Dealmaker’s Diary: How AI Turned This Cruise Company Into a Cash Cow

Alpesh Patel|August 21, 2025

Most investors see “cruise company” and think leisure. I see the numbers and think technology powerhouse.

This isn’t your grandfather’s vacation stock. This is a cutting-edge AI operation generating $17 billion in annual revenue with metrics that would make Silicon Valley jealous.

Think about the complexity: managing massive fleets across global waters, optimizing fuel consumption for ships the size of floating cities, coordinating thousands of crew members, and delivering personalized experiences to millions of guests.

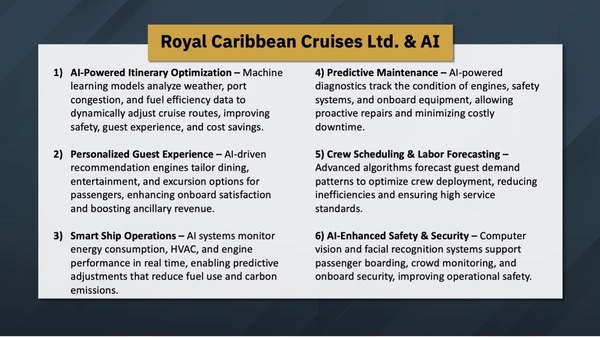

The AI applications are staggering.

While tech stocks swing wildly on hype and speculation, this company delivers consistent returns through operational excellence powered by artificial intelligence.

Click on the image below to see why this AI revolution at sea could make contrarian investors very wealthy.

Transcript

Hi, friends. Welcome to another Dealmaker’s Diary and the Stock of the Week. It’s not that I’m asking you all to go on holiday, and I haven’t been on a cruise, can you believe, ever in my life. But then again, when I’m looking at stocks, I’m looking at the data.

And this one led me to a merry journey. I follow the data wherever it leads me even on cruises. Now you’ll have heard of them. They do celebrity cruises. I haven’t been invited yet. I’m still waiting.

But beyond that, it is a company of some huge size, nearly $90 billion in size, and revenues of $17 billion. I would not have guessed that from just the brand name alone.

As you know, I like to educate and inform you each week with how these companies are using artificial intelligence.

Itinerary optimization.

Makes sense. I do it for my own trips, let alone if I have a whole fleet of ships.

Okay? Personalized guest experience. That makes sense.

In terms of what the clients might like, I use ChatGPT and AI for that myself. But can you imagine on a mass scale having it done for you?

Smart ship operations. Now that’s important.

That’s where you can save costs on energy consumption, for instance, engine performance, and improve the bottom line. Earnings are being improved by artificial intelligence, predictive maintenance. You can’t when you have those kind of numbers, you can’t afford to have ships going, well, on vacation, basically, on sick leave.

Crew scheduling, labor forecasting.

Yeah. I didn’t think of it beforehand, but, of course, you use it for that. And, safety and security, of course, given, the size and scale of the operations and all of that.

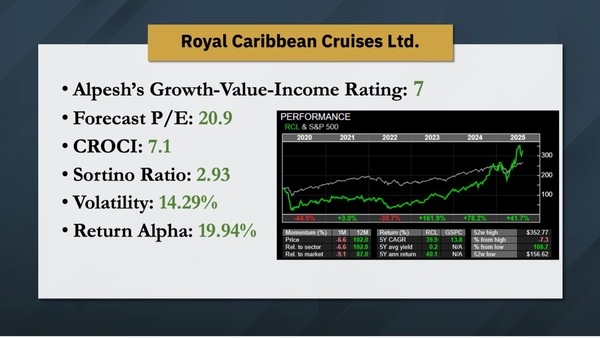

Now on my proprietary value growth income algorithm, this is a 7. So it meets our criteria of valuation, growth, and all of those factors which are very important for determining whether our company is undervalued growing, creating dividend deals.

You’re paying $20 for every future dollar of profit.

It’s not cheap, but it’s not expensive given everywhere I look, everybody seems to be spending a fortune on vacations and holidays.

And if I haven’t been on a cruise, and you can see there’s a big market which has yet to experience cruises.

Cash return on capital invested, 7.1%. Not as high as I would have liked. Over 10%, I would have liked, but seven, it’s a respectable number. Sortino is ridiculously high. I don’t think I’ve ever seen a stock with a Sortino this high. That’s average return versus downside volatility or risk of missing that return. That tells you something about consistency of performance, ridiculously high.

Volatility below 15%, that is low for a stock.

And you can see all of that exhibited, in the stock price, and you can see the direction I’m putting on this one as well at the same time.

Isn’t that just nuts? And on a discount cash flow basis, it remains undervalued.

So it’s a nice to have and a nice little box to tick off as well. There you have it.

Pretty good. Pretty good for a company which you might otherwise have thought, well, that’s just leisure, isn’t it? No. It’s AI.

And that’s the point I want to make to you. Everything is AI now, and it’s hitting the bottom line in profitability of companies as well. It is not just top line. Well, how many customers they’re getting through the door? It’s how much are they saving on all of their costs as a result of AI and how much are they improving efficiency.

Hope that’s insightful beyond just the stock itself, but insightful in terms of what’s going on in the world. Thank you very much.

Alpesh Patel

Alpesh Patel is an award-winning hedge fund and private equity fund manager, international best-selling author, entrepreneur and Dealmaker. He is the Founder and CEO of Praefinium Partners and is a Financial Times Top FTSE 100 forecaster. As a senior-most Dealmaker in the U.K.’s Department for International Trade, he is part of a team that has helped deliver $1 billion of investment to the U.K. since 2005 . He’s also a former Council Member of the 100-year-old Chatham House, the foreign affairs think-tank, whose patron is Queen Elizabeth. For his services to the U.K. economy, Alpesh received the Order of the British Empire (OBE) from the Queen in 2020. As a recognized authority on fintech, online trading and venture capital, his past and current client list includes American Express, Merrill Lynch HSBC, Charles Schwab, Goldman Sachs, Barclays, TD Bank, NYSE Life… and more.