Archive

Monday Takeaways: Record Highs and a 35% AMD Surge – Is This Peak Risk-On?

The S&P and Russell 2000 just hit new records while AMD exploded 35% higher on OpenAI news. Shah explains why this “risk-on” rally demands both participation and caution.

Why Long-Term Rates Are Rising Despite Rate Cuts

When the Fed cut rates 25 basis points in September, 10-year Treasury yields rose instead of falling. This counterintuitive move reveals the truth about the Fed…

Dealmaker’s Diary: Where AI Is Making Money NOW

Tech companies spend billions developing AI. This $294 billion pharmaceutical distributor spent millions implementing it – and those efforts went straight to the bottom line.

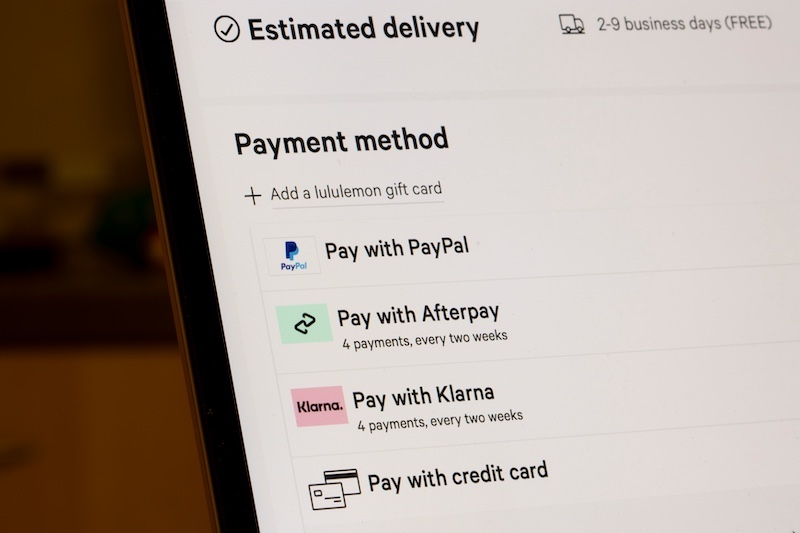

Buy This, Not That: Should You Buy This Crashed IPO?

This “buy now pay later” IPO crashed 36% from its high. But there’s one reason this stock could be a steal…

History Says This Bull Market Has Years – Not Months – Left to Run

The Fed has cut rates 20 times near all-time highs. Stocks were higher a year later every single time. Here’s why this bull market is just getting started.

Monday Takeaways: Credit Markets Send All-Clear Signal

With credit spreads at historic lows and GDP at 3.8%, Shah Gilani explains why the credit markets are sending an all-clear signal – and why this week’s potential government shutdown could create your next buying opportunity.

Why All Three P/E Measures Are Flashing Red

Most investors focus on one P/E ratio. Bu three different P/E measures tell three different stories – and right now, all three are signaling the same uncomfortable truth about market valuations.

Dealmaker’s Diary: Why This $200B Company Will Become the “Oracle” of AI

While everyone chases AI headlines, this enterprise giant quietly builds the infrastructure that makes it all work. 30% cash returns and trillion-dollar potential ahead.

Buy This, Not That: Nuclear’s International Showdown

It’s Canada vs. the United States in nuclear’s biggest face-off. One’s up 150%, the other 500%. Here’s the winner…

The Art of the Free Ride: The Simple Strategy That Turns Volatile Winners Into Stress-Free Wealth

The hardest part of investing isn’t buying – it’s knowing when to sell. The “free ride” strategy solves this problem by letting you have your cake and eat it too.