Shah Gilani's Archive

Shah Gilani

Wall Street superstar and former hedge fund manager Shah Gilani is the Chief Investment Strategist of Manward Press and at the helm of the Manward Money Report newsletter and the Launch Investor and Alpha Money Flow trading services. He’s a sought-after market commentator and has appeared on CNBC, Fox Business and Bloomberg TV. He’s also been quoted in The Wall Street Journal, The New York Times and The Washington Post, and he’s had columns published in Forbes.

In 1982, he launched his first hedge fund from his seat on the floor of the Chicago Board Options Exchange. He worked in the pit as a market maker when options on the S&P 100 Index first began trading… and was part of a handful of traders who laid the technical groundwork for what would eventually become the CBOE Volatility Index (VIX). He also ran the futures and options division at the largest retail bank in Britain. Shah gained notoriety for calling the implosion of U.S. financial markets (all the way back in February 2008) AND the mega bull run that followed.

Now at the helm of Manward, Shah is focused tightly on one goal: To do his part to make subscribers wealthier, happier and more free.

Meta’s Discounted Stock Isn’t Your Only Screaming Buy This Week

Meta’s earnings gave investors quite the scare yesterday with “weaker-than-expected” revenue growth.

But let me tell you something: I don’t scare easy, and Meta is still one of my number one buys this week. Sometimes, bottom fishing is great fun, and with FB trading 26% off its highs anyone that buys in now will get a discount on one of the most profitable companies on the markets.

You’ll want to buy in before everyone else gets wise – but make sure to use the trailing stop I give you in todays video to secure your gains.

FAANG to Push Through Nasdaq Downturn

The tech-heavy Nasdaq Composite, took a beating last night as Meta Platforms Inc led the entire tech sector and its shares lower into a dip that, according to some skittish investors, is looking more like a trench every day.

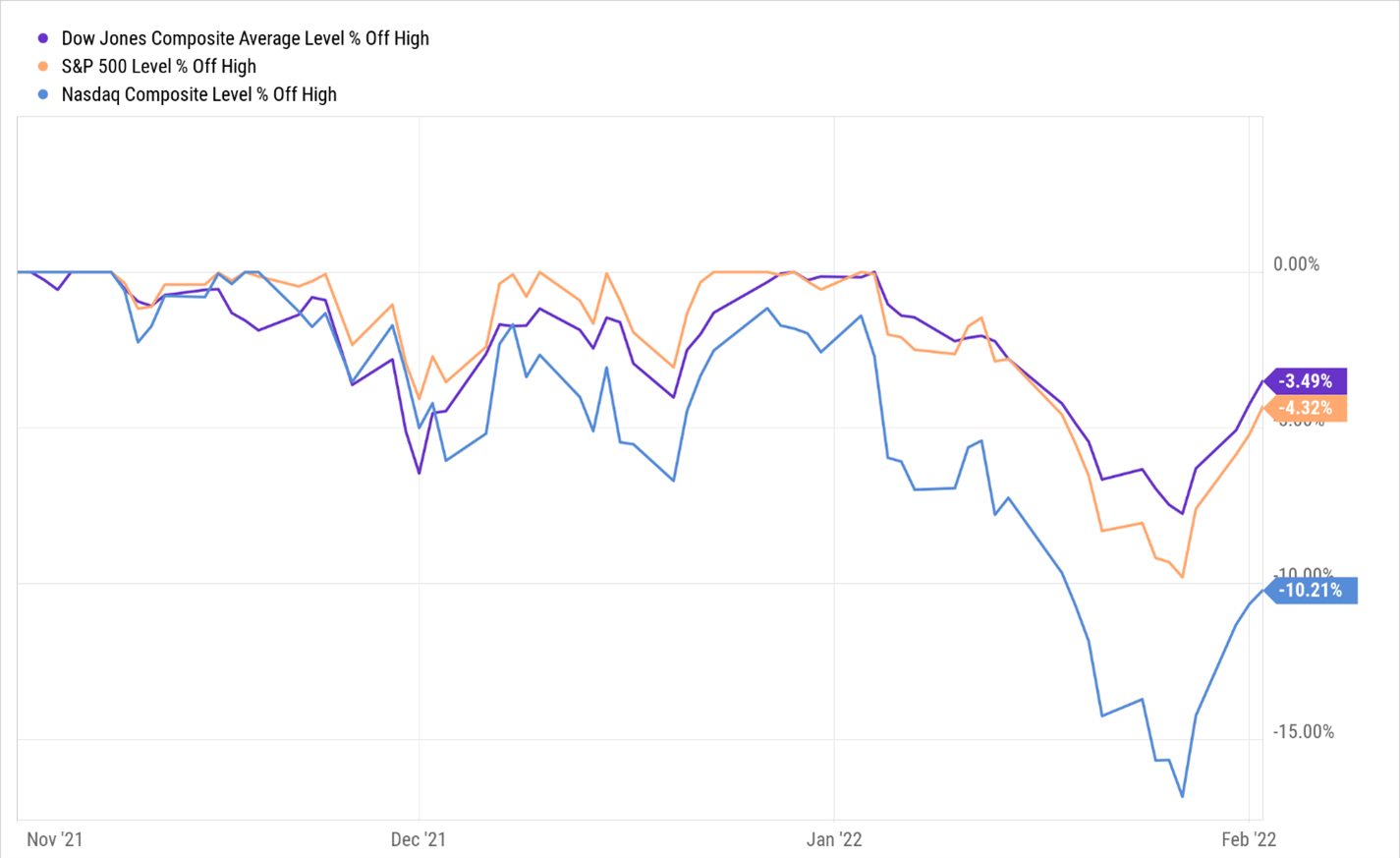

After a nearly 20% dip triggered by an inflation-anxiety-based selloff, the Nasdaq couldn’t return to its previous highs – making up only 50% of the ground lost.

