The 6 Best Cybersecurity Investments of 2019, 2020 and Beyond

vraju|July 30, 2019

The 6 Best Cybersecurity Investments of 2019, 2020 and Beyond

A massive shift is happening.

A massive shift is happening.

It’s taking over nearly every aspect of life…

From how we grow our food… to the way we conduct financial transactions…

From how we communicate with friends and loved ones… to the way we travel from place to place…

The Internet of Things (IoT) is bleeding into all that we do. We’re not just talking about smartphones and tablets either. The IoT is everywhere. It’s even creeping into mundane objects like blinds, toilets and spoons.

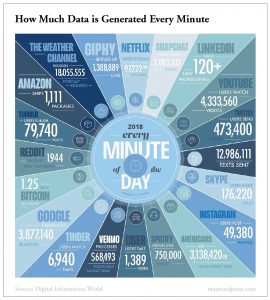

Not only has the amount of devices connected to the internet increased… but so has the speed at which information is being sent around the world.

Now, you may love Big Tech… or you may hate it.

Perhaps these stats excite you.

Maybe they terrify you.

Regardless, one thing is clear…

As the number of IoT devices continues to grow… so will the number of associated security threats.

Delinquents and criminals are already abusing these new devices’ barebones security features.

They’re using them to obtain social security numbers, banking details, addresses and credit card numbers. Even images of faces and videos from inside homes are being sent around the globe and distributed to illegal enterprises.

It can happen in less than a second.

In response, the cybersecurity industry has absolutely exploded in recent years. The work they’re doing is essential.

An Unprecedented Threat… And a Massive Opportunity to Profit

Part of what makes cybersecurity companies such compelling investments is the fact that they’re heavily relied on by every industry and sector around the world.

Cybersecurity threats are ever-evolving and come from extremely sophisticated adversaries. Due to common vulnerabilities, instances of security breaches happen across organizations and in patterns that are challenging to anticipate.

Cyberattacks and cyber theft impose huge costs to business and organizations. The Executive Office of the President of the United States (EOP) estimate that malicious cyber activity cost the U.S. economy between $57 billion and $109 billion in 2016.

And according to the EOP, the stock price reaction to the news of an adverse cyber event is significantly negative. Firms on average lost about 0.8 percent of their market value in the seven days following news of an attack.

The EOP estimates that, on average, the firms they studied lost $498 million per adverse cyber event. It’s a sizeable hit for any company – of any size – to take.

Now combine all that with a growing public push for the better securing of personal data…

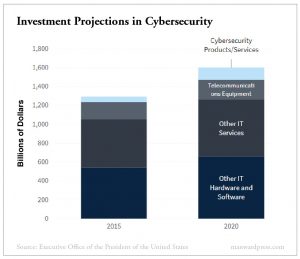

It’s clear why spending on cybersecurity products and services has seen such a tremendous uptick.

It’s a trend that should only continue as the number of cyberattacks against the U.S. continues to increase.

The sources of the attacks are far-reaching… and they’re coming from all directions.

Verizon’s Data Breach Investigations Report notes that 75% of recent cyber incidents and breaches were caused by outsiders, while 25% were performed by internal actors.

Overall, 18% of threats were perpetrated by state-affiliated groups, and 51% involved organized criminal groups. DNI notes that Russia, China, Iran, and North Korea, along with terrorists and criminals, are frequent cyber threat actors.

Verizon found that China accounted for 96% of economic espionage cases in its annual dataset of data breaches.

One of the more recent and devastating attacks by a nation-state was the destructive WannaCry malware attack initiated by North Korea. The damage done to the global economy is estimated to be in the billions of dollars.

While everyone loves to point their finger at the government and demand that they do something to protect us, the most direct actions in cybersecurity are in the hands of the private sector (where they should be).

Private firms are ultimately in the best position to figure out the most suitable sector- and firm-specific cybersecurity practices.

In 2016, Morgan Stanley estimates that spending on cybersecurity products and services will more than double from $56 billion in 2015 to $128 billion in 2020.

It’s easy to see why.

Cyber connectivity is an important driver of productivity, innovation, and growth for the U.S. economy… but it clearly comes at a cost. Companies, individuals, and our government are all vulnerable to malicious cyber activity.

Companies with a strong track record of defending personal data have a tremendous opportunity to profit handsomely – and generate huge gains for shareholders – as the need for tighter cybersecurity grows.

