Dealmaker’s Diary: An Auto Parts Giant With an AI-Driven Moat

Alpesh Patel|August 14, 2025

For decades, this company was just another auto parts retailer.

Then they did something remarkable.

They transformed themselves into a $67 billion technology powerhouse – and most investors still don’t realize what happened.

While everyone obsesses over flashy AI startups burning through cash, this established giant quietly implemented artificial intelligence across every aspect of their operations.

The results speak for themselves:

- AI-powered inventory management that predicts demand

- Dynamic pricing optimization that maximizes every sale

- Supply chain logistics that competitors can’t match

- 23.2% cash return on capital invested (the secret sauce!)

This isn’t speculation about the future of AI – it’s proven profitability happening right now.

When a 67-year-old company reinvents itself this successfully, smart money pays attention.

Click on the image below to see how this retail transformation created a 31% profit opportunity.

Transcript

Hello, friends. It’s the Stock of the Week from the Dealmaker’s Diary.

And the grand reveal is AutoZone (AZO). You might think, “You’re absolutely insane! Why are you not talking about AI and quantum computing?”

I could give you crazy speculative ones, but I quite like to be balanced as well, especially when the numbers – the numbers, the numbers – and the data hold strong.

So what have we got with AutoZone? You know, you’re going to say, “Come on. You’re kidding me. I’ve heard of it. Give me something I’ve not heard of.”

No. Numbers are good just because it’s boring. Boring is good with the markets. When you see the chart and the projections, you’ll see why boring can be exciting.

It’s a $67 billion company. This is the AI bit that I just love doing. It’s my favorite bit of doing the Dealmaker’s Diary.

And I should say the title comes about because my role with the British government as one of the U.K. government’s dealmakers. I’m the dealmaker for the U.K. government on AI.

So my job is to find the best AI talent from certain countries, with the aim of landing their businesses if they have one or the talent in the U.K.

Anyway, this is why I also love this and it ties up with my British government role. AI in what is it? I learn things because I don’t know every company and how they’re using AI. So I can’t at this point – I learn stuff.

It’s why I want to teach you guys. I’ve got a 7-year-old son and I just love teaching him things. And they soak it up like a sponge.

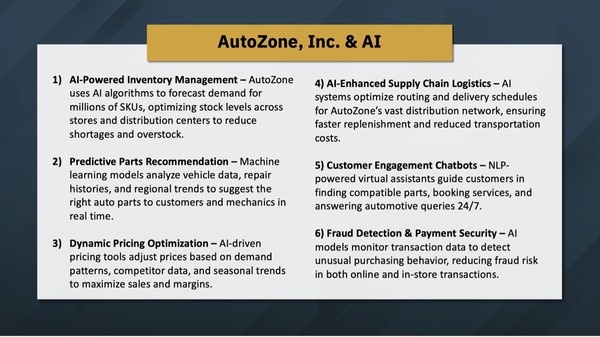

AI-powered inventory management – I’d expect that. Good.

Predictive parts recommendation – yeah, makes sense.

Dynamic pricing optimization – Uber’s been doing it for a while.

AI-enhanced supply chain logistics – my god, you better be doing it.

Now, the fact that they’re checking these boxes is not the reason to buy the stock.

It’s the fact that it shows up in the P&L, the balance sheet, and the cash flow statement.

I mean, customer engagement chatbots – you want to say, “Oh, for god’s sake, I bet you everybody does that.”

Yeah. I know. But I’m just saying the ways in which they’re doing it as well and, obviously, fraud detection, payment security – a major issue.

I think in the past week, American Express must have called me about half a dozen times, except it wasn’t American Express. It was scammers pretending to be American Express.

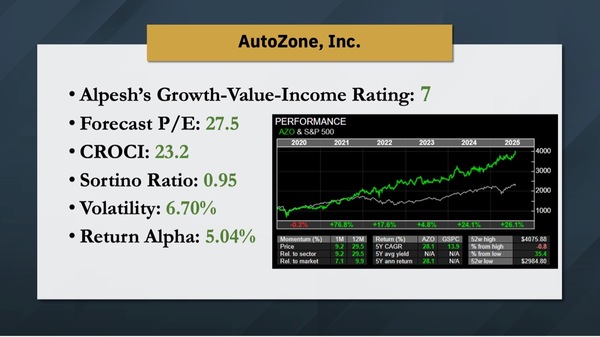

AutoZone’s growth-value-income rating is 7. So that’s my proprietary algorithm, which says growth-value -income is a 7 out of 10.

Forecast P/E is at a 27.5 multiple. What does that mean? You’re paying $27.50 for every future dollar of profits. Now for an AI company, that’d be cheap.

For an automotive-related company, that’s expensive. I can live with that number. I’ll tell you why.

Cash return on capital invested is one of the highest I’ve ever seen at 23.2%. That’s the Goldman Sachs metric by which they pick stocks. Those companies in the top quartile – of which this is definitely one – generate 30% per annum. And you can see this stock has been knocking the ball out of the park.

A Sortino of 0.95 is almost unheard of among stocks. What does it mean? It’s the average return versus downside volatility. This has next to no downside volatility.

How do I know? Well, just get the chart in front of you. Volatility under 20% is good. Under 10% – almost unheard of.

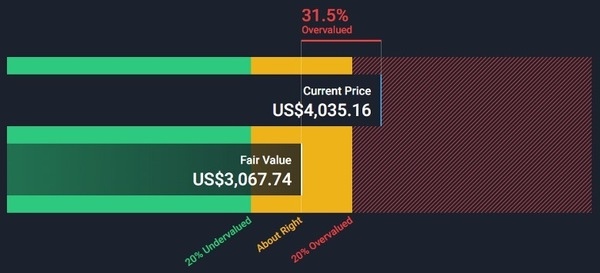

So don’t get bored with boring. Boring can be exciting because that’s my projection over 12 months – 31%. And what I’d say, where’s the stop loss on that? Well, if – let me put it this way – buy the dip.

Discount cash flow – overvalued. Can’t have everything. Not bothered. Not bothered because discount cash flow is less important. It’s a nice to have, not a must have. It’s a good condition, not a necessary condition. Got it?

Hope that was instructive and zoomed over to you a bit like a fast car which is well tuned, my friends. Thank you very much.

Alpesh Patel

Alpesh Patel is an award-winning hedge fund and private equity fund manager, international best-selling author, entrepreneur and Dealmaker. He is the Founder and CEO of Praefinium Partners and is a Financial Times Top FTSE 100 forecaster. As a senior-most Dealmaker in the U.K.’s Department for International Trade, he is part of a team that has helped deliver $1 billion of investment to the U.K. since 2005 . He’s also a former Council Member of the 100-year-old Chatham House, the foreign affairs think-tank, whose patron is Queen Elizabeth. For his services to the U.K. economy, Alpesh received the Order of the British Empire (OBE) from the Queen in 2020. As a recognized authority on fintech, online trading and venture capital, his past and current client list includes American Express, Merrill Lynch HSBC, Charles Schwab, Goldman Sachs, Barclays, TD Bank, NYSE Life… and more.