These “Red State” Tickers Are Soaring

Andy Snyder|July 14, 2022

It’s been a while since we wrote anything overly controversial.

Let’s make up for lost time!

Overpriced coffee chain Starbucks announced this week that it is closing more than a dozen stores because of safety concerns.

Ruh-roh.

It has nothing to do with working hours or how coffee is made.

The art history majors the company employs have it pretty soft.

No, the problem is the customers. They’re doing drugs and having sex in the bathrooms. They’re sleeping in the dining rooms.

Armed with little more than hot coffee and high prices, the employees can do little about it.

But management can…

“Like so much of the world right now, the Starbucks business as it is built today is not set up to fully satisfy the evolving behaviors, needs and expectations of our partners or customers,” CEO Howard Schultz wrote in a letter to employees Monday.

He’s closing stores… because the world is “evolving” too quickly.

We’re in trouble, folks.

Third-World America

Read the news and it’s no surprise which cities are having the biggest problems – and therefore seeing the most store closures.

Seattle and Los Angeles will each lose six stores. War-torn Portland, Oregon, will lose two.

In Philadelphia, where a 73-year-old man was recently beaten to death by a gang of preteens wielding a traffic cone, a single store will close.

And Washington, D.C., will lose one of its own so-called public bathrooms by the end of July.

But here’s the thing. It’s where we hope and pray the nation pays attention.

At nearly the same time that a CEO was forced to close his stores because the public is simply too dangerous for those stores to operate (and remember, it’s not like Starbucks is setting up shop in the leasing lobby of government housing projects)… we got a report from The Wall Street Journal that shows red states are economically outpacing blue states.

Surprised?

It all ties together.

Divided

The rag of record looked at a host of variables.

One of them was employment.

Compared with pre-pandemic figures, red states have seen an increase of 341,000 jobs.

Blue states, on the other hand, have lost 1.3 million.

Much of the problem stems from so many folks leaving blue states for red states. Thanks to remote work, they are now free to move to where their money (and freedom) will be treated best… where their neighbors won’t kill them over the color of their shed… and where the laws match their values.

A big reason for the mass migration is housing prices.

In the states that gained residents, homes are 28% cheaper than they are in the states that lost the most people.

Add in tax savings and it’s a recipe for economic success.

The states that gained the most new residents (and the economy-spurring dollars they brought with them) had an average maximum income tax of just 3.8%. Several states on the list had no income tax.

But the states that lost folks… their average tax rate was 8%.

Think taxes and the cost of living don’t have ripple effects? Think again… or call up Mr. Schultz.

He may have some candid thoughts.

We Have an Idea…

All of this got us scratching our head. Perhaps our readers would want a list of tickers for companies that do most of their business in these booming red states.

With this handful of stocks, you can avoid the cultural embarrassment that is harming chains like Starbucks and invest in the economic success stories we’re seeing in market-friendly states.

The first is a company we once called the “next Walmart.”

It hasn’t quite scaled up enough to live up to that (perhaps a good thing), but its share price sure has.

Since we made the claim, it’s soared more than 500%… outpacing its Bentonville, Arkansas, competitor by more than 5 to 1.

Casey’s General Stores (CASY) operates a chain of more than 2,400 convenience stores in the heart of the Midwest.

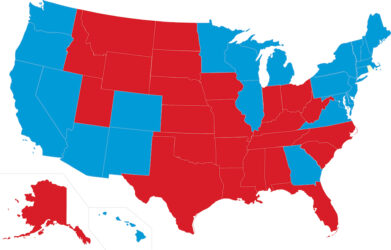

With just a few exceptions, its map of retail locations is a perfect match for those red state maps we see on election night.

This play reminds me a lot of Dollar Tree (DLTR) – a stock our Venture Fortunes subscribers tripled their money on last week. Casey’s is recession-resistant. History proves its sales move higher when times get tight.

Another red state player is Regions Financial (RF).

As its name suggests, it’s a regional bank… and it has operations throughout the nation’s low-tax, strong-economy states.

With rates in flux, banks are an ideal play. And with operations in areas with strong employment and still-growing economies, Regions should have no problem standing above its banking-sector brethren.

Many of its customers, in fact, may be taking out loans to purchase a car from Asbury Automotive (ABG) – a car dealer that (again, with a few exceptions) operates solely in red states.

Car sales aren’t in great shape these days.

First it was inventory problems – automakers couldn’t build cars fast enough. Now it’s a lack of demand – consumers are pondering the nasty effects that runaway inflation will have.

But a stake in Asbury offers the best shot at an industry that’s already pricing in trouble.

Why not stack the deck and focus on companies doing business in low-tax, high-growth areas? It sure beats owning shares of companies that work in high-tax, low-growth and anti-business areas.

That’s the point of all this.

It’s not political. It’s not about Trump or Biden or any of those games.

It shouldn’t be controversial at all.

It’s about investing in the assets that are likely to do the most for your money.

It’s common sense.

Low taxes leave more money in consumers’ pockets. They draw more folks to town. Those folks buy. They build. And they drive a strong economy.

Red states are doing better.

Take advantage of that knowledge and make more money.

Note: MDU Resources (MDU) is another red state winner. Based in coal-friendly North Dakota, it generates electricity for a host of Northern states. Operating in a region that has long supported mining and energy production, it has a solid lead on its blue state competitors, many of which are being pushed out of town by expensive new regulations.

Andy Snyder

Andy Snyder is an American author, investor and serial entrepreneur. He cut his teeth at an esteemed financial firm with nearly $100 billion in assets under management. Andy and his ideas have been featured on Fox News, on countless radio stations, and in numerous print and online outlets. He’s been a keynote speaker and panelist at events all over the world, from four-star ballrooms to Capitol hearing rooms.