Buy This, Not That: Will This Spending Spree Pay Off Later?

Shah Gilani|April 3, 2024

If consumer spending were an Olympic sport… Americans would sweep the podium.

The latest spending figures are out… and we spent $145.5 billion more in February than we did the month before. And the numbers have been ticking higher every month for years.

Consumers are certainly buying now… but will they pay later?

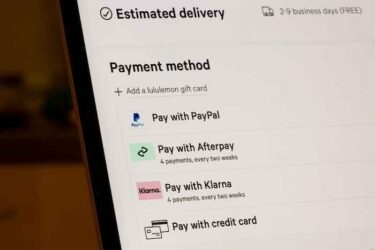

We’re looking at the “buy now, pay later” sector in today’s Buy This, Not That video.

The industry is big… and getting bigger. I found an astonishing number of companies in the sector… but most are private or in startup mode.

I zero in on four publicly traded BNPL stocks… and tell you which are a BUY now as consumers spend like crazy.

Click on the thumbnail below to watch.

Transcript

Hey, everybody. Shah Gilani here with your weekly BTNT, as in Buy This, Not That. Got a lot of questions about how consumers are doing. They’re spending like crazy, pouring money onto their credit card debt.

They’re doing buy now, pay later. They’re using buy now, pay later to buy groceries. I mean, things are getting really out of hand here, but they keep spending. So got a lot of questions about the buy now, pay later type firms, and are there any buys in there?

Would I buy this? Would I sell that? What would I do with this and that? So today, we’re gonna do Buy This, Not That on the buy now, pay later firms.

And who’s up first? The big daddy, Affirm Holdings, AFRM. This is the the big daddy in the group as far as publicly traded companies. There are a ton of private buy now, pay later type companies, folks.

You go looking them up, and you’re going to be amazed at how many there are in the private market. So maybe some of them eventually go public. Don’t know. But as far as what’s public now, the big name is Affirm Holdings, AFRM.

$10.69 billion-dollar market cap. Now Affirm Holdings came out in early 2021 at $49 IPO.

It had a heck of a run. It got up intraday on November 8, 2021 to $176.65. That’s a heck of a run. So we’re talking screaming higher.

Oh, but then it crashed on December 19, 2022, at about $8.62. Yeah. Down from a $176. So that tells you something about the volatility of Affirm Holdings. And it’s not done, by the way.

It will continue to go down. It’s been kinda trending between $8 and $9 and $22 and $24. So I don’t think this is a BUY, but I do think you can trade this one. I mean, reversion to the mean type trading, like, you try and catch the lows.

You look for the trends. You look for the channels where it closes. Catch the lows and try to sell the tops. You can maybe make good bit of money trading this.

As far as buying and holding, no. I don’t think so because it’s just on the same thing. While it’s in this $8 to $9 and $22 to $24 range, it’s been looking like it’s consolidated, and it did break out. It caught the November 2023 rally, like, off to the races.

Stock got up to $50. Earnings came out. I have to admit they were good, and the stock took off. But then it rolled right over again.

So we we are now short the stock in terms of we have couple put positions, put spreads on Affirm, that we’re rolling out a couple months.

It’s in a downtrend. And if it breaks the lower channel marker of this downtrend, it’s heading a lot lower. So while we’re playing it from the downside, will we maybe try and cover and maybe pick some up calls or maybe buy a call spread somewhere down below where I think it might bottom and we can maybe ride a little for a higher pop? Yeah.

Maybe. But right now, we’re down on Affirm Holdings. It’s not a buy.

It looked really good. The earnings looked good. Gotta admit, they had gross total merchant gross merchandise volume up 32%. Their revenue was at an all time high of $7.5 billion.

But the profit margin, people, is -39%. So it’s just not my cup of tea. I’m not so sure the consumer’s gonna be able to keep buying now, and I don’t know if they’re gonna pay later. So Affirm, for me, it’s a NOT, but if you wanna trade it, take a look at it.

It might be a good reversion to the mean type trading stock.

Next up, smaller, but still a name in the space.

Repay Holdings, RPAY, is trading around $10.35 thereabouts. So, it’s a less than a billion dollar – about $975 million – market cap company. And the right off the bat, I’ll tell you this. Profit margin is -37%.

It’s a long story, but I’m gonna say I’m down on this one. There’s no reason to buy this. If you’re gonna play it, you know, play pops, play Affirm. Oh, another thing about Affirm, it’s got 15% short of float, so you can get pops out of Affirm. Repay doesn’t have that. So RPAY, it’s not even worth trading up and down because there’s not enough action in it as far as I’m concerned.

The net income available to common shareholders, my favorite metric of profitability, is -$110 billion. Negative.

With that kind of negative profit margin, -37%, what do you expect?

You know, if you’re gonna ever buy something like this, you buy it as low as $5, you know, $5.50 somewhere, and then maybe take a chance with a very tight 10% stop. But this one to me is just NOW. I wouldn’t. Why why waste your capital?

Next up is Sezzle, s-e-z-z-l-e, Inc., symbol SEZL. Now I gotta say, I kinda like this company. It’s interesting. It’s a matter of timing and buying it at the right time.

And why do I like Sezzle, SEZL, which trades around $65 and change? It’s got a $384 million dollar market cap. So it’s small cap, but it’s profitable. Profit margin’s about, it’s knocking on, 5%, people.

This is the only one in the space that’s got a clearly nice profit margin that’s at least positive and growing, and I like that. So I think it’s pretty well run. It’s got $70 million in cash on the books. That’s a record for them.

This came out with earnings. They were pretty good.

Debt, $96 million. So they’re okay on that.

This stock is trading at $65 and change. It traded as high as $100 just recently on March 27. So it’s kinda rolled over, and it looks kinda ugly if you look at the chart. But I think you wanna watch it down here, and I would probably take a shot at this somewhere around $40.

This thing rolls over from $65 and change to $40 and I would probably take a shot at it with a tight stop on it and see if it can’t pop up again because, again, this is a profitable company in that space, and there aren’t very many of them. So, SEZL, worth a shot. Maybe put in a low ball bid at $40, see what happens, put tight stop on that.

Last but not least, and I I gotta love you guys for sending me in these stocks. So this one is SplitIt Payments Limited.

Symbol, STTTF. Yeah. Three T’s. STTTF. So that should tell you something right away.

It’s on the pink sheets. It’s not traded on an exchange. It’s traded on the pink sheets. So let me say this about that.

NOT. Do NOT buy this. I don’t care how cheap it is. I don’t even know, I don’t care if it’s $0.03.

You’re just taking a shot in the dark.

It’s like a $5,000 market cap, people. Profit margin -200%. It’s a joke. So, yeah, if you wanna take some pennies and throw it at this, have fun with it, but don’t expect much.

If you’re really seriously about invest investing and trading, then, you know, don’t do the pink stuff. That’s just flying blind, throwing darts in the dark. Are you gonna hit some? Yeah.

Most of them, you’re gonna lose on. And, hopefully, if you do play that silly game, you get one or two hits that basically cover all your losses. Good luck with that. So that’s it for today.

That’s it for buy now, pay later, and Buy This, Not That. I’ll catch you guys next week. Cheers.

Shah Gilani

Shah Gilani is the Chief Investment Strategist of Manward Press. Shah is a sought-after market commentator… a former hedge fund manager… and a veteran of the Chicago Board of Options Exchange. He ran the futures and options division at the largest retail bank in Britain… and called the implosion of U.S. financial markets (AND the mega bull run that followed). Now at the helm of Manward, Shah is focused tightly on one goal: To do his part to make subscribers wealthier, happier and more free.