History Repeats: Why Crypto Treasury Companies Are This Era’s Gold Miners

Robert Ross|August 5, 2025

Back in 2017, there was almost no way to invest in crypto through traditional equities.

One of the only stocks with crypto exposure was Overstock.com. It was the first publicly traded company to accept Bitcoin as payment. And it even launched its own cryptocurrency – tZERO – in December 2017. I know because I was trading these stocks when I served as the senior equity analyst for an investment research company.

But times have changed… drastically. We have pure crypto stock plays like Coinbase (COIN)… and we have something new called crypto treasury companies.

These are public companies that don’t just talk about blockchain – they actually hold crypto on their balance sheet, using it as a treasury asset. Some even integrate crypto into their core business models.

The most famous of these companies is MicroStrategy (MSTR).

And its story changed everything.

From Software to Bitcoin Standard

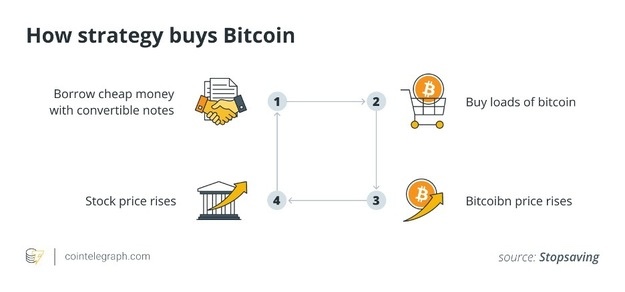

MicroStrategy started as a boring business intelligence software company. But in August 2020, CEO Michael Saylor did something radical: he began converting the company’s excess cash into Bitcoin.

His thesis was simple: the U.S. dollar is being devalued by reckless monetary and fiscal policy. And Bitcoin – unlike fiat currency – has a fixed supply. To Saylor, Bitcoin was the ultimate inflation hedge.

So instead of holding excess cash or bonds, MicroStrategy began accumulating Bitcoin. Lots of it.

Fast forward to today, and MicroStrategy now holds over 200,000 BTC – more than any other public company in the world. That’s over $13 billion worth of Bitcoin. And its share price has soared as a result, up over 1,000% since its pivot to crypto.

What Makes a Crypto Treasury Company?

The model is simple in theory: Hold a large portion of the company’s treasury in crypto, typically Bitcoin or Ethereum, and make that exposure part of the company’s value proposition.

Some companies, like MicroStrategy, make it their whole story. Others, like Tesla (TSLA), have flirted with it – buying BTC, then selling some, then going quiet. Still others are beginning to integrate real crypto functionality into their operations, including DeFi staking, token issuance, or yield strategies on crypto assets.

Crypto treasury companies appeal to both traditional and digital investors. To equity holders, they offer a public-market proxy for crypto exposure. And to crypto enthusiasts, they signal long-term confidence in digital assets.

Most importantly, they’re a bridge: a way for crypto adoption to cross into public markets without needing the SEC’s blessing on every new ETF idea.

Beyond Bitcoin: What’s Next?

MicroStrategy made headlines because of Bitcoin. But newer crypto treasury companies are going beyond BTC.

They’re holding Ethereum. They’re allocating to staking protocols. Some are even venturing into Solana and Avalanche ecosystems, where returns can be higher – but so can the volatility.

Believe it or not, there’s even one company acquiring Dogecoin (DOGE).

This new wave is important. It shows that crypto isn’t just a Bitcoin story anymore. It’s a full-spectrum asset class. And companies that position themselves ahead of the curve could see explosive revaluations – just like MicroStrategy did in 2020.

That’s why in our Breakout Fortunes research service, we’re watching this trend very closely.

And we’ve found a small company flying completely under the radar…

The Next MicroStrategy?

One tiny crypto treasury company has the potential to become the next breakout winner in this space.

It doesn’t just hold Bitcoin – it’s actively mining it using next-gen cooling infrastructure. That gives the company lower power costs, improved uptime, and higher efficiency than traditional mining operations.

But more importantly, management has made it clear they’re embracing the MicroStrategy playbook. Their public filings show a strategic pivot: convert excess cash to Bitcoin, mine at scale, and expand their digital asset treasury.

They’ve also hinted at allocating part of their holdings to Ethereum (ETH) staking and layer-2 ecosystems – two of the fastest-growing segments in crypto right now.

What does that mean for investors?

It means this isn’t just a small-cap mining stock. It’s becoming a full-blown crypto treasury vehicle.

Right now, the company is still flying under Wall Street’s radar. It has a sub-$100 million market cap, trades over the counter, and doesn’t yet have big institutional ownership.

But that’s exactly what made MSTR such an incredible opportunity in 2020: it was hiding in plain sight.

I’m convinced this new company could be next.

A Structural Shift

Crypto treasury companies are more than just a passing fad. They represent a structural shift in how companies think about capital preservation, inflation hedging, and long-term value storage.

Just like gold miners exploded in the 1970s during fiat currency debasement, crypto-native businesses like the one we just uncovered could soar as this new monetary era unfolds.

Because in crypto, the winners don’t always look like tech giants.

Sometimes… they start as tiny companies with bold conviction.

And just like in 2020, the next great opportunity may already be public – you just have to know where to look