Shah Gilani's Archive

Shah Gilani

Wall Street superstar and former hedge fund manager Shah Gilani is the Chief Investment Strategist of Manward Press and at the helm of the Manward Money Report newsletter and the Launch Investor and Alpha Money Flow trading services. He’s a sought-after market commentator and has appeared on CNBC, Fox Business and Bloomberg TV. He’s also been quoted in The Wall Street Journal, The New York Times and The Washington Post, and he’s had columns published in Forbes.

In 1982, he launched his first hedge fund from his seat on the floor of the Chicago Board Options Exchange. He worked in the pit as a market maker when options on the S&P 100 Index first began trading… and was part of a handful of traders who laid the technical groundwork for what would eventually become the CBOE Volatility Index (VIX). He also ran the futures and options division at the largest retail bank in Britain. Shah gained notoriety for calling the implosion of U.S. financial markets (all the way back in February 2008) AND the mega bull run that followed.

Now at the helm of Manward, Shah is focused tightly on one goal: To do his part to make subscribers wealthier, happier and more free.

The Way to Profit Off of Rivian’s Disappointing Financials

Rivian Automotive Inc. (RIVN), an electric truck manufacturer, reported quarterly results on Friday that disappointed investors. The stock dropped more than 7.33% in early-Friday trading.

For the quarter, the company reported revenue of $54 million which was considerably lower than the estimates of $64 million.

On the bottom line, adjusted earnings were a $2.43 loss per share, also lower than estimates of a $2.05 loss per share.

Beyond the financials, what really impacted the stock was Rivian’s new production forecast. The company once claimed it could produce 50,000 vehicles per year. Now, due to persistent supply chain issues, its capacity has been cut to 25,000. Rivian just can’t get key components it needs to finish building its vehicles.

Even with the pandemic easing and the global supply chain crunch slowly mending, I think it’s going to be quite some time before RIVN is at full production capacity.

In the meantime, the company is burning through cash, has large operating losses, and rising interest rates will hurt the stock’s forward valuation.

I wouldn’t be surprised if we don’t see a short-term rally as bargain hunters move in to catch a bounce, but longer term, I think shares are heading lower, at least until they have a plan for sustainable production increases.

If shares of RIVN trade up to $39.75 by March 18, let’s buy the RIVN May 20, 2022 $35/$30 Put Spread for $2.25 or less. Plan on exiting the RIVN May 20, 2022 $35/$30 Put Spread for a 100% profit or if shares of RIVN close above $49.50.

But that’s not all I’m watching this week.

Three Ways to Trade the Commodity Super Cycle

Commodities are hot right now, and for good reason. Oil, corn, wheat… they’re all through the roof – but they may not stay that way, especially where agricultural commodities are concerned. For all kinds of reasons, agricultural commodities don’t always go in one direction and rarely do for long. They are often overbought, are prone […]

