Beat Inflation With This Play on Rising Prices

Andy Snyder|March 9, 2022

An old friend called us up the other day.

“Andy,” he said, “what should I do about all this inflation?”

It’s a question lots of folks are asking.

But this particular fella already had the answer. He’s in fine shape.

He owns bins full of some of the fastest-appreciating stuff on the planet.

“They said I was crazy when I didn’t sell my corn earlier this year,” he said. “But I’m sure glad I held onto it.”

With prices surging, the corn and soybeans in our old pal’s grain bins are looking awfully good.

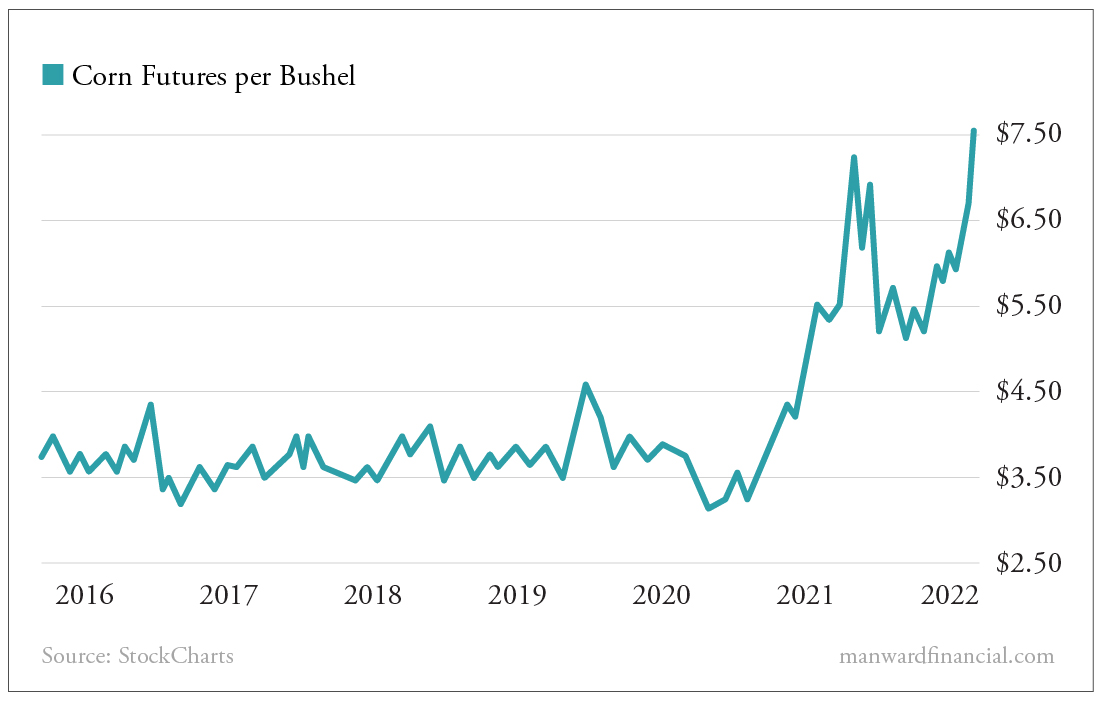

The price of corn hasn’t been this high in more than a decade…

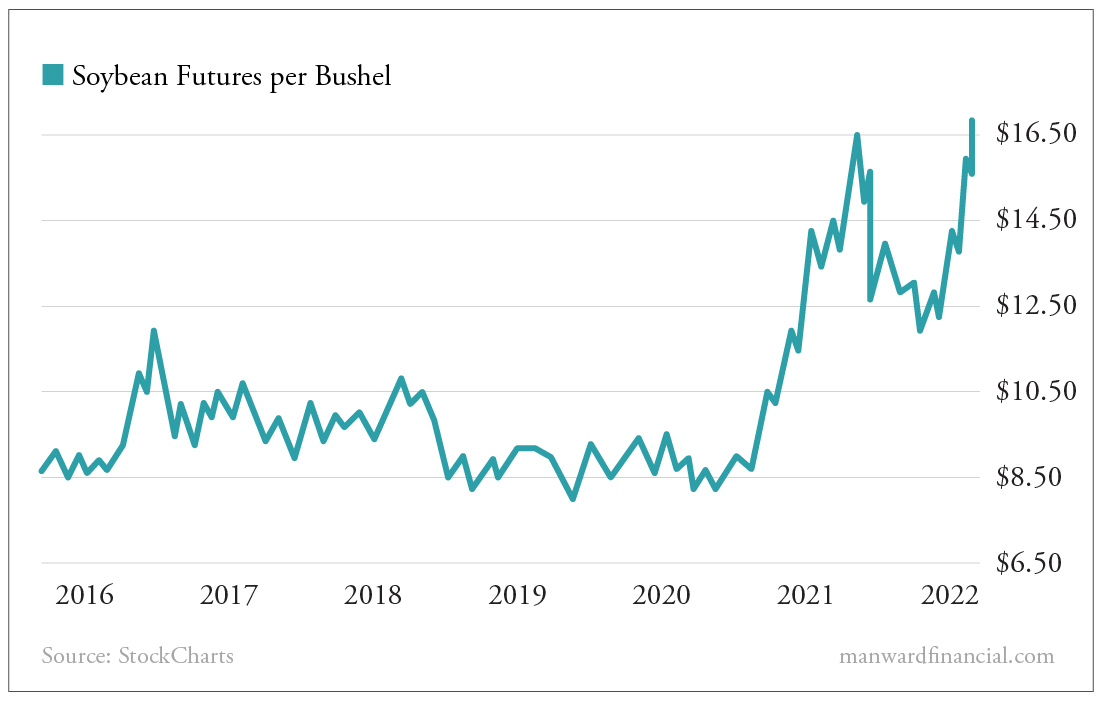

The price of soybeans is even higher.

“I’m not even thinking about selling until they hit $20 a bushel,” my friend said, quoting a price that would have had the heartland throbbing before this multiyear string of economic disasters.

The pain, as many folks have figured out, is going to be acute. Corn – for some dumb reason – goes into our fuel tanks, our plastics and our drugs. And if we cut it with just the right chemicals, some of it even ends up on our dinner plates.

When its price surges, the cost of more than just dinner rises.

It’s the same with soybeans.

Sealed your concrete lately? You may have helped out a soybean farmer.

Changed the oil in your car? See above.

Of course, not everyone can or wants to own a big patch of row crops. And not everybody has the guts or the skill set to play the futures market – where some serious money is exchanging hands right now.

But there are options.

Wise Moves

We’ve said it many times. The only way to beat inflation is to not just stay in the markets, but wisely play the markets.

On Monday, for instance, our Venture Fortunes subscribers locked in gains from a money-doubling play in the oil patch. It took less than a month.