Based on our research, these six companies – in particular – are best positioned to keep America safe… and deliver massive returns in the months ahead.

Read closely.

See that volume spike? Somebody just decided to buy a LOT of gold.

See that volume spike? Somebody just decided to buy a LOT of gold.1.) CACI INTERNATIONAL INC (NYSE: CACI)

CACI was founded in July of 1962 by Herb Karr, a visionary businessman, and Harry Markowitz, a programming genius.

Originally named, “California Analysis Center, Inc.,” these entrepreneurs took an unsupported public domain software language, realized it presented a promising business opportunity and created CACI to train and support its users.

Over the Years, CACI continued to watch trends and identify the most promising technologies and markets. In the 1970s, CACI pioneered easy-to-use database retrieval programs for the United States Department of Commerce. They applied this technology to projects for the DoD and DoJ.

The changes in the federal landscape in the 1980s, allowed CACI to rebrand itself from a professional services firm to an IT solution provider by the 1990s.

CACI has essentially grown though acquisitions of other IT companies – the company has successfully acquired and merged over 60 IT organizations over the last 20 years. The latest being LGS Innovations and Mastodon Design, for a combined total of $975 million.

Through these deals, CACI is establishing itself as a priority vendor for the intelligence community, and throughout the US government.

CACI works jointly with the Pentagon, intelligence organizations, federal civilian, state, and local customers. Its IT business is concentrated on systems management and countering cyber threats, while also assisting with a range of intelligence support, logistics, litigation, and reconnaissance support tasks.

CACI states that with its board expertise in cyber and electronic warfare, it can successfully:

Protect vulnerable platforms – airplanes, cell phones, weapons systems, and UAVs stay braced against cyber-attack. CACI combines digital signals processing and radio frequency expertise with proven cyber and electronic warfare experience to deliver solutions to both defend and attack platform systems that include aircraft and UAVs, vehicles and ships, space and weapons systems, supervisory control and data acquisition systems, and communications in the RF spectrum.

Safeguard critical infrastructure – the nation’s facilities and networks stand more securely. CACI performs reverse engineering on advanced persistent threats and other malware to discern their intent and impact, and to mitigate attacks against customer networks and platforms. We leverage tools that are developed internally, by customers, and by other trusted suppliers. We develop tools, tactics, techniques, and procedures to conduct operations related to networks, end points, and connected platforms and devices

Ensure comprehensive cyber support – our expertise ranges from traditional IT network security to nontraditional malware development, secure smartphone apps, and resilient platform engineering. We provide customers with signals collection, processing, and exploitation capabilities spanning the electromagnetic spectrum. Our analytics address both the offensive and defensive side of network and platform exploitation. We utilize diverse information sources to perform signals collection and analysis, determine system vulnerabilities, and apply analytic input to either develop more effective safeguards or deliver cyber countermeasures. CACI develops systems empowered by precision technologies to exploit emerging threats and protect platforms, such as smartphones, aircraft, UAVs, and vehicles.

Meet advanced mission needs – our rapid R&D, prototyping, and integration capabilities enable us to deliver unique solutions to combat shifting, emerging threats.

CACI’s sales growth is double the industry average, earnings growth is 14.58 compared to the industry average of -0.2, and its P/CF is half of the industry.

Its stock price steadily increased over the past 5 years, with an average of over 150%!

A Fortune World’s Most Admired Company, CACI is a member of the Fortune 1000 Largest Companies, the Russell 2000 Index, and the S&P MidCap 400 Index.

2.) CARBONITE INC (NASDAQ: CARB)

Carbonite began in 2005 as the answer to the question: “Why can’t there be an easy and affordable way to back up files online?”

Named after the fictional substance used to freeze Han Solo in Star Wars: The Empire Strikes Back, Carbonite now protects data for more than 1.1 million customers and organizations.

Founded as a company serving primarily homes and small business users, Carbonite offers all the tools necessary for protecting data from the most common forms of data loss: ransomware, accidental deletions, hardware failures and natural disasters.

Carbonite is built on four pillars—power, simplicity, value and security. This approach has served them well, since its startup stage to the current status as a leader in cloud-based data protection for businesses.

From automated computer backup to comprehensive protection for physical and virtual server environments, Carbonite ensures the accessibility and resiliency of data for any system.

It was the first to rebel against the status quo and offer unlimited backup space for a fixed price. Which revolutionized the price model for data backups, since all online backup services were priced by the gigabyte beforehand.

