Alpesh Patel's Archive

Alpesh Patel

Alpesh Patel is an award-winning hedge fund and private equity fund manager, international bestselling author, entrepreneur and Dealmaker.

He is the Founder and CEO of Praefinium Partners and is a Financial Times Top FTSE 100 forecaster, beating leading fund managers, analysts and journalists.

He has penned more than 200 columns for the Financial Times and has written 18 book on investing, translated into six languages, including The Mind of a Trader and 7 Simple Strategies of Highly Effective Traders. (One of his books was even a top 5 bestseller on Amazon – right behind Harry Potter.) A frequent guest on financial news shows, Alpesh also hosted his own shows on Bloomberg TV, CNBC and Sky TV.

He’s a sought-after speaker, having presented at more than 500 conferences across the globe, including for Rothschilds, Goldman Sachs, Barclays, and the London Business School.

A University of Oxford alumnus and former Visiting Fellow in Business, Alpesh interned for U.S. Congressman Eliot Engel and was appointed to a U.K. advisory position by former Prime Minister Tony Blair.

As a senior-most Dealmaker in the U.K.’s Department for International Trade, he is part of a team that has helped deliver $1 billion of investment to the U.K. since 2005. He’s also a former Council Member of the 100-year-old Chatham House, the foreign affairs think-tank, whose patron is Queen Elizabeth. For his services to the U.K. economy, Alpesh received the Order of the British Empire (OBE) from the Queen in 2020.

As a recognized authority on fintech, online trading and venture capital, his past and current client list includes American Express, Merrill Lynch HSBC, Charles Schwab, Goldman Sachs, Barclays, NYSE Life… and more.

Alpesh is also known for his philanthropic efforts. He co-founded the U.K. chapter of the largest entrepreneur mentorship organization in the world (TIE.org), and is co-chair of the Loomba Foundation, which supports widows and orphans.

Investor Magazine calls him “The U.K.’s most respected stock picker.” The Independent says he is “An expert in his field.” And Channel 4 TV called him “UK’s best known online trader.”

Alpesh writes an elite weekly column for Total Wealth and runs the award-winning research service GVI Investor… bringing his hedge fund secrets to everyday investors.

Dealmaker’s Diary: Where AI Is Making Money NOW

Tech companies spend billions developing AI. This $294 billion pharmaceutical distributor spent millions implementing it – and those efforts went straight to the bottom line.

Dealmaker’s Diary: Why This $200B Company Will Become the “Oracle” of AI

While everyone chases AI headlines, this enterprise giant quietly builds the infrastructure that makes it all work. 30% cash returns and trillion-dollar potential ahead.

Dealmaker’s Diary: Why Paying $36 for Every $1 of This Company’s Profits Makes $$

The valuation looks insane. The P/E screams “overpriced.” But when a company has AI superpowers that put it in the top 0.1% of all stocks for consistency, expensive might be cheap.

Dealmaker’s Diary: How This “Old Economy” Giant Outperforms Most Tech Stocks

While venture capital floods into AI startups, this established travel company quietly uses machine learning to generate 59% cash returns – better than most Silicon Valley darlings.

Dealmaker’s Diary: This $82 Billion Comeback Creates Rare Value Opportunity

This company died, got reborn, and emerged as an AI infrastructure giant. With $107 billion in revenue and trading 27% below fair value, this comeback story is just getting started.

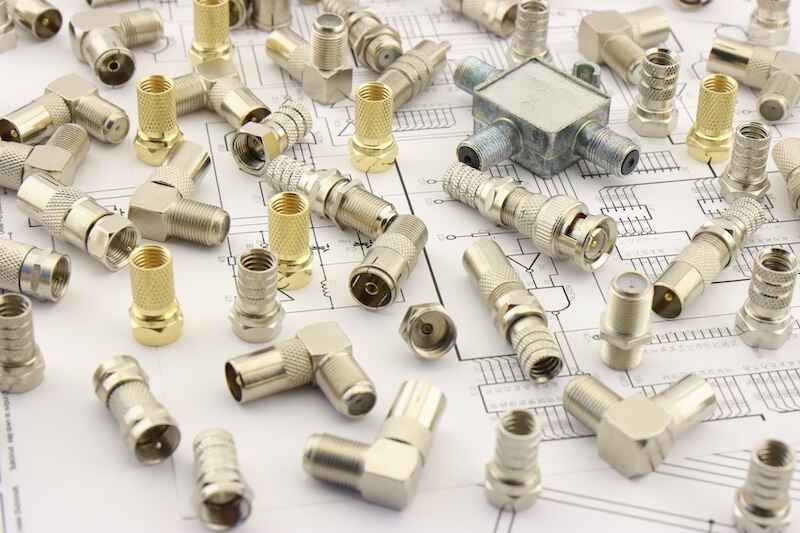

Dealmaker’s Diary: This Connector King Could Deliver 50% Returns With Low Volatility

While tech stocks swing wildly, this $135 billion infrastructure play proves that boring businesses can deliver exceptional returns with minimal drama.

Dealmaker’s Diary: How AI Turned This Cruise Company Into a Cash Cow

Seventeen billion dollars in revenue, AI optimization across every operation, and volatility below 15%. This isn’t your typical leisure stock – it’s a technology play disguised as a vacation company.

Dealmaker’s Diary: An Auto Parts Giant With an AI-Driven Moat

Predictive parts recommendations, dynamic pricing, and supply chain optimization aren’t just buzzwords – they’re competitive weapons. See how this $67B retailer is building a massive competitive moat.

Dealmaker’s Diary: This Market Leader Stuns With an 89% CROCI

In 30 years of analyzing stocks, our team has never seen a cash return on capital this high. This company’s 89% CROCI doesn’t just beat the market – it rewrites what’s possible when a company becomes a true cash-generating machine.

Dealmaker’s Diary: The $1.8 Trillion Stock Warren Buffett Doesn’t Own (But Should)

Even Warren Buffett doesn’t have meaningful exposure to this AI powerhouse. While the Oracle of Omaha sits on the sidelines, the numbers tell a different story about this quantum computing giant.