The Way to Cash in on Soaring Oil Prices

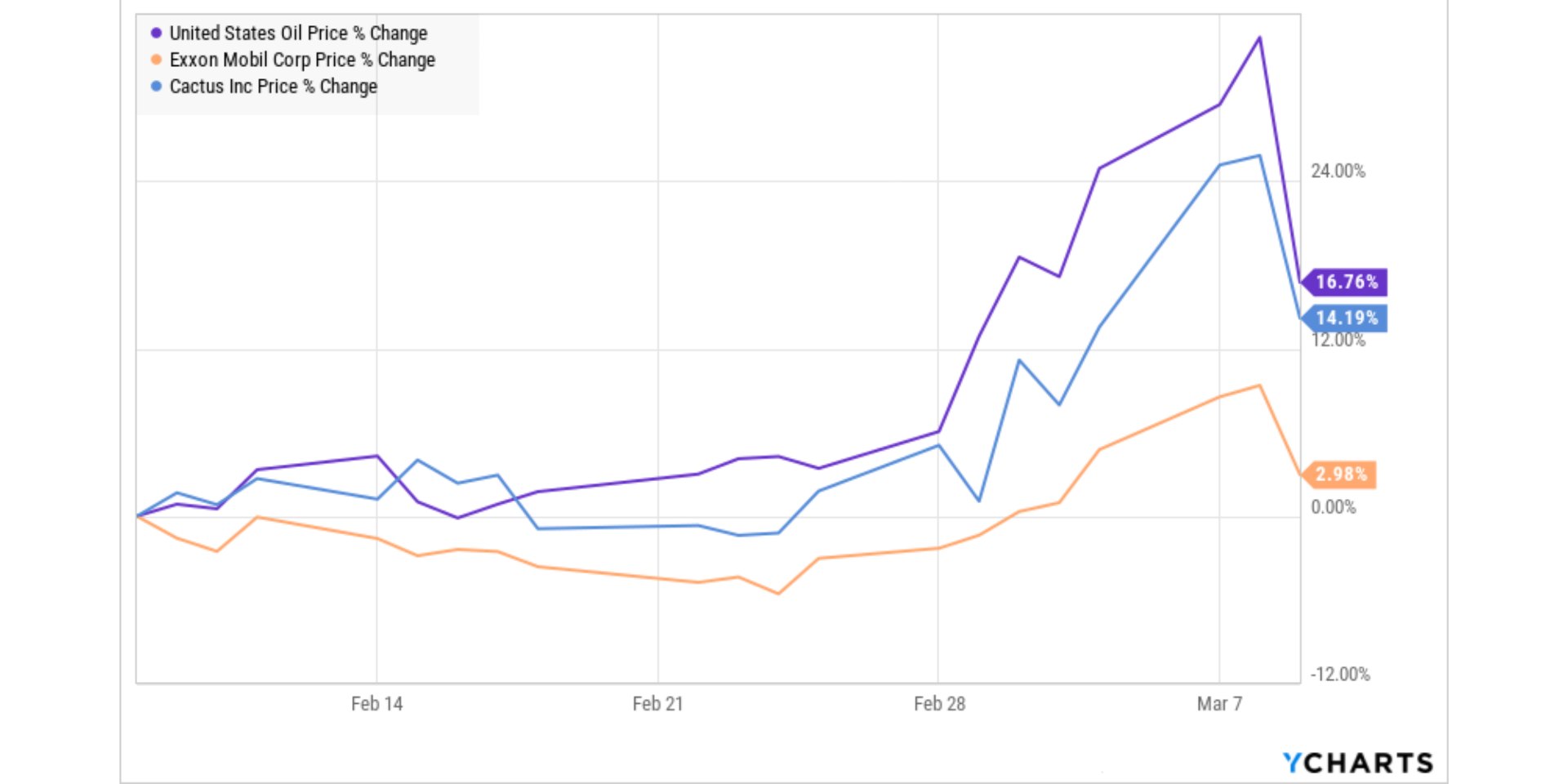

Oil, natural gas, and energy stocks are all soaring. Just take a look at how US Oil Fund (USO), Exxon Mobile (XOM), and Tuesday’s recommendation Cactus Inc (WHD) have fared in the last month.

If you’re not in any of these high-fliers, it’s not too late. They could go a lot higher.

And everyone knows what goes up must come down, and energy bets are no exception.

So, in today’s Total Wealth, I’m giving youthe smart way to get aboard what might be a momentum ride higher for already rocketing energy plays and, at the same time, set yourself up to profit if they crash back to earth.

As Energy Prices Ignite, Shah Directs Investors Toward Unlikely Oil Company

It’s not hard to figure out what’s hot in the markets right now after yesterday. We experienced a bear and bull market in the West Texas Intermediate (WTI), a key benchmark for the crude oil industry, all in a single day.

How do you play that? Well, I’ve got an answer for you.

Tech Costs to Spike as Russia-Ukraine War Withholds Vital Commodities

The Russia-Ukraine war has continued to escalate on all sides. As Russian forces continued bombing Ukrainian cities, Western Europe and the US have tightened all sanctions, for better or for worse. This conflict has affected millions, through physical and economic upheaval – leading to a series of global trends that will affect us all. Which […]

Mind Your Profits: SWIFT but Blunt Reaction to Russia-Ukraine War to Weaken USD

On Tuesday, CEO of JPMorgan Chase Jamie Dimon warned the world that cutting Russia out of the SWIFT system would yield “unintended consequences.”

That’s a monumental understatement.

In short, SWIFT is a system banks use to securely and quickly communicate transfer instructions across international borders. Cutting off an entire nation and its people from this system will have steep consequences across the globe.

We could be looking at the potential demise of the US dollar as the world’s reserve currency, another likely Lehman moment, and the acceleration of China’s progress from third-world nation to global power.

Here’s how the US’s influence on this apolitical system could hasten China’s ascent to global power.

Europe’s Breadbasket Under Siege, Grab Commodities While You Still Can

Here in the US, when we hear “breadbasket” we usually think of the Midwest. Ohio, Kansas, Illinois… When Europeans hear the phrase, they think of Ukraine – and for good reason. The country distributes 12% of global wheat exports, 16% of corn, and 18% of barley. Ukrainian agriculture is a pillar of grain production for […]

Two Stocks to be Bargain-Hunting Favorites

As I mentioned during last week’s State of the Markets (which you can watch here, if you’d like to catch up), things are looking grim but don’t sell yet.

Upset Markets Carve Out New Opportunities and Defensive Plays

There’s no reason to beat around the bush this week.

I’ve cancelled our regular Buy, Sell, or Hold this week to address what is on everyone’s’ minds this week: Russia’s invasion of Ukraine, the dramatic selloff that followed, and what can be done about it.

You can access this Emergency State of the Markets by clicking the video below.

The Real Estate Bubble That Isn’t – And How to Invest in It

Headlines about the residential real estate bubble popping any day now are nothing but fake news.

Just because prices of homes have skyrocketed doesn’t mean they’re coming down as they did in 2008, a true real estate crash. Home prices aren’t coming down; they’re going higher.

And there’s nothing “bubbleicious” about it.

In today’s Total Wealth, I’m exploringwhy the feared residential real estate “bubble” isn’t a bubble -and how you can ride the long-term appreciation potential of the boom by investing in it.