In early 2016, Carbonite acquired EVault, formerly a division of Seagate Technology. This addition expanded Carbonite’s data protection portfolio to include hybrid backup and disaster recovery services for larger businesses.

One year later, Carbonite expanded into enterprise-grade solutions with the acquisition of Double-Take Software, adding its assortment of high availability and data migration services, and cementing Carbonite’s place as a one-stop shop for data protection needs of every kind.

It also acquired Mozy, a cloud based backup solution from Dell Technologies, for $145.8 million the same year.

In 2019, Carbonite acquired Webroot, which delivers multi-vector Cybersecurity protection for endpoints and networks, as well as threat intelligence services to protect businesses and individuals for $618.5 million

As of early May 2019, Carbonite Inc’s market cap is currently $833.8M and has a P/E ratio of 105.31. The company has a Price to Book ratio of 3.24 and 131 recent corporate insider activity.

3.) FORTINET INC (NASDAQ: FTNT)

Fortinet was founded by brothers Ken and Michael Xie at the turn of the millennia. Headquartered in Sunnyvale, California. The company develops and markets cybersecurity software and appliances and services, such as firewalls, anti-virus, intrusion prevention and endpoint security.

Fortinet’s mission is to deliver the most innovative, highest-performing network security fabric to secure and simplify your IT infrastructure. They are a leading global provider of network security appliances for carriers, data centers, enterprises, and distributed offices

Fortinet spent two years in research and development before introducing its first product, FortiGate, in 2002. It took the company another six years to become profitable. By 2010, Fortinet had an annual revenue that exceeded $300 million.

In July 2014, Fortinet announced a technical certification program called Network Security Expert (NSE) that included eight levels of certification. The company launched a Network Security Academy later that year, to help fill open cyber security jobs in the U.S. Fortinet donated equipment and provided information to universities to help train students for jobs in the field. Also, Fortinet launched a program called FortiVet to recruit military veterans for cybersecurity jobs.

The Fortinet NSE Program is an 8-level training and assessment program designed for customers, partners, and employees, with over 200,000 security certifications to date.

The Fortinet Network Security Academy program provides industry-recognized Fortinet training and certification opportunities to students around the world.

Launched in 2016, this program is rapidly growing program has already been adopted by 153 academies in 57 countries.

Later in 2017, Fortinet created a standalone subsidiary, Fortinet Federal, to develop cybersecurity products tailored for government agencies.

Back in 2005, Fortinet created the FortiGuard Labs internal security research team… By 2014, Fortinet had four research and development centers in Asia, as well as others in the US, Canada and France.

In the same year, Fortinet founded the Cyber Threat Alliance with competitor and peer Palo Alto Networks, along with other leading Cyber Security firms, in order to share security threat data across vendors.

In April 2015, Fortinet provided threat intelligence to Interpol in order to help apprehend the ringleader of several online scams based in Nigeria.

The scams, which resulted in compromise of business emails and CEO fraud, had cost one business over $15 million

The following year, in March 2016, Fortinet and technology company, Cisco, joined NATO in a data-sharing agreement to improve their information security capabilities.

In 2018, Fortinet entered into an information-sharing agreement with Interpol.

The company has exponentially gained market share of global security appliances from just over 4% in 2011 to over 10% currently.

The company is correctly focusing on selling high-margin products and subscriptions, which should help further margin expansions in the future and higher earnings.

Fortinet is a company that is expected to grow for many years to come.

4.) PALO ALTO NETWORKS INC (NYSE: PANW)

Palo Alto Networks Inc., founded in 2005, are a global cybersecurity leader, known for always challenging the security status quo. Its mission is to protect everyone’s way of life in the digital age by preventing successful cyberattacks.

This has given them the privilege of safely enabling tens of thousands of organizations and their customers. Its pioneering Security Operating Platform safeguards your digital transformation with continuous innovation that combines the latest breakthroughs in security, automation, and analytics.

By delivering to the masses a true platform and empowering a growing ecosystem of change-makers like Palo Alto Networks, they provide their clients with highly effective and innovative cybersecurity across clouds, networks, and mobile devices.

Palo Alto Networks’ founder, Nir Zuk, stated that created the company because of his objective of solving a problem enterprises were facing with existing network security solutions: the inability to safely enable employees to use modern applications, which entailed developing a firewall that could identify and provide fine-grained control of applications.

