Shah Gilani's Archive

Shah Gilani

Wall Street superstar and former hedge fund manager Shah Gilani is the Chief Investment Strategist of Manward Press and at the helm of the Manward Money Report newsletter and the Launch Investor and Alpha Money Flow trading services. He’s a sought-after market commentator and has appeared on CNBC, Fox Business and Bloomberg TV. He’s also been quoted in The Wall Street Journal, The New York Times and The Washington Post, and he’s had columns published in Forbes.

In 1982, he launched his first hedge fund from his seat on the floor of the Chicago Board Options Exchange. He worked in the pit as a market maker when options on the S&P 100 Index first began trading… and was part of a handful of traders who laid the technical groundwork for what would eventually become the CBOE Volatility Index (VIX). He also ran the futures and options division at the largest retail bank in Britain. Shah gained notoriety for calling the implosion of U.S. financial markets (all the way back in February 2008) AND the mega bull run that followed.

Now at the helm of Manward, Shah is focused tightly on one goal: To do his part to make subscribers wealthier, happier and more free.

Buy This, Not That: Should You Buy This Crashed IPO?

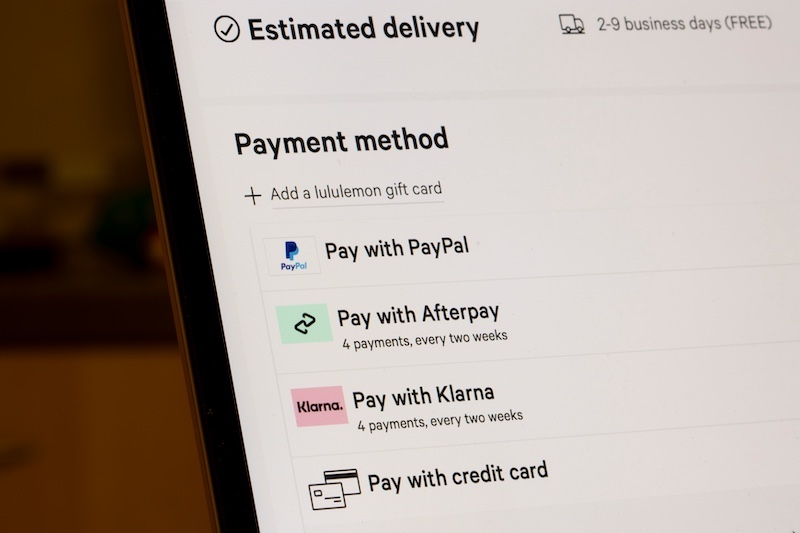

This “buy now pay later” IPO crashed 36% from its high. But there’s one reason this stock could be a steal…

Monday Takeaways: Credit Markets Send All-Clear Signal

With credit spreads at historic lows and GDP at 3.8%, Shah Gilani explains why the credit markets are sending an all-clear signal – and why this week’s potential government shutdown could create your next buying opportunity.

Why All Three P/E Measures Are Flashing Red

Most investors focus on one P/E ratio. Bu three different P/E measures tell three different stories – and right now, all three are signaling the same uncomfortable truth about market valuations.

Buy This, Not That: Nuclear’s International Showdown

It’s Canada vs. the United States in nuclear’s biggest face-off. One’s up 150%, the other 500%. Here’s the winner…

Monday Takeaways: CAPE Ratio Screams Caution as Rally Continues

The Shiller PE just hit 40x – within striking distance of dot-com bubble levels. Here’s why I’m staying bullish but getting defensive.

Why “Irrational Exuberance” in This Market Isn’t Irrational at All

Critics see bubbles where smart money sees opportunity. Today’s market leaders generate mountains of cash, crush earnings estimates, and invest billions in AI infrastructure – a far cry from 1999’s dot-com fantasies.

Buy This, Not That: Time for the Small Cap Gold Rush?

Lower interest rates won’t fix a fundamental flaw with small caps… that they’re packed with unprofitable companies that get crushed when markets turn volatile. See where Shah is looking now instead.

Monday Takeaways: Pivotal Fed Week Tests Central Bank vs. Presidential Power

Fed fund futures show 100% certainty of a 25 basis point cut Wednesday, but Trump wants 50. With labor markets softening and the S&P 500 testing channel support, this Fed meeting could determine the next market move.

When Your “Safe” ETF Strategy Becomes a Liability

Two reader questions reveal the hidden dangers in ETF investing: momentum strategies that amplify crashes and authorized participants who abandon ship when you need them most.

Buy This, Not That: The Zero-Commission Pioneer vs. the Established Giant

Robinhood just earned its spot in the S&P 500. But does that make it a better buy than Charles Schwab? The numbers might shock you…