It’s an obvious sector to trade right now.

Putin has vowed to push crude to $300 if the world continues to meddle with his country’s money. It’ll be hell if it happens – requiring sacrifices this nation and its latest generations have never pondered.

But there’s room for reprieve.

As we’ve said in this column before, getting into oil stocks is a wise move.

Chesapeake Energy (CHK) has gone up more than 25% since we plugged it on February 23.

Devon Energy (DVN) has gone up 13%.

And Continental Resources (CLR) has gone up 20%.

But there are more ways to play the situation… especially when it comes to the looming food crisis.

Crazy Times

It’s a small fish in a big pond, but the Teucrium Corn ETF (CORN) is an effective way to play rising prices.

Its sister play, the Teucrium Soybean ETF (SOYB) is equally effective.

And if you’re looking for a wild ride (that means lots of volatility), check out the Teucrium Wheat ETF (WEAT). It’s gone up 30% in just the last five trading sessions.

Be careful with these. They’re small funds that are getting a lot of attention these days (for good reasons). They can make big swings in either direction. Don’t bet the farm on them… like, literally.

But crazy times call for oddball strategies.

Russia has dug itself quite a hole. Even if the war ends today, the sanctions and the pain coming for the country will continue to bite. Putin’s punishment will be long-lasting.

Be prepared for higher prices.

Invest wisely.

Andy Snyder

Andy Snyder is an American author, investor and serial entrepreneur. He cut his teeth at an esteemed financial firm with nearly $100 billion in assets under management. Andy and his ideas have been featured on Fox News, on countless radio stations, and in numerous print and online outlets. He’s been a keynote speaker and panelist at events all over the world, from four-star ballrooms to Capitol hearing rooms.