This problem allowed Zuk and his company to create the world’s first ‘next-generation’ firewall. This application differed from pervious iterations because it allowed for the operation and inspection on all layers of the network stack and be intelligent enough to block threats independently of port numbers or protocols used.

Past versions of firewalls relied on simple rules of port numbers and protocol to block traffic.

In 2014, Palo Alto Networks founded the Cyber Threat Alliance with Fortinet and other major cybersecurity companies, a not-for-profit organization with the goal of improving cybersecurity “for the greater good” by encouraging collaboration between cybersecurity organizations by sharing cyber threat intelligence amongst members. It has over 20 world renowned cyber companies within its alliance.

Over the years, Palo Alto Networks has expanded and offered a wide range of enterprise cybersecurity service beyond its original next-gen firewall.

In 2017, the company announced a cloud-based service allowing customers to collect their own data for machine learning and data analytics – called Logging Service.

In 2018, Palo Alto Networks was one of the first companies to open a dedicated cybersecurity training facilities around the world as part of its Global Cyber Range Initiative.

In 2019, the company announced its K2-Series – a next-gen firewall developed with 5G and IoTs requirements in mind.

In the same year, many leaders from other high-profile tech companies moved and joined Palo Alto Networks. Nikesh Arora, Google’s Chief Business Officer and SoftBank’s President, join the company as chairman and CEO. Arora received a pay package of more than $125 million, making him one of the highest paid executives in the US for 2018.

Liane Hornsey, formerly Uber’s Chief People Officer, joined the company as its Chief People Officer. Followed by Amit Singh, formerly President of Google Could, became President of Palo Alto Networks.

Vanguard’s Market Index Funds are the top three owners of Palo Alto Networks shares;

- Vanguard Total Stock Market Index Fund has more than 2.24M shares, with a market value of just shy of half of a billion dollars.

- Vanguard Mid-Cap Index Fund comes in second place, with 2.07M shares.

- Vanguard Extended Market Index Fund in third, with 1.22M shares.

Palo Alto Networks actively engages and promotes cybersecurity community. The company has its own threat intelligence team, called Unit 42. This group are researchers and industry experts who use data collected by Palo Alto Networks’ platform to discover new cyber threats.

Many Unit 42 researchers have been named in MSRC Top 100, Microsoft’s annual ranking of top 100 security researchers. This list is compiled based on security impact and severity of vulnerabilities, and research in Mitigation Bounty and Bounty for Defense.

Palo Alto Networks has been working hand in hand with law enforcement. According to the FBI, the company has helped solve multiple cybercrime cases, such as the Mirai Botnet and Clickfraud Botnet case, the LuminosityLink Rat Case, and assisted with “Operation Wire-Wire.”

The company’s research team has recent evolved from finding undiscriminating cybercrimes to malware targeted at specific institution.

In 2018, Unit 42 discovered a hacking group that allegedly operated out of Pakistan and targeted government organizations in the United Kingdom, Spain, Russia, and the United States.

Later that year, Unit 42 found two malicious codes believed to originate from China that targeted cryptomining.

The research group also announced the discovery of a Trojan virus, called “Cannon,” that was being used to target the United States and European governments. It is believed that the virus was created by the cybercriminals and cyber-espionage group Fancy Bear, a Russian hacking group. The same group believed to be responsible to hacking the Democratic National Committee in 2016.

It’s worth noting as well that Palo Alto Networks has continued to retain a cash-rich balance sheet, with more than $3.5 billion of cash against about $1.5 billion of convertible debt. Allowing the company to be ready to expand through acquisitions.

5.) PROOFPOINT INC (Nasdaq: PFPT)

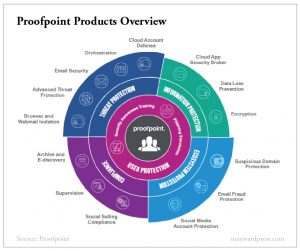

Proofpoint, Inc. was founded by Eric Hahn in June 2002 and is headquartered in Sunnyvale, CA. The company specializes cybersecurity company, which engages in the provision of cloud-based solutions.

Its security-and compliance platform is a combination of an integrated suite of threat protection, information protection, and brand protection solutions.

Most notably being email protection, advanced threat protection, email authentication, data loss prevention, SaaS application protection, response orchestration and automation, digital risk, web browser isolation, email encryption, archiving, eDiscovery, supervision, secure communication, phishing simulation and security awareness computer-based training.

