Dealmaker’s Diary: Where AI Is Making Money NOW

Alpesh Patel|October 2, 2025

Tech companies are burning billions building AI infrastructure hoping for future returns.

This $294 billion pharma company spent a fraction implementing AI applications – and the profitability showed up immediately.

Supply chain optimization. Predictive analytics. Cold chain monitoring. Fraud detection. Each AI deployment directly improving margins and cash generation.

The proof is in the metrics:

- Cash return on capital invested jumped to top-quartile status

- Profit margins expanding faster than revenue growth

- Sortino ratio of 0.91 (exceptional returns, low downside risk)

- Forward P/E of just $18.70 despite elite fundamentals

Someone asked me earlier why American company profits are growing faster than sales. This is why. AI implementation – not development – creates immediate operational efficiency gains.

Tech companies promise AI will change everything someday. This pharmaceutical distributor is using AI to generate cash today.

The long-term chart shows an uptrend that keeps delivering.

Click on the image below for the ticker.

Transcript

Hi, friends. It’s the Stock of the Week from the Dealmaker’s Diary. Cencora (COR) this week. Why did I go with this?

Well, it’s not because it’s a $294 billion in sales company with a market capitalization of $57 billion, or that it’s pharmaceuticals. My god. Haven’t we had issues with those recently? By the way, you might know this company better as AmerisourceBergen. I don’t know why they changed names after they’ve invested so much in their previous brand name. No. It’s the numbers.

Before we get to the numbers, what do we do every week? We look at the AI aspects. Why?

Well, education, information, and we want to know specifically with the stock why it’s important – supply chain management, cold chain monitoring, drug distribution, predictive health care analytics. My god.

Somebody asked me earlier today, “Look, Alpesh, you noted that the profitability of American companies has gone up more than sales have gone up. Is that AI?” And I said, “Well, it may well be.”

Because when I look at these individual companies and share the deep down knowledge and data with you, that’s what I’m finding. It’s the AI element. Fraud detection, obviously personalized patients programs, operational efficiency – the rate at which AI is adding to the bottom line is phenomenal, and it’s very good news, of course, for all concerned.

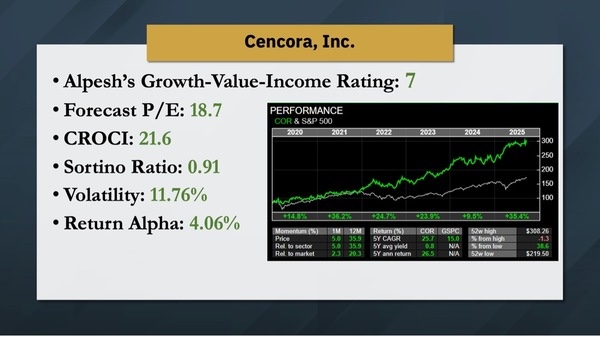

So where does that bring us? Well, on my proprietary Growth Value Income rating, it’s a seven. So well above the minimum that I need. This looks at valuation, revenue growth, and so on.

Forecast P/E – you’re paying $18.70 for every future dollar of profit. Cash return on capital invested – one of the best we’ve seen of any company. Given that pharmaceuticals tend to spend a lot of capital in order to make a little bit of cash, this is good. This is impressive. Sortino, 0.91 – very high average returns, low downside volatility as you can see as well.

If I had to project forward, it’s really simple. You just continue that trend forward. There you go. It’s right in front of you.

Yes, it’s overbought. Yes, it’ll have down months, maybe even whole years where it’s down. But longer term, it just seems to be going in one direction. There’s no reason to think that suddenly has stopped.

On a discounted cash flow basis, it’s undervalued as well.

Should be almost double the price it is now according to discounted cash flow. It’s not a guarantee of the future, but my god, isn’t that reassuring?

Hope you enjoyed that, and it provided some insights into AI and how it’s shaping our world and the companies we could have in our portfolios as well. Thank you very much.

Alpesh Patel

Alpesh Patel is an award-winning hedge fund and private equity fund manager, international best-selling author, entrepreneur and Dealmaker. He is the Founder and CEO of Praefinium Partners and is a Financial Times Top FTSE 100 forecaster. As a senior-most Dealmaker in the U.K.’s Department for International Trade, he is part of a team that has helped deliver $1 billion of investment to the U.K. since 2005 . He’s also a former Council Member of the 100-year-old Chatham House, the foreign affairs think-tank, whose patron is Queen Elizabeth. For his services to the U.K. economy, Alpesh received the Order of the British Empire (OBE) from the Queen in 2020. As a recognized authority on fintech, online trading and venture capital, his past and current client list includes American Express, Merrill Lynch HSBC, Charles Schwab, Goldman Sachs, Barclays, TD Bank, NYSE Life… and more.