Buy This Stock Before June 1 (Here’s Why)

Bryan Bottarelli|May 3, 2022

Editor’s Note: Today, our friend Bryan Bottarelli from Monument Traders Alliance shares details on a stock that is a “strong buy” this month. Below, you’ll discover why.

And if you are looking for more trading ideas like this, Bryan and his team have a special offer you must check out.

Next week (May 9-13), you can get an entire week of FREE access to their real-time trading platform, The War Room.

At their last Open House, they closed out 20 trades – and all of them were winners!

Don’t miss your chance for more winning trades. Unlock your FREE access here.

If you look up the term “duopoly,” you’ll see that it describes a situation where two firms have dominant or exclusive control over a market.

Some classic duopolies include…

- Airbus and Boeing – which control the commercial aircraft market

- Google’s Android and Apple’s iOS – which account for 99% of the mobile operating system market

- DC Comics and Marvel Comics – which dominate the American comic book market.

But today, I’m going to focus on another duopoly – one that is often considered one of the strongest barometers of the strength of the U.S. economy…

FedEx (FDX) vs. United Parcel Service (UPS)

The reason we’re looking at the relationship between FedEx and UPS right now is simple…

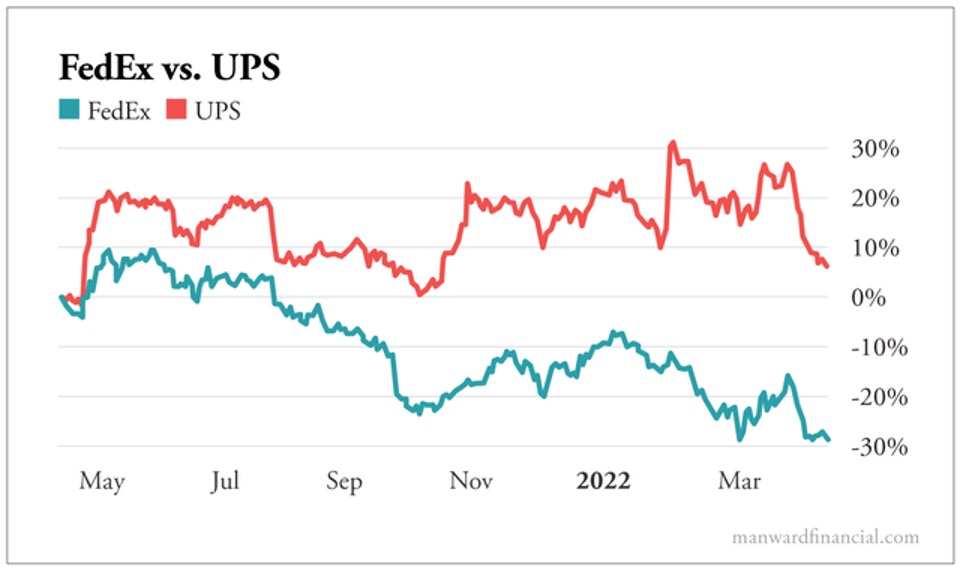

As you’ll see, FedEx looks extremely cheap compared with UPS. And that could set up a tremendous opportunity for you right now.

Here’s the scoop…

Right now, FedEx trades at 10X projected 2022 earnings.

Meanwhile, UPS trades at 15X projected 2022 earnings.

If that gap seems extremely wide to you, you’re not alone.

Barron’s says that UPS “trades at an unusually wide premium to FedEx.”

Both stocks have traded lower recently, which could be attributed to Wall Street’s concerns about the economy – think fuel prices – or even consumer spending.

But it’s not every day that you see a dominant duopoly with such a large valuation gap. FedEx has a 30% market share in the ground delivery segment.

So why is there such a dramatic difference in premium between UPS and FedEx?

Here’s my explanation…

It was recently reported that Fred Smith, who founded FedEx 51 years ago, will step aside as chief executive on June 1.

I think this announcement has brought additional fear, apprehension and uncertainty to FedEx shares – which explains exactly why we’ve seen the company dip compared with UPS.

But to me, this is a major opportunity. After all, FedEx is scheduled to hold an investor day in late June – shortly after Fred Smith officially steps aside. At this meeting, the company will most likely present on how it plans to boost margins and profitability. The meeting could act as a trigger for Wall Street to breathe a sigh of relief and move back into FedEx shares.

Action Plan: So buying now – while FedEx’s share price is down – could be a savvy and opportunistic maneuver. When it comes to trading, the time to act is BEFORE the trigger catalyst – and that means now in this case.

If you are looking for more timely trade ideas like this, I invite you to join our War Room Open House next week.

During the week of May 9-13, you can access our real-time trading chat room and get all of our insights and trading ideas for FREE.

We chose one of the most EXCITING weeks for our Open House…

There are 541 earnings announcements planned for next week.

These are the BEST opportunities to take advantage of my FAVORITE trading strategy: Overnight Trades.

These are trades where our members have made the trade… gone to sleep…

And woken up to overnight gains like 167% on Abercrombie & Fitch… 188% on FedEx… and 292% on Snap!

It’s going to be a MONSTER week.

All you have to do is RSVP HERE.

Bryan BottarelliHead Trade Tactician, Monument Traders Alliance

Bryan Bottarelli started his career trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There he was mentored by one of the country’s top floor traders in the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. As a so-called “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk. Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager. He now spends his days moderating one of the most elite trading research forums ever created, The War Room.