Dealmaker’s Diary: This Connector King Could Deliver 50% Returns With Low Volatility

Alpesh Patel|August 28, 2025

Most investors are chasing the next big tech breakthrough.

I’m looking at the company that makes them all possible.

While everyone obsesses over AI software, this $135 billion giant quietly manufactures the connectors, sensors, and cables that power every smartphone, data center, and autonomous vehicle.

The numbers tell an incredible story…

- 13% volatility

- Sortino ratio above 1

- $18 billion in annual revenue from essential infrastructure

- Six sigma quality standards with AI-powered manufacturing

This isn’t speculative technology. It’s the physical foundation that makes the digital economy possible.

Every aerospace system, defense application, and mobile device depends on their interconnect solutions. As AI computing demands explode, someone has to build the cables and connectors that link it all together.

Click on the image below to see why this infrastructure king could deliver 50% annual returns with Treasury bond-like stability.

Transcript

Hi friends, and welcome to the Dealmaker’s Diary and Stock of the Week.

Amphenol is not one you might have come across before, but it’s a $135 billion company.

Let’s put it this way: not one you might have heard of when you think of $135 billion companies.

Given that they generate $18 billion in revenue, it’s one we should all have come across. But you might not be surprised that you haven’t heard of the name when I say they’re in the field of interconnect systems.

Not exactly something that sets the world on fire, is it?

They produce connectors, sensors, antennas, and cable assemblies used across aerospace, defense, automotive, data communications, mobile devices, and industrial markets.

Who would have thought that would get you into the S&P 500?

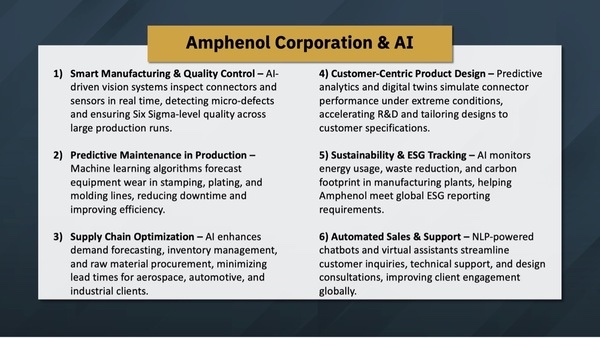

Before we look at the numbers… I want to do the very important thing that I like to do every week when we look at these companies – look at how they’re using AI. This is partly for educational purposes, partly so we can have a deeper dive into the stock itself.

Smart manufacturing quality control – they’re using AI to inspect their connectors to ensure quality.

Do you remember the phrase “Six Sigma level”? This goes back about 25 years.

Just to make sure, basically, they’ve got the best of the best when it comes to quality.

Predictive maintenance in production, machine learning algorithms to forecast equipment wear in stamping, plating, molding lines, and so on. Well, I’d expect them to use AI to do those things, but I only expect it in hindsight. Once I read about it, I think, oh, of course. And thank goodness they are.

Supply chain optimization, customer-centric product design.

This might even give you, if you’re in business yourself, some ideas about what you ought to be doing. It’s part of why I do this – so it’s an education in and of itself, not just in terms of the stock.

Sustainability and ESG tracking. Flavor of the year, month, decade – you have to do that.

Automated sales and support is now becoming incredibly important. NLP-powered – neuro-linguistic programming-powered chatbots. So they sound as human as possible, but more importantly, they can accurately answer questions.

So that’s AI.

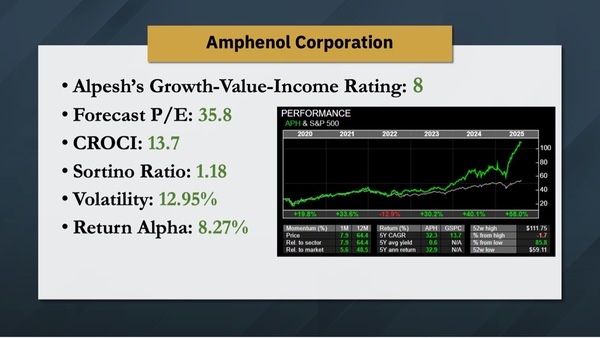

Let’s go into the stock – an 8. On my proprietary algorithm, anything which is 7, 8, 9, or 10 meets my minimum criteria of undervaluation, growth, dividend yields, and so on. This is an 8. Great.

Cash return on capital invested is 13.7%. Anything in the top quartile, usually above 10%, means it meets that Goldman Sachs requirement, which pushes it into those higher-performing stocks, which on average generate 35% per annum or more over the longer term.

Forecast price-to-earnings – you’re paying $35 for every expected dollar of profits. Well, it’s a bit pricey, but the other things make up for it.

Sortino above 1 – very rare for a stock to have high average returns above 1 and volatility being so low.

And speaking of volatility, under 13% volatility is also rare for a stock. This is actually a rare company.

There’s a projection based on historic moves.

Can it do 50% in 12 months?

I would say I’d be happy with 50% even if it took two years. To be honest, if it took three years, I’d be fine.

Does it have drawdowns? Yes. Do they have long durations? Yes. That’s fine. I think I can live with all of that.

What about discounted cash flow valuation? A bit overvalued.

Can’t have everything.

Discounted cash flow is a nice-to-have, not a must-have, so that’s okay. Overall, it’s ticking the boxes.

Hope you enjoyed that. Thank you very much.

Alpesh Patel

Alpesh Patel is an award-winning hedge fund and private equity fund manager, international best-selling author, entrepreneur and Dealmaker. He is the Founder and CEO of Praefinium Partners and is a Financial Times Top FTSE 100 forecaster. As a senior-most Dealmaker in the U.K.’s Department for International Trade, he is part of a team that has helped deliver $1 billion of investment to the U.K. since 2005 . He’s also a former Council Member of the 100-year-old Chatham House, the foreign affairs think-tank, whose patron is Queen Elizabeth. For his services to the U.K. economy, Alpesh received the Order of the British Empire (OBE) from the Queen in 2020. As a recognized authority on fintech, online trading and venture capital, his past and current client list includes American Express, Merrill Lynch HSBC, Charles Schwab, Goldman Sachs, Barclays, TD Bank, NYSE Life… and more.