A $30B “Boring” Stock Delivering Steady 11.6% Growth

Alpesh Patel|July 10, 2025

But this “boring” company is actually an AI powerhouse using…

- Automated risk assessment

- Fraud detection algorithms

- Predictive analytics for cross-selling

- Personalized policy recommendations.

This $30B giant isn’t flashy – but it is profitable, has low volatility, and is quietly riding the AI wave behind the scenes.

While other stocks zigzag, this one just keeps compounding.

I wouldn’t call it exciting. But I do call it smart.

Click on the image below for the full analysis and ticker.

TRANSCRIPT

Hi, everyone. Welcome to another Stock of the Week from the Dealmaker’s Diary. And what have I got for you?

In many ways, a safe play…

With all the volatility in copper prices and tariffs, I could have picked Nvidia. But you might’ve said, “A bit late!” if you’ve already been holding it. So, it’s a little blasé to go with the obvious.

|

I’ve gone with Brown & Brown (BRO) – solid, steady, and driven by the numbers.

Nothing specific happening this week, but in a world of extreme volatility – with missiles flying right, left, and center, tariffs and untariffs everywhere, invasion worries (and that’s just for the Canadians) – it’s not a bad idea to look for something slow, steady, and stable.

That’s where this insurance brokerage comes in. The company is still growing fast: 11.6% year-over-year revenue growth.

That’s impressive for a $30 billion company.

It’s one of the top six global insurance brokers – not small by any stretch.

The P/E is a little expensive. We’ll get to that in a second. Valuation is the one area that gives me pause.

Let’s take a look at how it’s using AI. I like to show this for educational and entertainment purposes – but also because it’s important. Any company we look at should be making full use of AI. If not, they’re falling behind.

Automated risk assessment? You’d expect that – and yes, they are using AI models for it. Claim processing? Efficient. Fraud detection? Good – it adds to the bottom line.

Personalized policy recommendations? That helps the top line by pulling in more customers and improving retention.

Client interaction and chatbots? Standard now. These things matter, because without automation, service costs pile up.

Predictive analytics for cross-selling? Great – more revenue.

Operational efficiency and automation? That cuts back-office costs – and hopefully makes the staff happier, too, by removing some of the more tedious work and letting them focus on higher-value tasks.

It’s a microcosm of how jobs are changing.

Now, let’s look at Growth, Value, and Income – that’s my proprietary rating, which looks at valuation, revenue growth, dividend yields, and other important factors. We want high-growth, relatively cheap companies with decent dividends. Brown & Brown scores a 7 out of 10 – solid.

Forecast P/E is 26 – a bit expensive. You’re paying $26 for every $1 of future earnings. But remember, it’s arguably an AI company now. These days, who isn’t?

Cash return on capital invested, according to Goldman Sachs’ model, is 9.9 – strong. I want companies in the top quartile. Goldman says that group, as a basket, tends to return about 30% per year – not every stock, not every year, but on average.

Sortino ratio: 0.74 – that’s good. Hard to get much higher for individual stocks. But if your portfolio average is over 0.6, you could end up with a portfolio Sortino above 1 – which is great. That’s how diversification works. It’s like sodium and chlorine – deadly on their own, but together, salt. Which, okay, can also kill you – but we use it every day.

Volatility: very low. That’s one of the main reasons I picked it. The whole point is, do I really want wild swings?

Alpha: consistent ability to outperform the market. That’s the goal.

Looking forward: be cautious. We could be heading into headwinds. Momentum looks overbought – it might pull back or go sideways for a year. This isn’t one of those straight-up stocks. If you have to hold it longer, be comfortable doing so. Even after momentum dips, it has a tendency to keep climbing later.

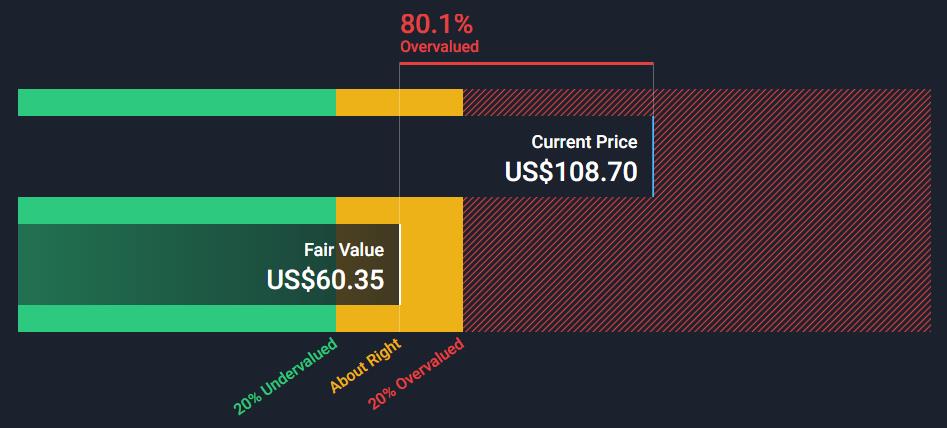

Discounted cash flow shows it’s overvalued – like I said, big companies rarely tick every box.

Hope you liked that. Hope you found it interesting – and maybe even a little entertaining. Not quite as entertaining as Wimbledon down the road, but still, pretty good.

Thank you.

Alpesh Patel

Alpesh Patel is an award-winning hedge fund and private equity fund manager, international best-selling author, entrepreneur and Dealmaker. He is the Founder and CEO of Praefinium Partners and is a Financial Times Top FTSE 100 forecaster. As a senior-most Dealmaker in the U.K.’s Department for International Trade, he is part of a team that has helped deliver $1 billion of investment to the U.K. since 2005 . He’s also a former Council Member of the 100-year-old Chatham House, the foreign affairs think-tank, whose patron is Queen Elizabeth. For his services to the U.K. economy, Alpesh received the Order of the British Empire (OBE) from the Queen in 2020. As a recognized authority on fintech, online trading and venture capital, his past and current client list includes American Express, Merrill Lynch HSBC, Charles Schwab, Goldman Sachs, Barclays, TD Bank, NYSE Life… and more.