Monday Takeaways: The Great AI Divide – Winners Surge as Losers Crash

Shah Gilani|November 3, 2025

The AI hype train just hit a reality checkpoint…

Last week exposed which tech giants are actually delivering on AI… versus which ones are just talking a good game.

Amazon? Blockbuster earnings. AWS showing 20%-plus cloud growth.

The market loved it because cloud growth means AI growth – and Amazon’s got the revenue to prove it.

But then there’s Oracle…

The stock gapped up when they announced billions in AI spending. Everyone cheered: “They’re not getting left behind!”

Then reality set in. They don’t have the money. They don’t have the revenue yet. And the stock got crushed.

This is what happens when AI promises meet actual earnings.

Meta learned the same lesson – absolutely hammered below its ascending trend line despite years of leading tech performance.

The market is telling us something critical…

- Beats get rewarded handsomely

- Misses get obliterated

- Positive guidance matters more than anything

This nervousness – even in a bull market – means you need to own the right names.

I’ll reveal which tech stocks have proven AI revenue streams you can trust, why investor nervousness creates opportunity in the right names, and the exact positioning strategy I’m using for the final two months of the year.

Click on the image below to discover which AI stocks pass the revenue test.

Transcript

Hey, everybody, Shah Gilani here with your Monday Takeaways. It was another pretty good week for the Street. Yes, stocks were higher at the end of the week. That’s a heck of a six-month run, of stocks moving higher.

And as we come into year-end, here we are turning the page now in November. We’ve got a couple of months left. It looks like the markets want to continue to rally through year-end, which is very much the pattern for the last decade-plus. So while cyclically and seasonally, this is a good time to buy stocks, there are also other reasons.

No. 1 being earnings. No. 2, the Fed wants to cut rates. Yes, they cut last week, 25 basis points.

The little bit of a knock on the Fed continuing to cut is pushback by Chairman Powell on whether or not December would see a cut. In other words, it’s not a foregone conclusion. Markets didn’t love that, and they got a little testy. But by Friday, they managed to come back and say, “All right, I guess things are pretty good.” The trend is still down. We don’t have a lot of numbers.

So it’s hard to take away where the economy is, what the Fed could do, and how loose monetary conditions are. We know fiscal conditions are fairly loose even though the government is closed. When they open, there’s going to be a floodgate that opens up. Fiscally, we have seen pretty loose conditions.

And monetary-wise, we’re seeing loosening. So the only caveat to that – which I got a lot of questions about – was, what does it mean that the Fed is going to end quantitative tightening? Meaning, they said that they are not going to let bonds run off their balance sheet when they mature and not replace them, because they have not been replacing them. So they have a huge portfolio, and when bonds, bills, and notes on their balance sheet mature, they have been letting them just run off and not replacing them by going out into the market and buying more.

So that’s been pretty good. Now they’re saying, “Yeah, in spite of the fact that markets have held up and there’s plenty of liquidity, we’re going to stop quantitative tightening. We’re going to go back to buying bonds when they mature.” But they’re not going to buy mortgage-backed securities. When the mortgage-backed securities mature, they’re going to take that money from maturing MBS agency bonds, and they’re going to buy Treasurys – mostly short-term bills.

That’s a liquidity issue. Are they worried about something? That worries me. Quantitative tightening was going along just fine. There was no need to stop quantitative tightening. I like the fact that they were reducing their balance sheet. It made sense. It certainly wasn’t having much of an impact, but maybe it is. Maybe it’s having some impact in the short-term market and the repo market, and that’s always a worry for the Fed. So that’s a takeaway from the messaging that we got from Chairman Powell last week.

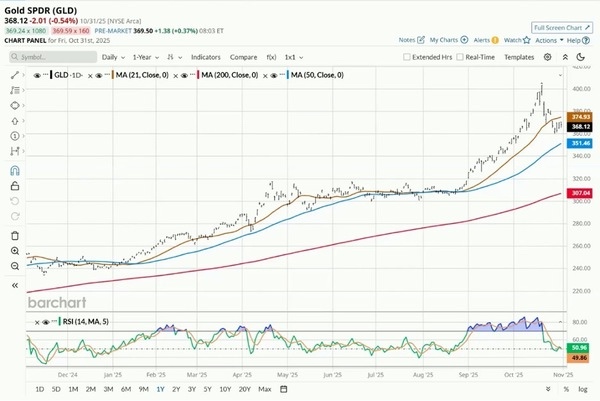

Now, we also got some pretty interesting messaging from, guess what, companies reporting earnings. And for the most part, there was some risk-off-looking stuff. Here’s gold measured through the GLD, the SPDR Gold ETF.

