Shah Gilani's Archive

Shah Gilani

Wall Street superstar and former hedge fund manager Shah Gilani is the Chief Investment Strategist of Manward Press and at the helm of the Manward Money Report newsletter and the Launch Investor and Alpha Money Flow trading services. He’s a sought-after market commentator and has appeared on CNBC, Fox Business and Bloomberg TV. He’s also been quoted in The Wall Street Journal, The New York Times and The Washington Post, and he’s had columns published in Forbes.

In 1982, he launched his first hedge fund from his seat on the floor of the Chicago Board Options Exchange. He worked in the pit as a market maker when options on the S&P 100 Index first began trading… and was part of a handful of traders who laid the technical groundwork for what would eventually become the CBOE Volatility Index (VIX). He also ran the futures and options division at the largest retail bank in Britain. Shah gained notoriety for calling the implosion of U.S. financial markets (all the way back in February 2008) AND the mega bull run that followed.

Now at the helm of Manward, Shah is focused tightly on one goal: To do his part to make subscribers wealthier, happier and more free.

Monday Takeaways: Consumer Spending Cracks Could Trigger Market Breakdown

Consumer discretionary fell 2.7% last week – the worst of all 11 sectors. With Home Depot, Walmart, and Target reporting this week, we’re about to find out if consumers are pulling back heading into the holidays…

An $800B Revenue Shortfall Investors Can’t Ignore

By 2030, AI companies need $2 trillion in annual revenue just to pay for computing power. Expected revenue? $1.2 trillion. The math doesn’t work.

Buy This, Not That: Five Reasons One Airline Beats Its Biggest Rival

Higher profit margins. Stronger earnings growth. Better revenue growth. And one more advantage that could deliver bigger gains as flights resume…

Monday Takeaways: Will Investors Get Lucky in This “Throw the Dice” Market?

Friday’s dramatic 100-point S&P rally off the lows wasn’t enough to erase an ugly week dominated by AI spending concerns. Meanwhile, the government shutdown is clouding critical data and Nvidia dropped 9%. What happens next?

AI: It’s Not a Bubble… It’s a “Spiral Convolution”

Nvidia invests in OpenAI. OpenAI buys Nvidia chips. Oracle borrows to buy Nvidia chips for OpenAI data centers. The money goes in circles – and everyone books revenue and growth. Here’s the problem…

Buy This, Not That: Should You Chase Amazon’s Gap or Buy Microsoft’s Dip?

Amazon jumped on cloud earnings. Microsoft’s been moving sideways. One has 40% growth with low-40s margins. The other has 20% growth with mid-30s margins. Which is the better buy?

Monday Takeaways: The Great AI Divide – Winners Surge as Losers Crash

Earnings season is exposing the truth about AI investments. Amazon’s 20%-plus cloud growth sends the stock soaring, but Oracle and Meta learned that promises without revenue lead to brutal sell-offs.

Diversification Is Dead – ETFs Killed It

U.S. ETFs now hold $10.3 trillion in assets, but the diversification investors expect is an illusion…

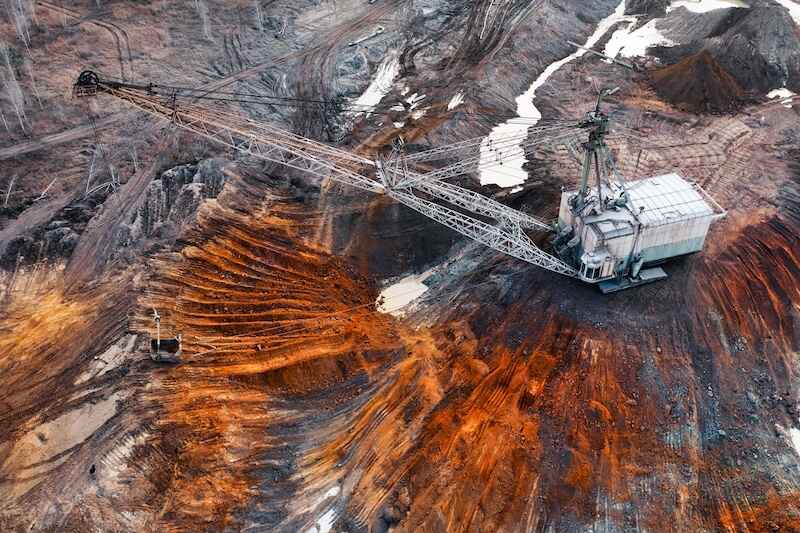

Buy This, Not That: Revenue vs. Hype in Rare Earth Stocks

One rare earth company has a bigger market cap but zero revenue. Its smaller competitor generates $30.5 million in sales with 29% margins…

Monday Takeaways: Why This Bull Market Is Just Getting Started

From Trump-Xi trade talks to mega-cap earnings, from technical breakouts to geopolitical wins – every signal points to one conclusion: We’re in a bull market. Enjoy it.