Shah Gilani's Archive

Shah Gilani

Wall Street superstar and former hedge fund manager Shah Gilani is the Chief Investment Strategist of Manward Press and at the helm of the Manward Money Report newsletter and the Launch Investor and Alpha Money Flow trading services. He’s a sought-after market commentator and has appeared on CNBC, Fox Business and Bloomberg TV. He’s also been quoted in The Wall Street Journal, The New York Times and The Washington Post, and he’s had columns published in Forbes.

In 1982, he launched his first hedge fund from his seat on the floor of the Chicago Board Options Exchange. He worked in the pit as a market maker when options on the S&P 100 Index first began trading… and was part of a handful of traders who laid the technical groundwork for what would eventually become the CBOE Volatility Index (VIX). He also ran the futures and options division at the largest retail bank in Britain. Shah gained notoriety for calling the implosion of U.S. financial markets (all the way back in February 2008) AND the mega bull run that followed.

Now at the helm of Manward, Shah is focused tightly on one goal: To do his part to make subscribers wealthier, happier and more free.

Monday Takeaways: Panic Sellers Just Gifted You AI’s Leader at Fire Sale Prices

This recent rollover has spooked the market, but at 8% of the S&P, any dip toward $150 is a gift. Here’s why the pullback sets up the next leg higher.

A Powerful Asset Class Bigger Than the Stock Market

U.S. exchanges now host more ETFs than individual stocks, creating market mechanics that work beautifully – until they don’t. When “authorized participants” step back, the “passive bid” becomes a passive bleed.

Buy This, Not That: The “Better” Way to Own Gold at All-Time Highs

Gold just made a new all-time high. But if you want to own it, there are two popular ETFs to choose from. Only one gives you the better deal…

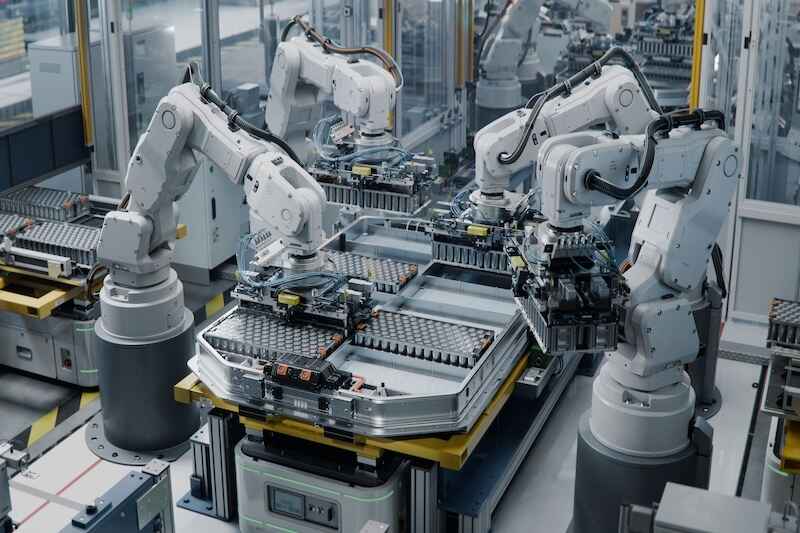

The Death of Free-Market Capitalism: How Washington Turned the U.S. Into China

From Intel’s $11 billion government investment to MP Materials’ Defense Department partnership, America is adopting China’s playbook of state-controlled capitalism – and taxpayers are footing the bill.

Buy This, Not That: This Durable Goods Winner Could Fill a 15% Earnings Gap

Durable goods orders just posted their worst reading since April 2020. But one sector is rising while another crashes 9.7%. Here’s which stock could bounce back 15%…

Monday Takeaways: Jackson Hole’s Short Covering Frenzy Hides Inflation Reality

Powell’s dovish surprise triggered massive short covering Friday, but with Walmart and Target warning about tariff price impacts every week, this September rate cut narrative faces a harsh reality check.

Paying Up Makes Sense: The Case for High P/E Multiples in a Predictable Bull Market

The S&P 500 trades at 22.8x forward earnings – a 23% premium to historical averages. Old-school analysts call it frothy, but they’re missing the real story: investors are paying for certainty, not just growth.

Buy This, Not That: Earnings Are In – Home Depot vs. Lowe’s?

Two of the biggest names in home improvement just reported earnings: Home Depot and Lowe’s. Both stocks jumped. But if you’re thinking about investing in one of these retailers right now… The choice is clear.

Monday Takeaways: Stocks at Record Highs – What’s Next?

The S&P 500, Nasdaq Composite, and Nasdaq 100 all notched fresh record highs last week… yet Wall Street is split. Are stocks “too good to be true”—or is the rally just getting started?

How Wall Street Plans to Turn Your 401(k) Into Their Personal ATM

Trump’s executive order opens 401(k)s to private equity and private credit – Wall Street’s latest scheme to use your retirement money as their bailout fund when deals go bad.