Meanwhile, the other indexes have bushed themselves off. The S&P 500 is currently down 4% off its last high, and the Dow is only down 3%.

Below, you’ll see just how far the Nasdaq Composite has fallen from its three-month highs.

Click to Enlarge

Source: YCharts

But, as my mantra goes, “you need to buy the dip. Every dip.”

The tech industry’s rally isn’t over yet. For the best stocks on the Nasdaq Composite, this is just a brief pause on their journey even higher – and it’s an opportunity for you to jump on one of the most lucrative industries of the modern era.

Click here to get three tech stocks you ought to buy now, while they’re still on sale.

Discounted “Raging Bull” Food Company Goes Beyond Wall Street Expectations

Not much has been bullish these past few weeks.

Tech is languishing. The rug was pulled out from under the Dow and the S&P 500. Inflation, Russia, China… there are threats to every market and every sector around every corner.

Yet, this $42 billion food company managed to boost its profit margin 31%, sending Wall Street reeling.

Play to Win Off of Tech Company Pulling Ahead of the Pack

Here’s the thing about Apple Inc (AAPL). Over the last year, the stock has come down more than 10% – but that’s no surprise. Skittish investors concerned about rising rates have dragged down the whole tech sector. But they may be humming a new tune now that this tech giant has reported its first-quarter earnings. […]

Emergency Meeting Called to Address Market Pullback

If you enjoy watching my appearances on Varney & Co., you may be familiar with my nickname: The King of Buy-the-Dips.

Stuart Varney himself gave me that name because, as a guest of his show every week for the past eleven years, I’ve been calling every single dip. Every single buy-the-dip opportunity. And I’ve been right every single time.

This week I added another to the track record. I told Stuart that the selloff we’re seeing right now is another opportunity caught in the convergence of three super-wealth building events.

And today, I’m calling an emergency meeting tonight at 7:00 pm ET to tell you about them. This isn’t your average buy-the-dip event, so I’m working double-time to ensure you have to stocks to withstand this market pullback.

First of which I’ve included in this special edition of Total Wealth Research.

Fortress Stock to Guard Your Portfolio from Market Disaster

The markets have gone wild.

With the DOW down thousands on points, stocks swinging up and down, and a bond rally taking investors by storm… And on top of that, we’re in the middle of a convergence of three hyperdrive events. It’s hard to know where to go to keep your portfolio from circling the drain.

But luckily, these market mood swings have presented us with deal bargain-hunter’s dream of. Make sure you grab up your shares by clicking the video below.

The Energy Play Investors Can’t See

No one in the world is safe from rising oil prices.

Recent estimates expect global oil and gas investment to grow to $628 billion by the end of 2022. Investors are scrambling every which way to find the best energy plays before costs really take off – but many are missing a key opportunity one step removed from the oil drillers they love so much.

I’m talking about oil services. Companies that make all the products drillers need to stay afloat. Companies like Schlumberger Limited (NYSE: SLB), a Texas-based oil company.

Unlike exploration companies that drill for oil and sell it into the global market, SLB merely provides the equipment for the drilling operations, which means its performance is less tied to short-term energy prices and more tied to longer-term energy demand.

Microsoft in the Sights of Anti-Trust Crusader

Microsoft’s plan to drop $69 billion on Activision Blizzard Inc (Nasdaq: ATVI) did everything the company expected… Drummed up considerable excitement for the acquisition, a media frenzy about the price tag, and a flood of investors scrambling to buy shares of ATVI.

But does it really expect the acquisition to go through when an anti-trust crusader leading the Federal Trade Commission is ready to shut it all down?

I think Microsoft (and ATVI investors) are about to get a rude awakening – one that we can ride out to incredible profits with an options play I’m giving you in today’s Buy, Sell, or Hold.

Food-Stock Round Up 2022 – An Inflation Action Plan

Inflation is hitting everything.

Our wallets. Our bank accounts. And even our stomachs.

I’m sure you’ve seen it. Empty grocery store shelves juxtaposed with rising grocery bills. The tab at your favorite take-out spot or a famous restaurant forcing a double-take…

Prices of almost everything we eat and drink have risen and will continue to rise – but not always for the reasons you think. Some food inflation is being exasperated by food giants looking to turn a profit.

So, in today’s Total Wealth, I’m exploring why this frightening trend is embedded in our future and how exactly you can counter this affront with three new food-stock plays.

Click here to read more and learn how to play GIS for a 100% gain.

The Global Mining Company Everyone Needs on Their Portfolio

Remember when the Fed claimed last year’s inflation was “transitory” and was “only temporary”? How J. Powell must feel now that every other news article is about how it has only gotten worse… But I hope you aren’t bored of the topic yet. This inflation isn’t going anywhere and will be one of the top […]