The Latest Inflation Numbers Don’t Tell the Real Story

Amanda Heckman|July 14, 2023

Will they or won’t they?

That’s the question that’s been on every pundit’s lips since we got a cooler-than-expected inflation reading on Wednesday.

Consumer prices for June came in just 3% higher year over year… and just 0.2% higher month over month.

Does that mean the Fed’s done cleaning up the mess it made?

Are rate hikes finished… finito… kaput?

While some folks are delighted…

We’re here to offer a much-needed dose of reality.

Underlying, or core, inflation (which removes volatile food and gas prices) came in at 4.8%, more than twice the Fed’s 2% target.

Unemployment is still near a 60-year low, and hourly earnings ticked up 0.4% in June.

We still have a ways to go.

Yet the markets now expect that the Fed’s promised rate hike later this month will be its last.

They’ve priced in a 1-in-4 chance for a later rate hike… down from 1-in-3.

And then there’s this guy (emphasis ours)…

“Clearly inflation is heading in the right direction, and this is showing that they’ve made significant progress in their battle to tamp it down,” said Art Hogan, chief market strategist at B. Riley Wealth Management in Boston. “Even if they raise rates at the end of this month, that may likely be the last time.”

Let’s look at the facts, folks.

Our economy is far from healthy.

Consumer debt is soaring. Small business optimism remains at pandemic levels.

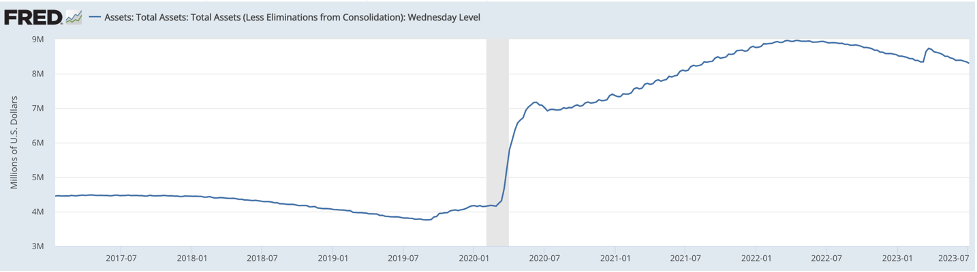

And we still have way too much cash swirling around in the system. Just a fraction of the $5 trillion printed during the pandemic has been erased from the books.

Andy has shown you this chart before…

This is the critical fact we can’t overlook: We can’t have a healthy economy with that much cash on the loose. According to Andy… there are only two ways out of this pickle.

Either inflation will continue to destroy middle-class wealth through a surging cost of living… or we’ll enter a painful recession that cleanses the economy of this monetary cancer.

The Fed is going to either change its inflation targets and be happy with prices that jump 4% to 6% each year (which would be an utter disaster for savers and fixed-income retirees) or do its job and push us into a less-than-comfortable recession.

Buckle up, folks.

For more than a decade, the Fed’s been pulling the strings of the economy like a puppet master gone wild…

And the end’s nowhere in sight.

Now more than ever, you need to think different. As Alex wrote on Wednesday… “If you want to do more than just survive in retirement, the ‘conventional’ way of investing doesn’t cut it anymore.”

That’s why we launched our proprietary investment system built on the No. 1 factor affecting the economy… interest rates.

And it’s why we share unconventional – some might call it controversial – advice about not paying off your mortgage… as Andy did on Thursday.

Things aren’t right, folks.

Don’t invest as if they were.

Amanda Heckman

Amanda Heckman is the publisher of Manward Press. With unrivaled meticulousness, she has spent the past 15 or so years in the financial publishing industry. A classically trained musician and a skilled writer in her own right, Amanda takes an artistic approach to the complex world of investing. Her skill has led her to work with numerous bestselling authors, award-winning financial gurus, and – lucky for us – the fine folks at Manward Press.