A Triumphant Return… a Big Year… and Big Gains

Joe Hill|January 24, 2024

Dear Reader,

Welcome to the Midweek Bulletin.

That’s right… the Bulletin is back.

I hope you’re as excited as we are.

If you’ve been with us for a while, you may recall that every Saturday we used to publish The Manward Bulletin – a weekly summary of what we were watching and what we’d been up to.

That mailing originally featured our now-retired mascot, Rory the Rooster. It was often our most-read email of the week.

Now, as you can see, the Bulletin is making its triumphant return.

Why, you ask? To put it simply… there’s a lot going on at Manward these days. A LOT.

We also understand that the average person’s email inbox has become an increasingly crowded place. So we wanted to give you an opportunity to catch up on Manward’s latest goings-on – all in one convenient, easy-to-digest Bulletin.

We couldn’t have picked a better time to kick things off.

Hello Rate Cuts, My Old Friend

Now that we have Shah leading our team of seasoned investment experts, observations and opportunities abound.

Shah began the week as he always does – by looking at the latest data and sharing his key takeaways with Total Wealth readers.

All eyes remain on the Federal Reserve, with investors wondering just how many rate cuts we’ll see in 2024. “The takeaway is, it doesn’t matter anymore because rates are going to get cut at some point,” Shah said. “But what really matters is: Are there going to be any more hikes? And the answer is no.”

The trend is still our friend – for now. Click here or on the play button below to get Shah’s full thoughts on the subject.

Just minutes after we posted that bullish take from Shah, we rang the register on his Tesla (TSLA) May 17 $220/$210 put spread recommendation in Alpha Money Flow.

If you’ve been reading Total Wealth, you know that Shah is all about profiting from Tesla stock as it sinks. Already this year, shares have plummeted more than 15%.

It may be unfortunate news for Elon Musk (he’ll be fine), but it’s just more proof that Shah’s analysis of the situation has been spot-on.

In the end, we closed the position for a quick 22.53% gain.

Nice!

Crypto Still Crushing

Of course, it hasn’t been all bad news for Tesla lately. As the third-largest holder of Bitcoin (BTC) among publicly traded companies, it’s sitting on approximately $420 million worth of the world’s largest cryptocurrency.

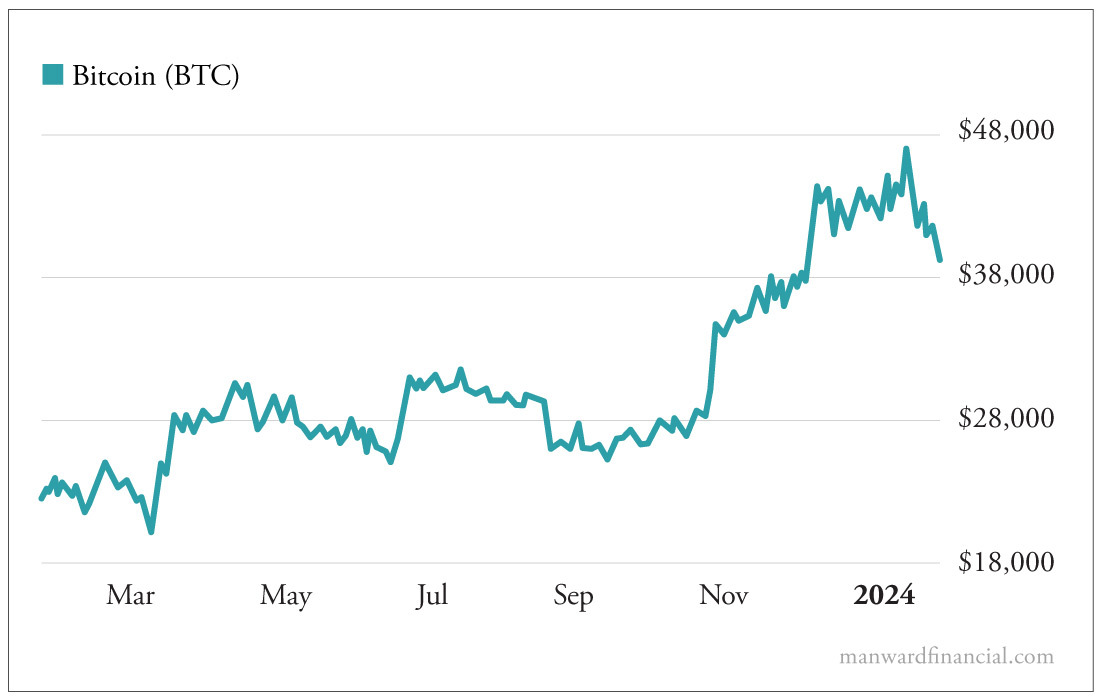

And the way Bitcoin has been trending over the past 12 months, that stockpile is likely to be worth a whole lot more soon.

Crypto, as you’ve no doubt heard, is having a strong resurgence. In hardly any time at all, BlackRock’s newly approved spot Bitcoin ETF crossed $1 billion in assets under management.

That’s huge.

No doubt, more and more old-school investors will pile in now that crypto has been made easily accessible to them.

But for now, as Robert pointed out yesterday, the greatest opportunities in crypto are still in altcoins.

Solana (SOL), in particular, has had an incredible six months. It’s soared 700%.

“This isn’t just luck,” Robert wrote. “It’s the result of a powerful combination of factors that makes Solana stand out in the crowded crypto market.”

Those factors have quickly made Solana one of the biggest cryptocurrencies in the world.

It doesn’t matter whether you’re a crypto fan or a crypto skeptic… or something in between. What’s driven Solana illustrates how crypto markets work in general.

Robert laid everything out here.

By the way, if you have any crypto questions for Robert, you can submit them here. He’ll do his best to tackle them in a future essay.

Already Winning in 2024

We knew during the first week of January that this was going to be another big year for crypto. Our first triple-digit gain of 2024 made that crystal clear…

Launch Investor subscribers will be familiar with Hamilton Lane (HLNE). We recommended a play on the company back in September. The private equity firm has invested big in blockchain and tokenization projects.

The 163.64% profit we scored on our Hamilton Lane February 16 $95 calls proves that Wall Street is starting to get as excited about the crypto space as we are.

And since we’re already talking big returns, here are a few more gains we’ve seen recently across Manward’s publications and services.

- 100% on GigaCloud Technology (GCT) in the GVI Lifetime Portfolio

- 39.2% on Targa Resources (TRGP) in Alpha Money Flow

- 122.64% on our Camtek (CAMT) February 16 $65 calls in Alpha Money Flow

To be clear, those are just some of the winning positions we’ve closed so far in 2024. The year is young, and we’re looking forward to adding many more to the list.

Stay tuned.

And keep an eye on your inbox this Saturday. We’ll be sending you a brand-new essay from everyone’s favorite lunatic farmer, Joel Salatin.

I’ll be back with your next Midweek Bulletin next Wednesday.

Note: Our goal with this weekly mailing is to shine a light on any action you may have missed at Manward over the last week. We hope you find it useful. If you have a minute, let us know how we’re doing here. And thanks for reading.