Buy This, Not That: Should You Buy This Crashed IPO?

Shah Gilani|October 1, 2025

It’s been a hot year for IPOs… 224 so far versus just 136 last year.

But many of the hottest ones have crashed hard after their debuts.

One “buy now pay later” stock is a perfect example. It soared to $57 on its first day… then crashed to $36.68.

That’s a 36% plunge in just weeks.

In today’s Buy This, Not That, I’m comparing this crashed IPO to an established competitor that’s been around since 2020.

One has a better balance sheet, higher EBITDA, and bigger ambitions. The other? Not so much.

Click on the thumbnail to see which one deserves your money.

Transcript

Hey, everybody. Shah Gilani here with your weekly BTNT on a very fall-like first of October.

Yes.

Speaking of fall-like, a lot of companies’ IPOs have fallen out of bed.

The ones that came out of the box roaring higher have fallen hard and fast, and I’m going to talk about one of them today. I’m going to talk about Klarna. Klarna Group IPO’d just recently on September 10th – which feels like the other day to me because time travels pretty quickly – and has the standing or notion that it’s a buy now pay later company. Symbol is KLAR.

I’m going to compare this hot IPO, which has fallen out of bed, with Affirm Holdings. Now Affirm Holdings, also a buy now pay later company, has been around since 2020 as far as its IPO goes. So we’re going to compare a newly IPO’d company to one that’s been around for five years. Now Klarna is more than a buy now pay later company.

KLAR versus Affirm, which is AFRM. We’re not exactly comparing apples to apples here because on the surface, Klarna is known as a buy now pay later company, but there’s a lot more to what Klarna actually does. Yes, they are a payments company, but Affirm also calls itself principally a payments company. However, Affirm is really focused primarily on buy now pay later, where Klarna aspires to be a lot more.

Klarna, besides buy now pay later, also has a shopping app and a messaging app on their platform. They offer personal recommendations. They have loyalty programs integrated throughout the platform so you can go to certain retailers, join loyalty programs there, and manage a lot of that through Klarna. So there’s a lot of aspiration in terms of Klarna’s future.

They want to be more than buy now pay later, and they’re already more than that. So they’re not exactly the same, even though everybody’s looking at Klarna like, “Okay, it’s going to be a competitor of Affirm.” Yes, it is going to be a competitor of Affirm. But I think in the long run, they’ll offer a lot more.

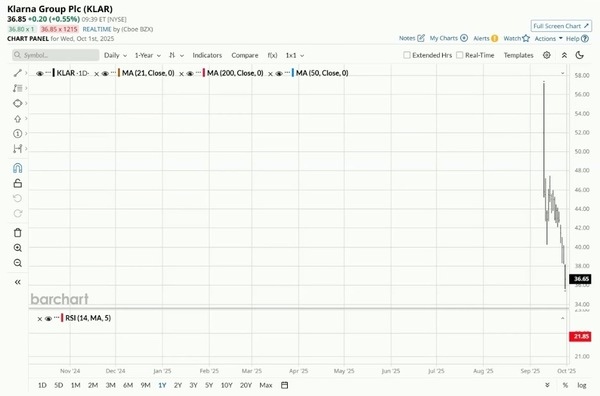

Now let’s take a look at the stock and compare it to what Affirm looks like. Here is the Klarna IPO.

It’s been a hot year for IPOs. Year to date through mid-September, there have been 224 IPOs this year. In 2023, year to date to the middle of September, there were only 136. So it’s been a hot year for IPOs.

Some of them have come out of the box and screamed higher, as Klarna did, and then collapsed. This is a pretty ugly chart. On the first day of trading, Klarna hit a high – are you ready? You sitting down? Fifty-seven dollars. It skyrocketed to $57 and then closed at $45.82.

So it rocketed higher, closed down, and now Klarna is trading at $36.68. That’s a pretty ugly sell-off. But we’re seeing a lot of IPOs that come out and scream higher because the expectation in a hot IPO market is you want to get in and ride the tiger. Klarna is one of a group that has fallen out of bed pretty hard and fast. I don’t think that’s a problem. I think that’s an opportunity.

Now here is Affirm.

If you look at Affirm on a one-year basis, the stock has had a bit of a sell-off. There was a nice rise back in April, but the stock was heading down before April. If we look at it on a two-year basis, it’s been pretty much all over the place – definitely working higher, but this stock is volatile, people.

Lately, we made a big high and then pretty much fell on its face. Now we’re coming right into some support here. The stock is up a little bit this morning, about 2% to 2.5%. But if you look at this on a longer-term basis, it’s not that impressive.

Here’s the IPO back in 2020. It tumbled, made a huge high at $176, and then came right back down. Now we’re at $74 and change. So it tumbled down, made its way up, and now it’s all over the place.

Do I like Affirm? No. I actually like Klarna.

Even though Affirm has more history in terms of stock trading, I like Klarna here, not Affirm. Why do I like Klarna and not Affirm? Not just because it’s on sale, which it is – and if you look at this chart, that’s pretty ugly. But to me, that’s an opportunity.

Why? I like Klarna better on a pretty straightforward basis – you’re buying a company on sale from its IPO. Now the difference between Klarna and Affirm: as far as revenue goes, they’re pretty close. Klarna’s revenue – we’re talking trailing 12 months here – is about $3 billion. For Affirm, it’s $3.22 billion. So they’re both fairly aligned in terms of revenue.

Profit margin? They’re pretty close, pretty thin on the profit margin because the buy now pay later business has thin profit margins. But again, I’m giving the edge to Klarna because their aspirations are greater than Affirm’s.

Profit margins aside, what matters to me – against that $3 billion-plus for both of them in terms of revenue – is EBITDA. For Affirm, EBITDA is $185 million. The EBITDA for Klarna, on the other hand, is $364 million. Significantly higher EBITDA for Klarna than for Affirm. I like that.

The other thing I like about Klarna is their balance sheet is better. Klarna has $6.74 billion in cash and debt of $814 million, while Affirm has cash of $1.39 billion and debt of $7.85 billion – compared to Klarna’s $814 million in debt. So when it comes to Klarna, yes, the chart is ugly, but it’s a buy. Affirm? Not so much.

So there you have it for today, people. Affirm has a little more trading history, but for my money, I’m going to take Klarna over Affirm any day.

Catch you guys next week. Cheers.

Shah Gilani

Shah Gilani is the Chief Investment Strategist of Manward Press. Shah is a sought-after market commentator… a former hedge fund manager… and a veteran of the Chicago Board of Options Exchange. He ran the futures and options division at the largest retail bank in Britain… and called the implosion of U.S. financial markets (AND the mega bull run that followed). Now at the helm of Manward, Shah is focused tightly on one goal: To do his part to make subscribers wealthier, happier and more free.