The company began its journey by pioneering a new product called Proofpoint Protection Server, which was a proprietary machine learning algorithms applied to identify spam emails using tens of thousands of different attributes to differentiate between spam and valid emails.

Their product came to market at the prefect time as the number of spam emails started to increase exponentially, which threatened worker’s productivity and sensitive data.

In 2004, new regulations governing financial disclosures and the privacy of health care data, such as Sarbanes-Oxley, HIPPAA, and Framm-Leach-Bliley, prompted Proofpoint to begin developing and capitalize on new products that would automatically identify and intercept outbound email containing sensitive information.

In 2008, Proofpoint acquired Fortiva, a provider of on-demand Email archiving software for legal discovery, regulatory compliance, and email storage management. The acquisition allowed Proofpoint to synergistically integrate and expand the company’s proficiency and capabilities.

The company also has products that stop both traditional cyberattacks and socially engineered attacks by using a blend of sandbox analysis, reputational analysis, automated threat data, human threat intelligence and attributes such as sender/recipient relationship, headers, and content, and more to detect potential threats.

Proofpoint’s fiscal 2018 revenue grew 38% to $717 million and non-GAAP earnings of $1.47 per share, compared with $1.10 a year ago. Revenue from subscription for the year grew 39% to $704.4 million.

6.) BLACKBERRY LTD (NYSE: BB)

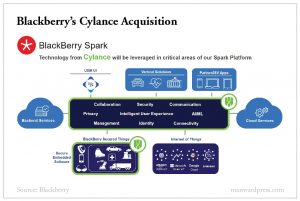

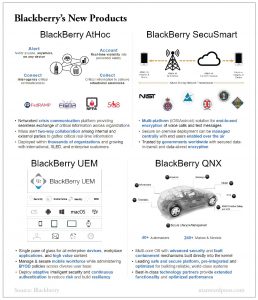

BlackBerry is widely recognized for productivity and security innovations. The company provides mobile enterprise solutions in the market through a broad portfolio of products and services. It offers software and services platform for the Enterprise of Things within the enterprise that communicate with each other to enable smart business processes.

Among the new assets in the BlackBerry security portfolio is Cylance, which BlackBerry acquired in a $1.4 billion deal announced in November 2018. Cylance is, however, only one of many cyber-security technologies within BlackBerry.

Among the cyber-security technologies in the BlackBerry portfolio is mobile device management capabilities gained via the acquisition of Good Technology for $425 million in 2015.

QNX Technologies, which BlackBerry acquired in 2010 for $200 million, provides a secure embedded operating system that is widely used in the automotive industry and general engineering. Certicom is another core cyber-security asset in the BlackBerry portfolio, providing cryptographic and hardware key provisioning capabilities. BlackBerry acquired Certicom in 2009 for $106 million.

BlackBerry managed to drastically turn around their financials in 2019 as a result of restructuring efforts.

Other factors like patent revenue and industry tailwinds also played a role.

The deal with the Chinese internet giant, Baidu, means BlackBerry could potentially capture a larger market in China.

Since the appointment of John Chen as its new CEO in 2013, BlackBerry has taken on a new direction and since delved into the enterprise software and cybersecurity space.

Blackberry being synonymous with professional mobile hardware are long gone which the rise of iOS and Android devices. This has caused the company to focus on its software, which was once the catalysis that promoted the popularity of the Blackberry mobile devices.

As the world adapts to new information and communication infrastructure, Blackberry has been investing and creating software that will be necessary to keep all devices and information safe.

From encryption of multi-platform devices to interconnectivity of thousands of organizations; and from administering mobile devices and workforce to security and communication of IoT. BlackBerry is working on a solution to every new problem faced by corporations, governments, and people.

In mid-June,2019, BlackBerry announced that its new Government Mobility Suite has received Federal Risk and Authorization Management Program Ready status. The firm’s cloud-based endpoint management solution has been designed particularly for the U.S. government agencies.

The company is poised to benefit from surge in its business, while providing one of the most secure mobile enterprise solutions in the market.

Driven by diligent execution of operational strategies, shares of BlackBerry have rallied 16.1% against the industry’s decline of 5.4% in the year-to-date period after its announcement of its FedRAMP’s Ready status.

BlackBerry has transformed its fundamental roots and business model since its golden era as the king of proto-smart mobile device days. It has diversified into high growth tech verticals that promise to prosper as the next wave of technology arrives.