Shah Gilani's Archive

Shah Gilani

Wall Street superstar and former hedge fund manager Shah Gilani is the Chief Investment Strategist of Manward Press and at the helm of the Manward Money Report newsletter and the Launch Investor and Alpha Money Flow trading services. He’s a sought-after market commentator and has appeared on CNBC, Fox Business and Bloomberg TV. He’s also been quoted in The Wall Street Journal, The New York Times and The Washington Post, and he’s had columns published in Forbes.

In 1982, he launched his first hedge fund from his seat on the floor of the Chicago Board Options Exchange. He worked in the pit as a market maker when options on the S&P 100 Index first began trading… and was part of a handful of traders who laid the technical groundwork for what would eventually become the CBOE Volatility Index (VIX). He also ran the futures and options division at the largest retail bank in Britain. Shah gained notoriety for calling the implosion of U.S. financial markets (all the way back in February 2008) AND the mega bull run that followed.

Now at the helm of Manward, Shah is focused tightly on one goal: To do his part to make subscribers wealthier, happier and more free.

Buy This, Not That: Natural Gas Will Outshine Oil in 2025

While oil prices struggle with supply and demand challenges, natural gas demand is surging thanks to AI data centers and European winter needs. We’ve got the ticker to play it.

Monday Takeaways: The First Test of 2025

Despite missing the Santa Claus rally, tech stocks are finding their footing again after a brief sell-off. But two key factors could impact this rally…

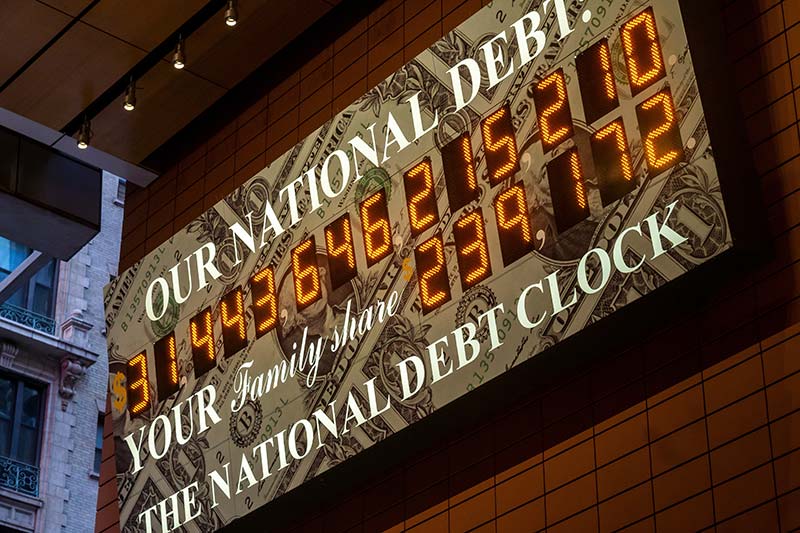

The $1 Trillion Problem No One’s Talking About

As government interest costs approach $1 trillion annually, markets face a ticking time bomb.

Buy This, Not That: A Tale of Two Spirit Giants

One’s a top shelf buy… the other’s giving investors a headache.

Monday Takeaways: The Year-End Rally Hits a Wall

Rising bond yields, mega-cap tech weakness, and mounting government debt paint a concerning picture for investors heading into 2025.

This $10T Market Tells Us What to Expect in 2025

The stock market is powered by many forces, but there’s one force that has been front and center this year.

Buy This, Not That: A Tale of Two Toymakers

With holiday shopping coming down to the wire, we’re tackling the ultimate toy story showdown.

Monday Takeaways: A Pivotal Fed Week

Will the Fed cut rates again? That’s the big focus for the week.

Like It or Hate It… Crypto Is Here to Stay

Everyone wants to get rich, and the volatility of the crypto markets offers opportunities to make big gains.

Buy This, Not That: This Dividend Payer Will Deliver the Goods

This beaten-down shipping company is about to join an elite group of stocks.