You see gold has come off from its peaks, and it hasn’t been able to do much – kind of come off pretty harshly. So is that a bit of risk-off? Yeah, that’s a cautionary tale.

The all-over risk-on everything trade is just maybe not petering out but has paused. But it hasn’t paused for the likes of Amazon, which came out with blockbuster earnings. And the thing that was really the keynote from Amazon – the takeaway – is cloud growth. So AWS is the largest cloud out there. And when it sees cloud growth 20-plus percent, everybody gets excited.

Well, this is all about AI. This is all about the future of AI. And Amazon, we know, is huge in the cloud and is huge in AI. It’s moving a lot of its facilities and turning them over to robots. All that’s going to be good for their margins and all that stuff. So here we are, big move from Amazon.

And we saw that last week with stocks that reported good earnings. They were handsomely rewarded.

The problem is those that didn’t got beaten up pretty good. Google, again, good earnings, but Friday didn’t really see much of a follow-through.

But then again, it’s already had a heck of a run. On the other hand, and this is the story of Oracle. I’m putting it in terms of Oracle because when Oracle came out and said, “We are going to spend umpteen billions of dollars,” the stock gapped up and everyone said, “Yes, they’re not going to get left behind in the AI race and they’re going to be a huge player. They’re partnering with this one, they’re partnering with that one.”

And then as people realized, “Well, they don’t have the money to build all this stuff out and they don’t have the revenue yet that they’re talking about,” here’s what the stock did.

So this is what happens when the AI story meets reality. And we are seeing that and we’re going to see that with some stocks here and there. Meta, case in point last week with its earnings – here’s what happened to Meta.

Goodnight. Absolutely hammered down here. All right, so here’s one of your big tech leaders. It’s been in a nice move up here. It’s been in this nice ascending trend and then absolutely hammered below trend now.

So that’s something to keep an eye on and how much Meta can recoup from this loss. So again, what we’re seeing is misses are getting hammered and beats are getting rewarded. Positive guidance is getting rewarded more than anything else. That tells me that investors are getting a little bit nervous.

That, the fact that seasonally here we are coming into the end of the year – seasonally that’s positive for markets.

Nvidia is still hanging in there really nicely. We don’t want to see, we can’t afford to see cracks in the likes of Nvidia or now Apple. Apple is just again surprisingly good, much better than expected results, given the fact that their China business is still way off. It’s been, I don’t know, six consecutive quarters where their sales there have been terrible. And again, they were terrible. But Nvidia, there you go. There’s your market leader – a $5 trillion market cap stock. And Apple, again, here’s a company that everyone said, “Uh-oh, it’s got problems, doesn’t have an AI representative product in the game.” But it’s going to have something we know that is going to be probably as good as anybody else’s.

And when they come, they’re always late. Apple rarely ever leads people, but the stock is now leading. So takeaways this week are watch for earnings, watch for the market firming up here. If the market gives way here on negative earnings or I would say poor guidance from companies that report this week, and don’t forget anything negative in terms of economic news, then the markets could pull back a little bit here because last week there was a little bit of nervousness in spite of the fact that we ended up higher.

Again, there we are. Yes, the usual. It’s about earnings. About half of the S&P 500 companies have reported. Earnings growth has been north of 8% on the whole. So really positive stuff. Margins have been double digits. So far, so good. We’ve got a lot of other companies to report and companies outside the S&P. But so far, so good. Investors like it. They’re cheering on the AI narrative, cheering on markets. And again, keep playing from the long side, people. That’s the takeaway here.

I have tightened up my stops. Why? I think we can see a year-end rally for sure, but there are certain names I don’t mind taking profits on because I’ve taken some profits on some positions – a 40% position in Ford stopped out last week, took 100% profit on part of my Nvidia and more than 100% on my Intel. So yeah, I’m getting stopped out on some pieces of positions here and letting others run because it’s just – you know there’s fear and there’s greed. I’m not fearful, but I tend to get greedy and I try to rein that in because triple-digit gains are pretty nice to book. And sometimes, even if it’s a short-term gain, you don’t mind paying taxes. Those are your takeaways for this week.

Have fun out there. Cheers, everybody.

Shah Gilani

Shah Gilani is the Chief Investment Strategist of Manward Press. Shah is a sought-after market commentator… a former hedge fund manager… and a veteran of the Chicago Board of Options Exchange. He ran the futures and options division at the largest retail bank in Britain… and called the implosion of U.S. financial markets (AND the mega bull run that followed). Now at the helm of Manward, Shah is focused tightly on one goal: To do his part to make subscribers wealthier, happier and more free.