From Tulips to Infrastructure: How Crypto Skeptics Missed a $3 Trillion Revolution

Robert Ross|July 7, 2025

A few weeks ago, my uncle cornered me at a family barbecue.

He knows I’ve been a longtime crypto investor – even publishing a book on how to invest in the space with one of the world’s most prestigious publishers.

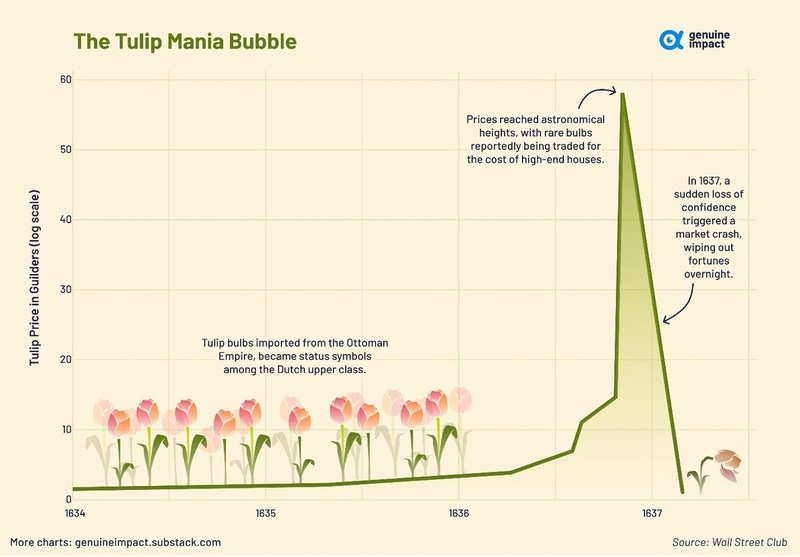

But he can’t help himself from saying things like, “crypto is the modern version of tulip mania.”

I’ve had this exact conversation more times than I can count. With family. With friends. With Uber drivers. Somehow, over a decade into Bitcoin’s existence – and trillions of dollars in value created – people are still comparing the entire crypto ecosystem to a 17th-century flower bubble.

Look, I get the instinct. Crypto is volatile. A lot of projects have been outright scams. And the price moves can feel more like a casino than a market.

But the idea that Bitcoin, Ethereum, and stablecoins are “just tulips” misses the forest for the trees.

A Flower With No Roots

Let’s revisit the actual tulip mania story for a moment.

In the 1630s, tulip bulbs in the Netherlands briefly became the hottest speculative item on the planet. Prices soared as people traded bulbs for homes, livestock – even entire businesses. But eventually, buyers realized that a tulip, no matter how rare or beautiful, is still just a flower. It has no inherent utility. So, when confidence collapsed, so did the market.

The key point? Tulips were never more than an aesthetic good.

Crypto – especially assets like Bitcoin and Ethereum – is something very different.

The Software Behind the Hype

Bitcoin (BTC) isn’t a pet rock. It’s a decentralized protocol that allows anyone on Earth to store and send money without needing a bank, government, or intermediary.

It’s open-source. It’s borderless. It’s censorship-resistant. And it has a fixed supply – only 21 million coins will ever exist.

That last point alone makes it very different from tulips, dollars, or even gold. It’s math-backed scarcity, accessible to anyone with a smartphone.

Ethereum (ETH), meanwhile, is an entirely different beast. Think of it as a global computer that lets developers build financial applications without middlemen.

Today, Ethereum powers:

- Over $100 billion in stablecoins (digital dollars)

- Decentralized exchanges processing billions per week

- Lending protocols, NFT marketplaces, and even real-world asset tokenization.

This is not some abstract speculation. This is real-world financial infrastructure – used daily by millions.

And the best part? Anyone can audit the code. You don’t have to “trust” Ethereum. You can verify everything on-chain. Try saying that about your local bank or brokerage.

Crypto Solves Real Problems

One of the laziest criticisms I hear from people like my uncle is, “crypto has no use case.”

But that couldn’t be further from the truth.

Crypto helps:

- Hedge against inflation: In countries like Argentina or Turkey, where the local currency can collapse in a matter of months, Bitcoin and stablecoins provide a financial lifeline.

- Enable cheap, fast remittances: Instead of paying 10% fees to Western Union, people can send USDC or Bitcoin across borders in minutes for pennies.

- Unlock financial access: Billions of people globally remain unbanked. Crypto gives them access to savings, lending, and payments with just a phone.

And here in the U.S., crypto is increasingly integrated into traditional finance. Bitcoin ETFs are live. Fidelity offers Bitcoin in retirement accounts. Institutions from BlackRock to the government of El Salvador hold crypto on their balance sheets.

This Isn’t a Bubble. It’s a Revolution.

Here’s the bigger picture.

Crypto doesn’t behave like a bubble because it’s not a single product. It’s a technology stack – like the internet in the ’90s. And yes, just like the internet, it’s gone through hype cycles and crashes.

But each crash leaves the ecosystem stronger, not weaker.

The infrastructure keeps improving. Regulatory clarity is growing. User bases are expanding. And developers continue building – regardless of price action.

That’s not tulip mania. That’s what adoption looks like.

Just as Amazon, Google, and Apple emerged from the rubble of the dot-com bubble, I believe Bitcoin, Ethereum, and a handful of other projects will emerge as the bedrock of the next financial system.

Don’t Throw the Baby Out With the Bath Water

Will some crypto tokens go to zero? Absolutely. Some deserve to. There’s plenty of vaporware and hype-driven fluff out there.

But dismissing the entire crypto movement because of a few bad apples is like swearing off all tech stocks because of Pets.com.

Crypto is not a flower. It’s software. Infrastructure. Monetary policy. Financial access.

And it’s not going away.

Now, whether my uncle will ever come around? That’s still up for debate. And honestly, when he does, that will be my signal to sell… as he’s the best “contra” indicator I know.

But for investors willing to look past the noise and dig into the fundamentals… there’s still massive opportunity ahead.