Shah Gilani's Archive

Shah Gilani

Wall Street superstar and former hedge fund manager Shah Gilani is the Chief Investment Strategist of Manward Press and at the helm of the Manward Money Report newsletter and the Launch Investor and Alpha Money Flow trading services. He’s a sought-after market commentator and has appeared on CNBC, Fox Business and Bloomberg TV. He’s also been quoted in The Wall Street Journal, The New York Times and The Washington Post, and he’s had columns published in Forbes.

In 1982, he launched his first hedge fund from his seat on the floor of the Chicago Board Options Exchange. He worked in the pit as a market maker when options on the S&P 100 Index first began trading… and was part of a handful of traders who laid the technical groundwork for what would eventually become the CBOE Volatility Index (VIX). He also ran the futures and options division at the largest retail bank in Britain. Shah gained notoriety for calling the implosion of U.S. financial markets (all the way back in February 2008) AND the mega bull run that followed.

Now at the helm of Manward, Shah is focused tightly on one goal: To do his part to make subscribers wealthier, happier and more free.

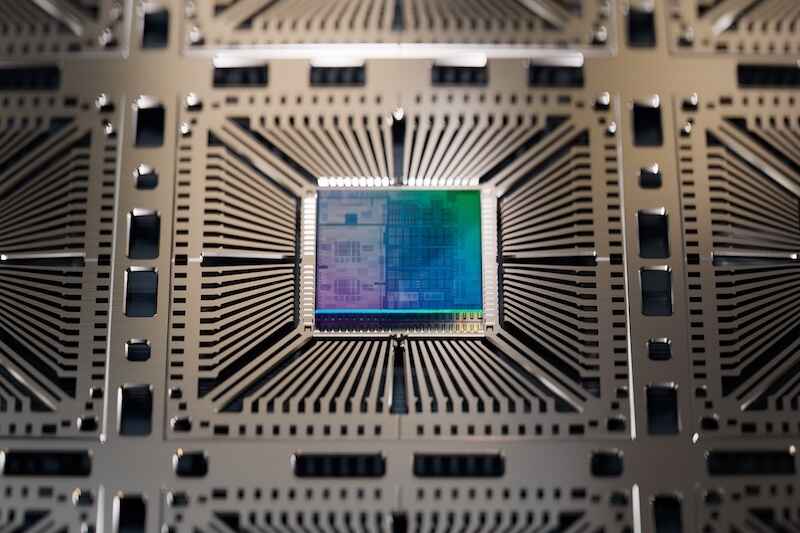

Buy This, Not That: Trump’s China Chip Deal – Who Wins?

President Trump just negotiated a surprise chip deal with China. But which semiconductor giant should you buy to profit from the new export rules?

Monday Takeaways: Trump’s $500 Billion IPO Gambit

While 81% of S&P 500 companies crush earnings estimates, President Trump has floated a plan to take Fannie Mae and Freddie Mac public – potentially raising $500 billion but threatening to spike mortgage rates for millions.

How Private Equity Firms Are Targeting Your 401(k) – And Why You Should Fight Back

Wall Street is pushing private equity into retirement accounts, but decade-long lockups and high fees make PE investments unsuitable when you need retirement income.

Buy This, Not That: $43 Billion in Debt vs. a 24% Profit Machine

One beloved entertainment company carries crushing debt while its rival generates fat profit margins. Only one of these media titans deserves your money.

Monday Takeaways: Record Earnings Beats Battle Recession Fears

While Friday’s jobs report revisions painted a grim picture, corporate earnings are delivering the strongest beat rate in years. The market’s next move depends on which trend prevails.

Buy This, Not That: A $750 Billion Windfall Makes This LNG Giant a Winner

Trump just secured a massive $750 billion European commitment to buy U.S. energy. But only one of these LNG giants is positioned to truly capitalize…

Monday Takeaways: Single-Stock ETFs Signal Speculation Is Back

ETFs now outnumber individual listed stocks, and the flood of new single-stock leveraged products tells us everything about where this market is headed next.

How We Made 50% in Three Weeks Playing Tech’s July Pattern

Our seasonal TQQQ strategy delivered 50% gains in just three weeks by exploiting tech’s predictable July surge. Two more positions remain profitable.

Buy This, Not That: Meme Stock Mania Strikes Again

One retail stock shot up 37.62% on Tuesday thanks to meme stock mania. But before you chase it, here’s what you need to know about this company… and its better-run competitor.

Monday Takeaways: Three Key Sectors Reveal True Market Leadership

Why these earnings leaders matter more than overall beat rates.