgier peers, Manward has been willing to embrace cryptocurrencies like Monero (XMR), which has soared by double digits this year.

But you wouldn’t get any of that if you followed the mainstream.

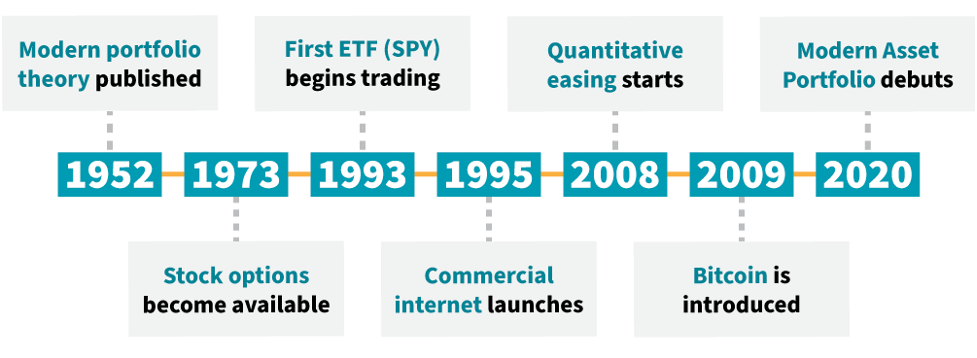

Just consider the investing framework still used by many in the financial advisory business. Modern portfolio theory (MPT) doesn’t have a place for crypto. It was established more than half a century before Bitcoin was even introduced.

It predates options… ETFs… and the dawn of the internet.

And yet, MPT still serves as the backbone of most prefab investment plans.

American retirees want better. The Wall Street Journal‘s findings prove it. That’s precisely where our modern asset portfolio (MAP) theory comes in…

No More “Buy and Pray”

In case you didn’t know, MAP theory is Manward’s “riff” on MPT. We debuted it in 2020 – a time when we, like most folks, found ourselves with a lot of extra time on our hands.

Some folks spent the pandemic learning how to make bread… We perfected a new investment system.

In a lot of ways, MAP theory is similar to MPT. The big difference is that we trade MPT’s focus on correlation coefficients for a focus on interest rates – the single most powerful factor in the pricing of modern assets.

Sound complicated? It’s not… We swear. To make things perfectly simple, we posted an easy-to-follow primer here on our website. Anyone with a subscription to Manward Financial Digest can access it.

This passage gets to the heart of how MAP theory works:

When rates are at one level, we invest a certain way. When they’re at another, we follow the money and invest another way. The whole time, we’re using modern assets to greatly put the odds of success in our favor.

MAP theory has categories aimed at buyback stocks, deflation leaders, blue chips, crypto and a host of others.

It’s a simple solution to what has increasingly become a dangerous model… buying and walking away.

It used to be that “buy and hold” would work. But now… it’s more like “buy and pray.”

Again, you can get the full report here on our site. It’s yours, free, as part of your subscription.

If you like doing things the unconventional way, you’re sure to get a kick out of it.

Note: Tomorrow, Andy will share one of his most unconventional – and controversial – pieces of advice with you. Stay tuned.